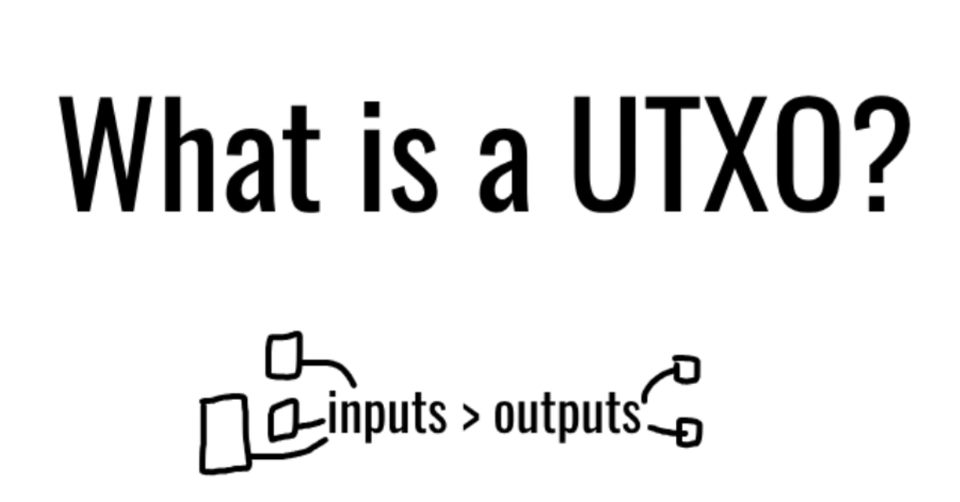

What is a UTXO?

A UTXO has to do with a unit of Bitcoin and is a fancy acronym for Unspent TX(transaction) Output.

Bitcoin does not operate like a digital bank account, where transactions are added or subtracted from your total balance.

It behaves more like cash in your wallet.

How so?

Here is a quick example:

Any amount of Bitcoin is a UTXO.

If you buy a $75 steak with a $100 bill, you may receive $20 and $5 UTXOs in change.

The $100 bill is the spent tx input, and the $20 and $5 bills are the unspent tx outputs.

Bitcoin functions like this digitally.

The spent inputs get destroyed and recreated as unspent outputs at the receiving address.

Most wallet applications will not show you the status of your UTXOs but a combination of them all, so it appears like an account balance:

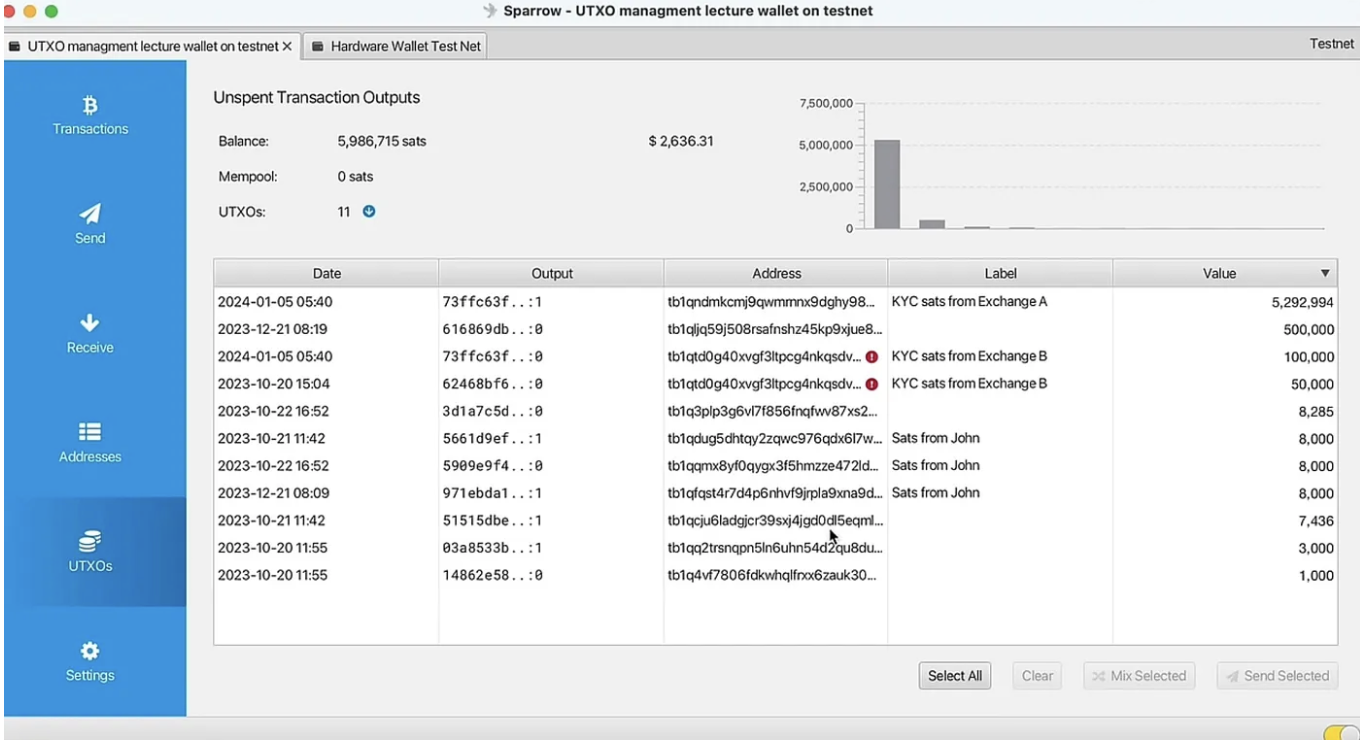

Sparrow is a desktop wallet that DOES show UTXOs:

UTXOs are important because they impact the transaction fee.

