Bitcoin Transaction Fees Explained

Each Bitcoin transaction includes a fee, which is paid to the miner as a tip to incentivize them to include your transaction in the next block.

There is a demand to move Bitcoin on-chain, and data storage in a block is currently limited.

This leads to competition for who can motivate miners the most.

The higher the fee a miner can earn from including a transaction, the more likely they are to add it to the next block.

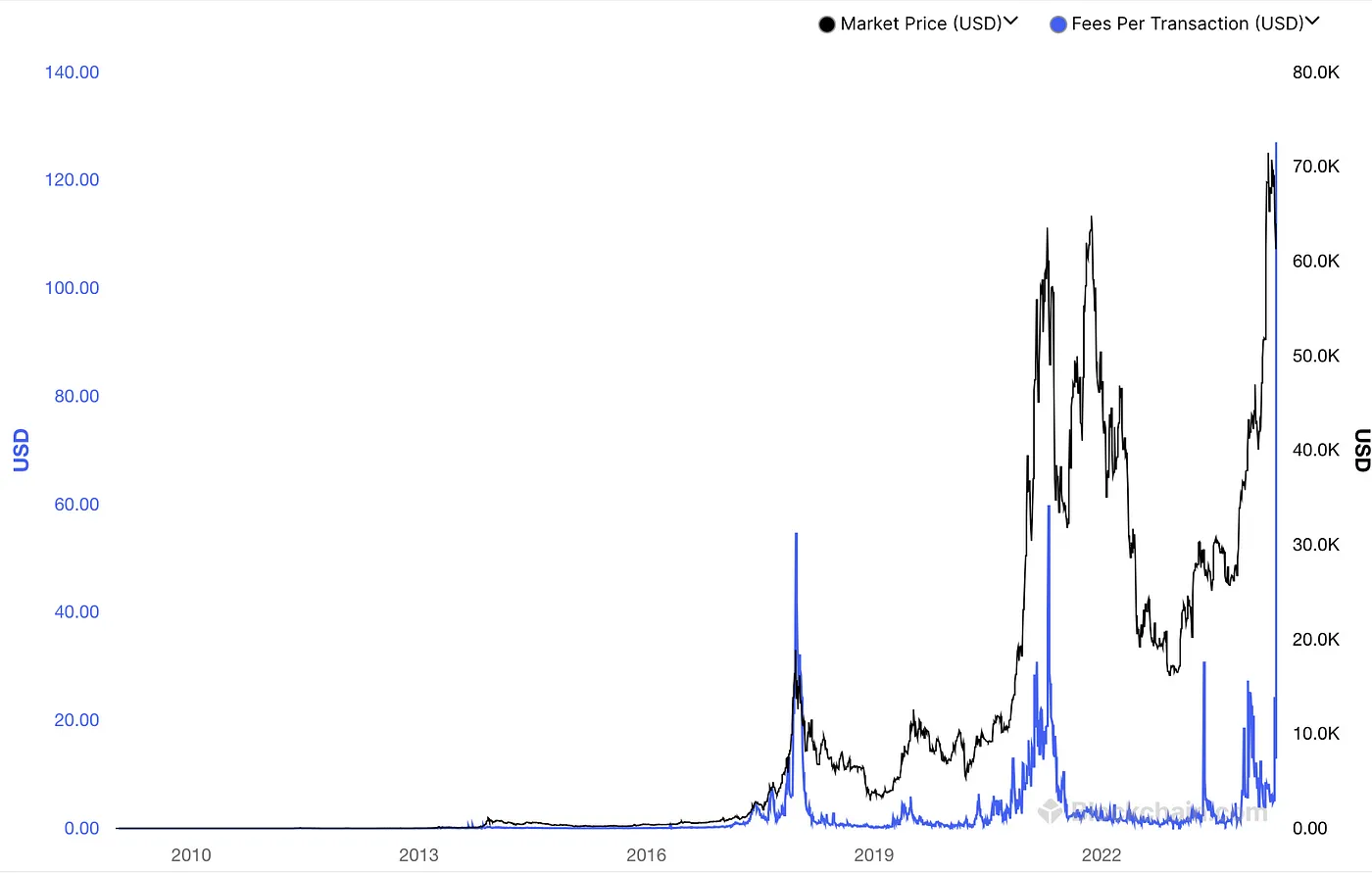

This creates higher transaction fees over time as on-chain activity increases and the exchange rate of Bitcoin increases.

Fees typically rise in tandem with the USD price of Bitcoin:

Hashprice is a metric revealing how much a miner can earn per unit of hash.

Hashprice is comprised of network difficulty, Bitcoin’s price, block subsidy, and transaction fees.

While transaction fees are the bread and butter for miners, they may present a future hindrance to network users.

Remember that 1 bitcoin = 100,000,000 satoshis.

