What Are Bitcoin Capital Gains?

Three things are for certain:

Death, Taxes, and 21,000,000 Bitcoin.

How you handle taxes can significantly impact your success as an investor.

And your freedom in this investor's case:

You don’t want to be this investor.

It’s important to handle taxes strategically.

With Bitcoin over $100k, some of you may be thinking about realizing some gains.

Obviously you should “never sell your Bitcoin”, but at the end of the day, Bitcoin is just money, and money is a means to an end.

For some investors, maybe now is the time for you to start reaping the rewards of your low-time preference.

If so, you should consider capital gains tax (U.S. residents).

Capital gain just means, “Did your BTC appreciate in $ terms?”

If it did, and you plan on realizing these gains, the IRS requires a piece of the pie (what a surprise).

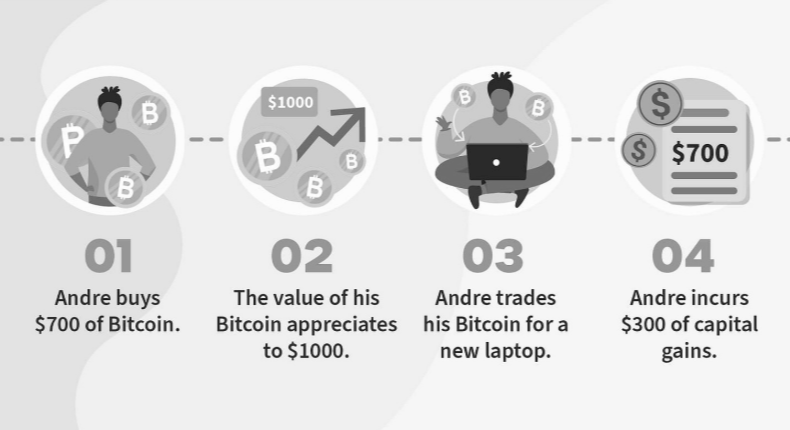

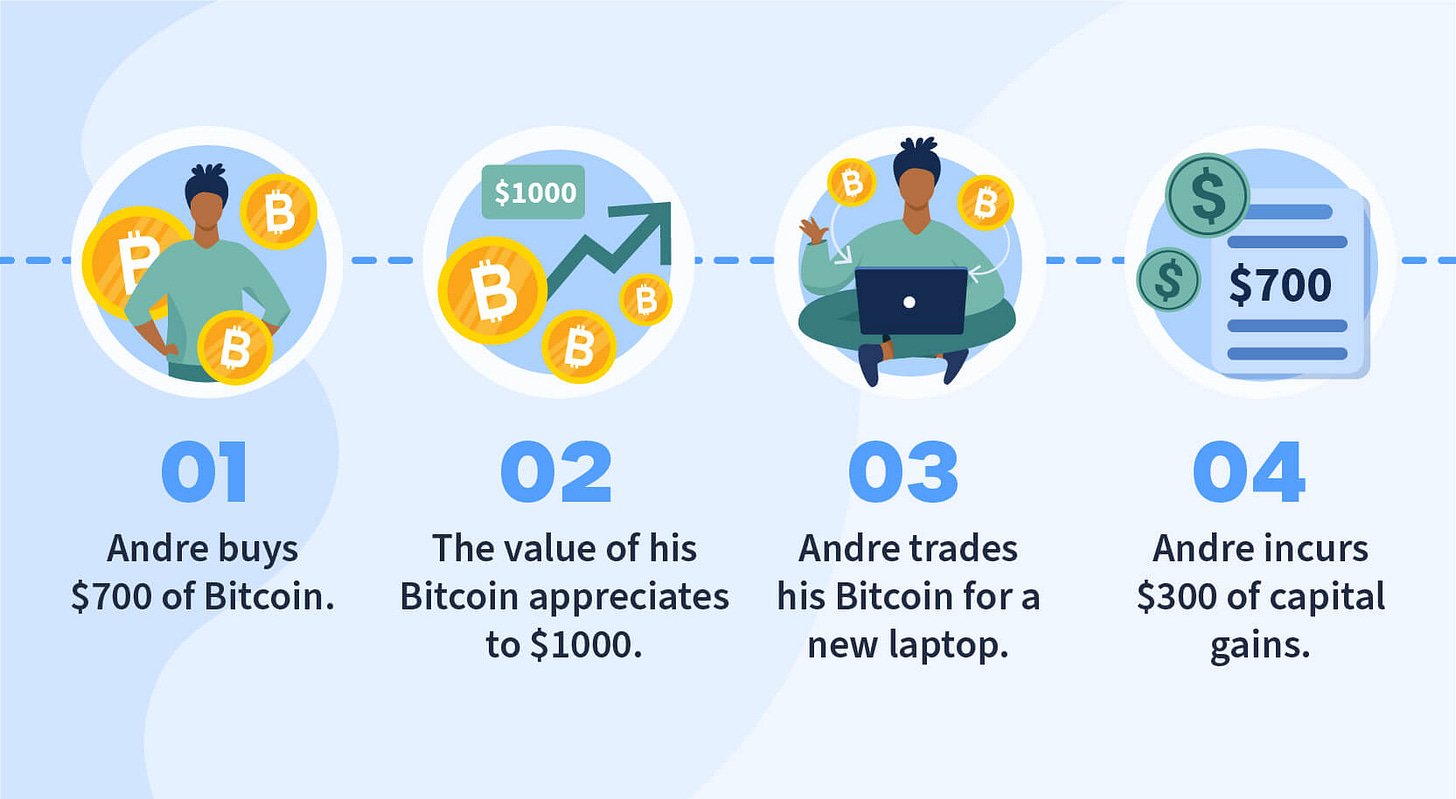

It’s important to understand what “realizing” means.

This is not limited to selling your BTC on an exchange.

This could include transferring to another asset.

For example, if you own $500 in BTC, it appreciates to $1000, and you convert it to Solana (God forbid), you would realize a $500 gain.

Here’s another example:

Some Bitcoiners may take the approach of “I’m never selling. I’ll just use my stack to buy what I want in the future.”

This is great, but under current laws, any realized appreciation is subject to tax.

How much is the appreciation taxed?

It depends on your income and how long you’ve held the asset.

If you have a low income and held for over 1 year, it could be 0%.

If you have a high income and held for less than 1 year, it could be as high as 37%.

There are some ways you can navigate this, like a collateralized loan against your BTC, but I won’t get into that here.

You can also realize losses to decrease your tax burden.

I am not a tax professional, and you should consult your tax professional before making any tax-related decisions.

At Simple Mining, we partner with LaLuna, Cohen & Lampert accounting firm.

LCL is an expert team in the digital asset mining space and can help you properly track and report your mining operations.

Below are the details on how you can work them to prepare your tax return and create adequate accounting systems:

Starting January 9th, 2025, at 9 AM, you can book your appointment online at this link: https://www5.apptoto.com/b/booklcltax/

Appointments are phone calls only: You will receive a callback within the 1-hour window of your scheduled time.

LCL can also file an extension for you and schedule a meeting after April 15th, should you need more time.

Any documents received after March 20th, 2025, will require an extension.

Set up an accounting system for mining business: https://lcltax_mlaluna.apptoto.com/

Here is what’s included:

• Learn how to keep track of everything with a few software integrations.

• Use the income statements to assess the performance of your business.

• Loan applications that could help with business equipment purchases.

• Tax planning.

If you have any questions, you can send an email to our partner tax team –info@lcltax.com