Remember that 1 Bitcoin = 100,000,000 satoshis.

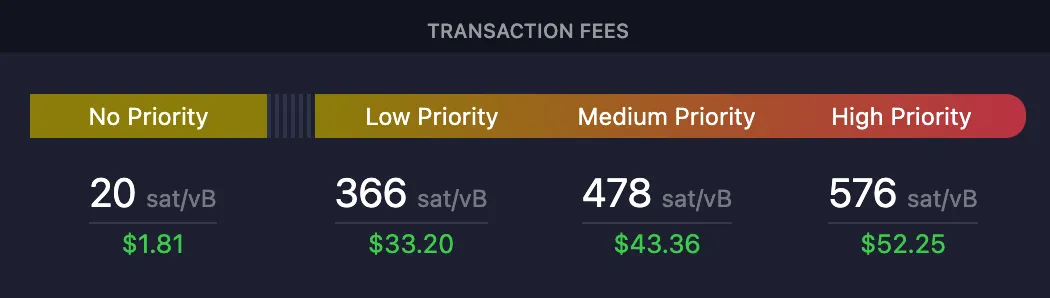

Sat/vB (satoshis per virtual byte) measures the bid required for various priority levels per byte of block space:

The more UTXOs (chunks of Bitcoin data), the higher the transaction fee.

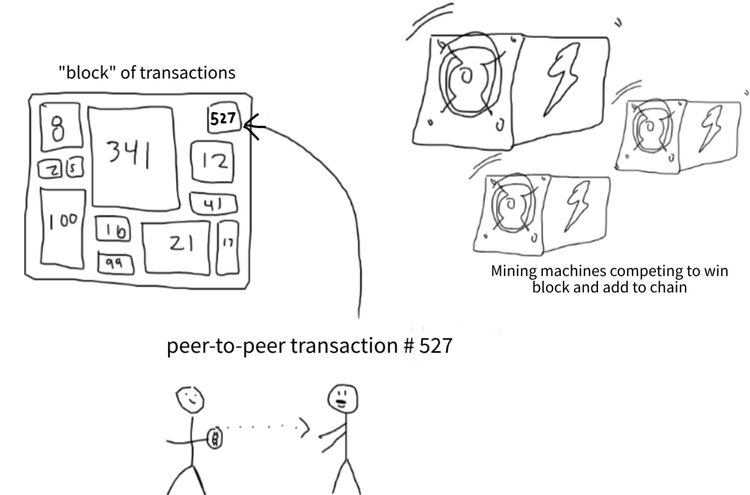

1 block is limited to ~ 2 megabytes of transaction data (not including SegWit data).

So if your transaction takes up 1000 bytes of data, and you are in a rush to get included in the next block, then you would pay 576 sats * 1000 bytes (according to the image above).

That’s 576,000 sats (currently $340).

As you can see, the amount of data sent and the current demand for block space are major contributors to the transaction fee.

A common misconception is that transaction fees are a percentage of the amount sent, like the traditional financial system.

However, on the Bitcoin network, it could be cheaper to send $1,000,000 of BTC than $50 of BTC.

Here’s why:

The bytes of a transaction are influenced by the quantity of UTXOs.

(one $1,000,000 UTXO vs fifty $1 UTXOs)

This is why it is crucial not to have many small UTXOs.

If the fee for moving a UTXO is higher than the UTXO itself, it effectively becomes unspendable or “stranded.”

Using fees above as an example, low priority was 366 sat/vB. Anything below that bid is not getting moved by miners.

If fees were never to go below 366 sat/vB, and you had been making $10/day DCA buys for the past year and never consolidated the UTXOs, your entire stack could effectively become UNSPENDABLE.

What should you do?