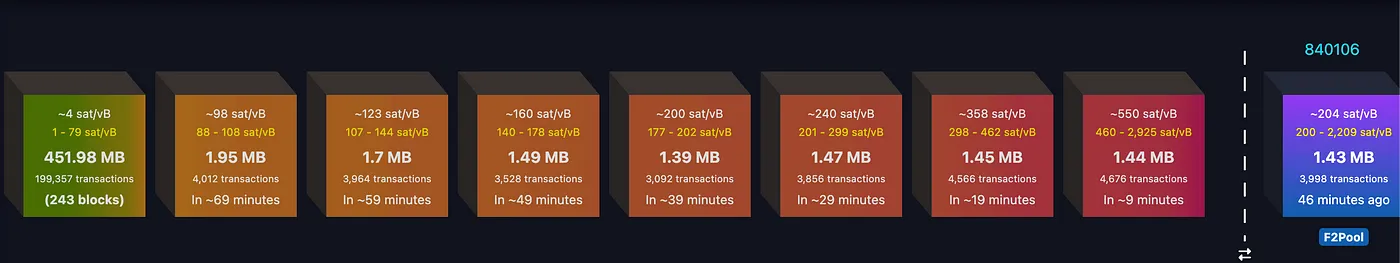

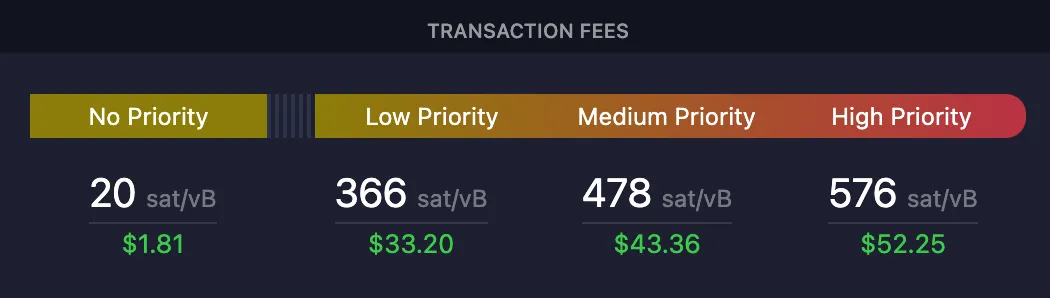

Referring back to this image:

Sat/vB (satoshis per virtual byte) measures the bid required for various priority levels per byte of block space.

1 block is limited to 1 megabyte of transaction data (1,000,000 bytes).

So if your transaction takes up 1000 bytes of data, and you are in a rush to get included in the next block, then you would pay 576 sats * 1000 bytes (according to the image above).

That’s 576,000 sats, 0.00567 btc, $368.

As you can see, the amount of data being sent and the current demand for block space are major contributors to the transaction fee.

What makes a transaction take up more bytes?

A common misconception is that transaction fees are a percentage of the amount sent, like the traditional financial system.

However, on the Bitcoin network, it could be cheaper to send $1,000,000 of BTC than $50 of BTC.

Here’s why:

The bytes of a transaction are determined by the type of Bitcoin address used, amount of inputs(UTXOs), and witness data.

Witness data is everything in the block that is not specifically transactions (Signatures, Inscriptions, etc.), and is why you see block sizes over 1MB.

This is why it is important not to have many small UTXOs. If the fee for moving a UTXO is higher than the UTXO itself, it effectively becomes unspendable or “stranded.”

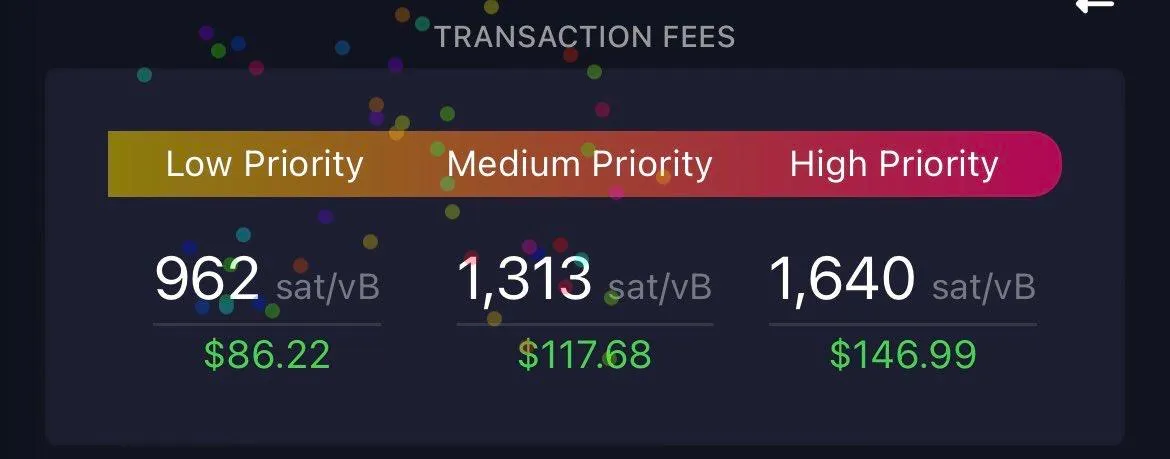

The halving was a perfect example of this:

Low priority was 962 sat/vB. Anything below that bid is not getting moved by the miners.

