Bonus Depreciation for Bitcoin Miners

2024 Bonus Depreciation for Bitcoin Mining Companies.

By Michael LaLuna, CPA and Partner at LaLuna, Cohen & Lampert, a NY Based Accounting Firm

As the 2024 tax year approaches, it is important for Bitcoin mining companies to stay on top of tax strategies that can enhance their financial outcomes.

One such strategy is leveraging bonus depreciation, a powerful tool for reducing taxable income.

Here’s an in-depth look at how bonus depreciation works and how Bitcoin mining companies can utilize it to their advantage.

Understanding Bonus Depreciation

Bonus depreciation is a tax incentive that allows businesses to immediately deduct a significant percentage of the cost of eligible assets in the year they are placed in service rather than spreading the deduction over the asset's useful life.

Under the Tax Cuts and Jobs Act of 2017, businesses could deduct 100% of the cost of qualifying property. However, starting in 2023, the bonus depreciation rate began to decrease by 20% each year. For 2024, the rate is 60%.

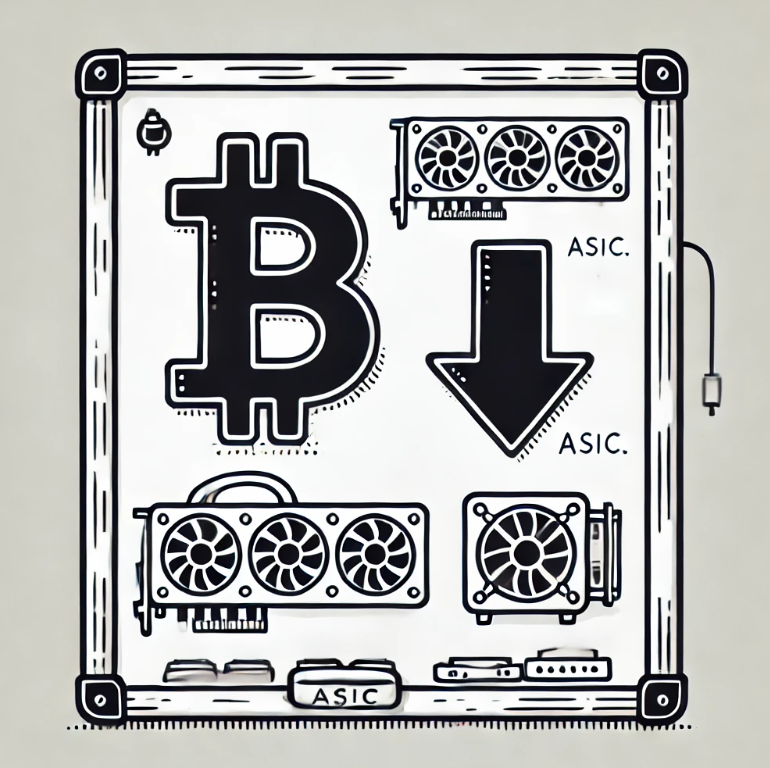

Qualifying Assets

For a Bitcoin mining company, several types of assets may qualify for bonus depreciation:

- Mining Hardware: This includes ASIC miners, GPUs, and other specialized equipment.

- Computers and Servers: Essential for managing mining operations and processing transactions.

- Electrical Infrastructure: Such as transformers, power distribution units, and cooling systems.

- Building Improvements: Certain improvements to buildings or leased property may also qualify.

How to Leverage Bonus Depreciation

Strategically plan when you will purchase assets.

- Timing: To qualify for the 60% bonus depreciation, ensure that new equipment and infrastructure are placed in service within the 2024 tax year.

- Budgeting: Allocate capital expenditure budgets to maximize the benefit of the immediate deduction.

- Cost Segregation Studies: Conduct a cost segregation study to identify and reclassify assets eligible for shorter recovery periods, thereby maximizing bonus depreciation benefits. (Mainly with buildings and larger spaces)

- Section 179 Expensing: Combine bonus depreciation with Section 179 expensing, which allows for the immediate deduction of certain assets up to a specified limit, further reducing taxable income.

Financing Considerations

Evaluate financing options to balance cash flow needs while still taking advantage of depreciation deductions. Leasing might defer the deduction, so purchasing may be more beneficial. Loans or BTC-backed lending can be a way to build cash for the financing of new machines. (We work with a few sources already)

Financial Impact

Immediate Tax Savings: Accelerating depreciation can significantly reduce a company's taxable income, leading to immediate tax savings.

Improved Cash Flow: Tax savings can enhance cash flow, allowing for reinvestment in business operations or new technology.

Competitive Edge: Enhanced cash flow and reduced tax liability provide a competitive advantage, enabling quicker scaling of operations and investment in advanced mining technology.

Potential Pitfalls and Considerations

Decrement Schedule: Be mindful of the scheduled phase-down of bonus depreciation. For assets placed in service after 2024, the percentage will continue to decrease to 40% unless updated legislation passes in the Senate.

Compliance and Documentation: Ensure thorough documentation of all purchases and their placement in-service dates to substantiate the deductions.

Tax Law Changes: Stay informed about potential changes in tax laws that may impact depreciation strategies. Consider consulting with a tax advisor to navigate these complexities.

Bonus depreciation is an advantageous opportunity for Bitcoin mining companies to reduce their tax liability and improve their margins. By strategically planning asset acquisitions and leveraging this powerful tax incentive, mining companies can position themselves for growth and profitability in the competitive mining landscape.

Michael LaLuna is a CPA and Partner at LaLuna, Cohen & Lampert, specializing in the digital asset mining industry. You may contact the firm at info@lcltax.com for further information and tax consultations.