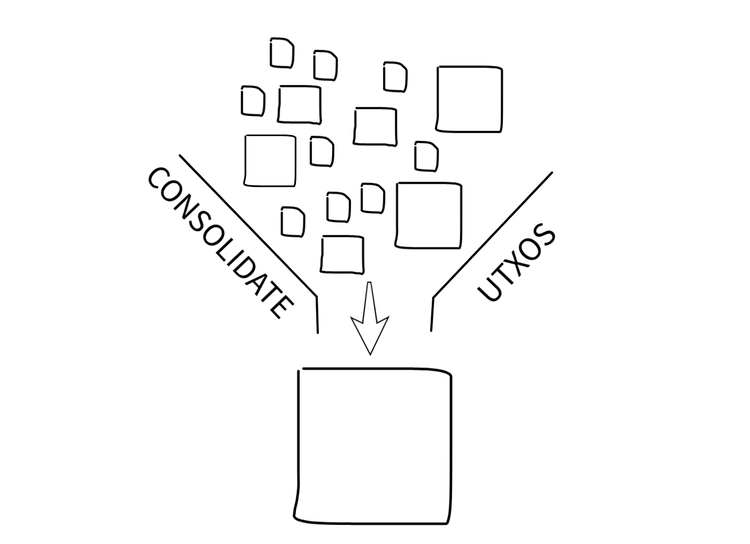

Consolidate your UTXOs or verify they are a good size.

This means combining small UTXOs that may become unspendable in the future into larger UTXOs that are more immune to high fees.

(BTC Sessions made a great video on this here)

"Good sized" depends on your total Bitcoin stack.

Some people say a 1,000,000 sat UTXO minimum is a good size to aim for.

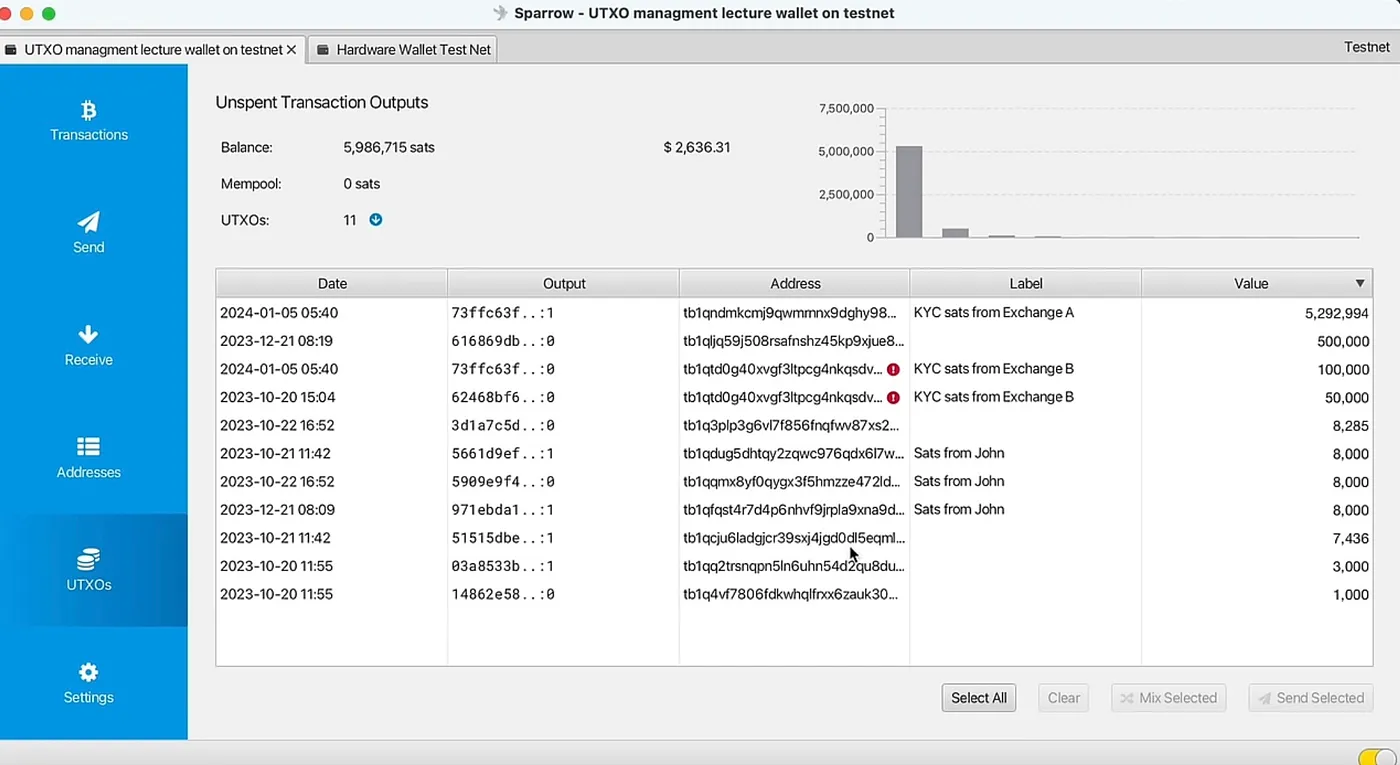

Sparrow Wallet makes it very easy to do this:

1) Select all the UTXOs you want to combine.

2) Send them to your own address (preferably when fees are low).

This is a good practice to ensure your UTXOs are not stranded during high-fee environments.

It is difficult to confidently predict where transaction fees will go in the future.

Yet, as Bitcoin adoption increases and its technology provides more value to application builders, a greater demand for blockspace is inevitable.

And when blockspace is a hot commodity, transaction fee bids will go higher.