Transaction fees are as free market as it gets. You see a similar situation with paid parking, express theme park lines, toll roads, express shipping, VIP access events, etc, where those that pay higher fees get higher priority.

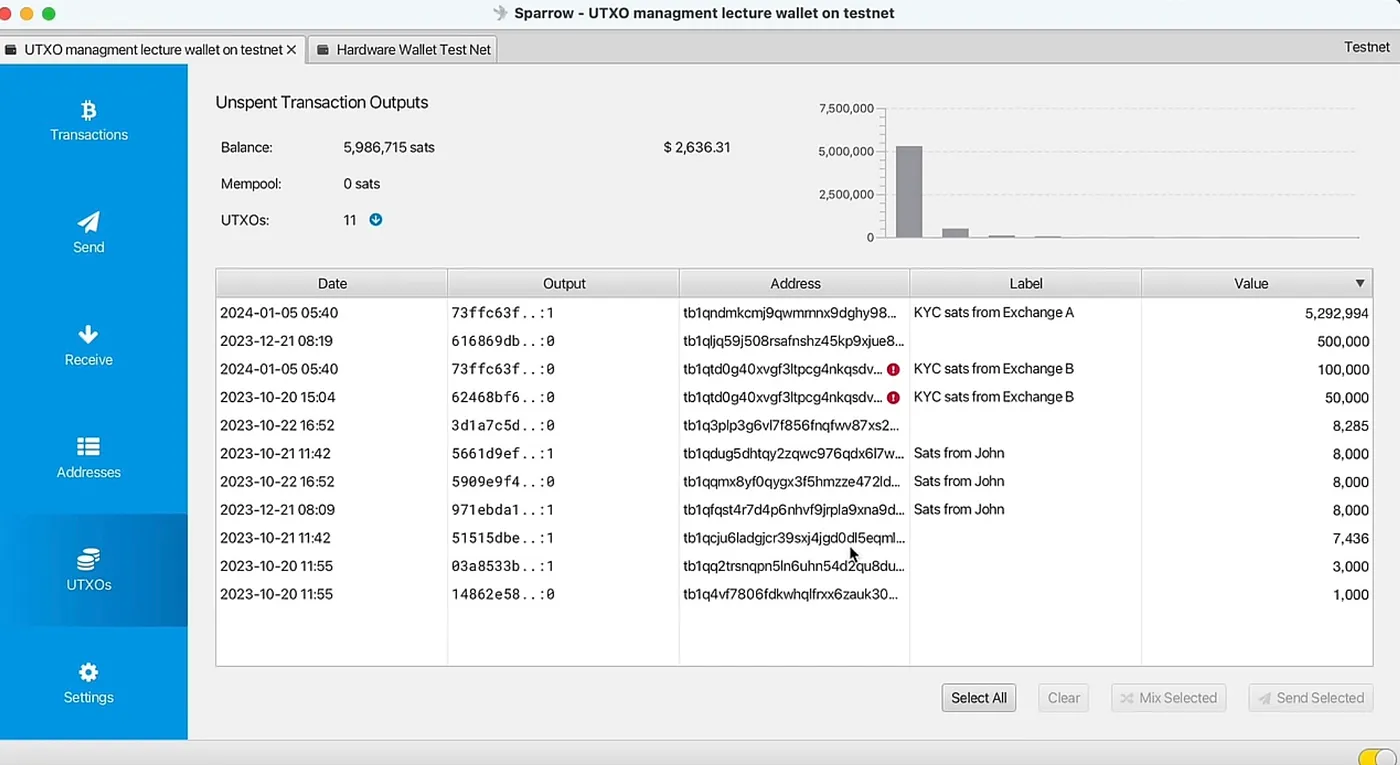

What does this mean for holders of Bitcoin UTXOs?

Consolidate UTXOs

This means combining small UTXOs that may potentially become unspendable in the future into larger UTXOs that are more immune to high fees.

Sparrow Wallet makes it very easy to do this:

All it takes is selecting all the UTXOs you want to combine, and sending them to your own address (preferably when fees are low).

This is a good practice to ensure your UTXOs do not become stranded during high-fee environments.

It is difficult to confidently predict where transaction fees will go in the future.

Yet, as Bitcoin adoption increases and its technology provides more value to application builders, a greater demand for blockspace is inevitable.

And when blockspace is a hot commodity, transaction fee bids go higher.

That’s it! Elevated transaction fees are a blessing to miners and a consolidation warning to holders.

If you have any questions about any of the content in this article, please reach out to support@simplemining.io.