Bitcoin Halving Breakdown

If you currently own or mine Bitcoin, you've probably heard of a significant event known as the "Bitcoin Halving."

Sounds eerie and mysterious without a doubt...

Here at Simple Mining, we want to make puzzled concepts like this one, simple.

So simple you can read this and then go teach your friends and family about the notorious Bitcoin halving over dinner.

First, let’s start out with what the Bitcoin halving is NOT:

- It does NOT cut the number of bitcoins on the market in half.

- It does NOT cut the price of a bitcoin in half.

- It does NOT cut Bitcoin transactions in half.

What does the halving do then?

The halving reduces the amount of bitcoin a “miner” is able to “unlock”.

Bitcoin miners “mine” or produce bitcoins according to the rules outlined in the Bitcoin protocol — protocol being the system that explains the correct procedures to be followed formally within a network.

The foundation for all of this is the Bitcoin code base. You can check it out here.

Miners are also part of the reason why you can’t send your friend Joe more bitcoin than you actually have possession of.

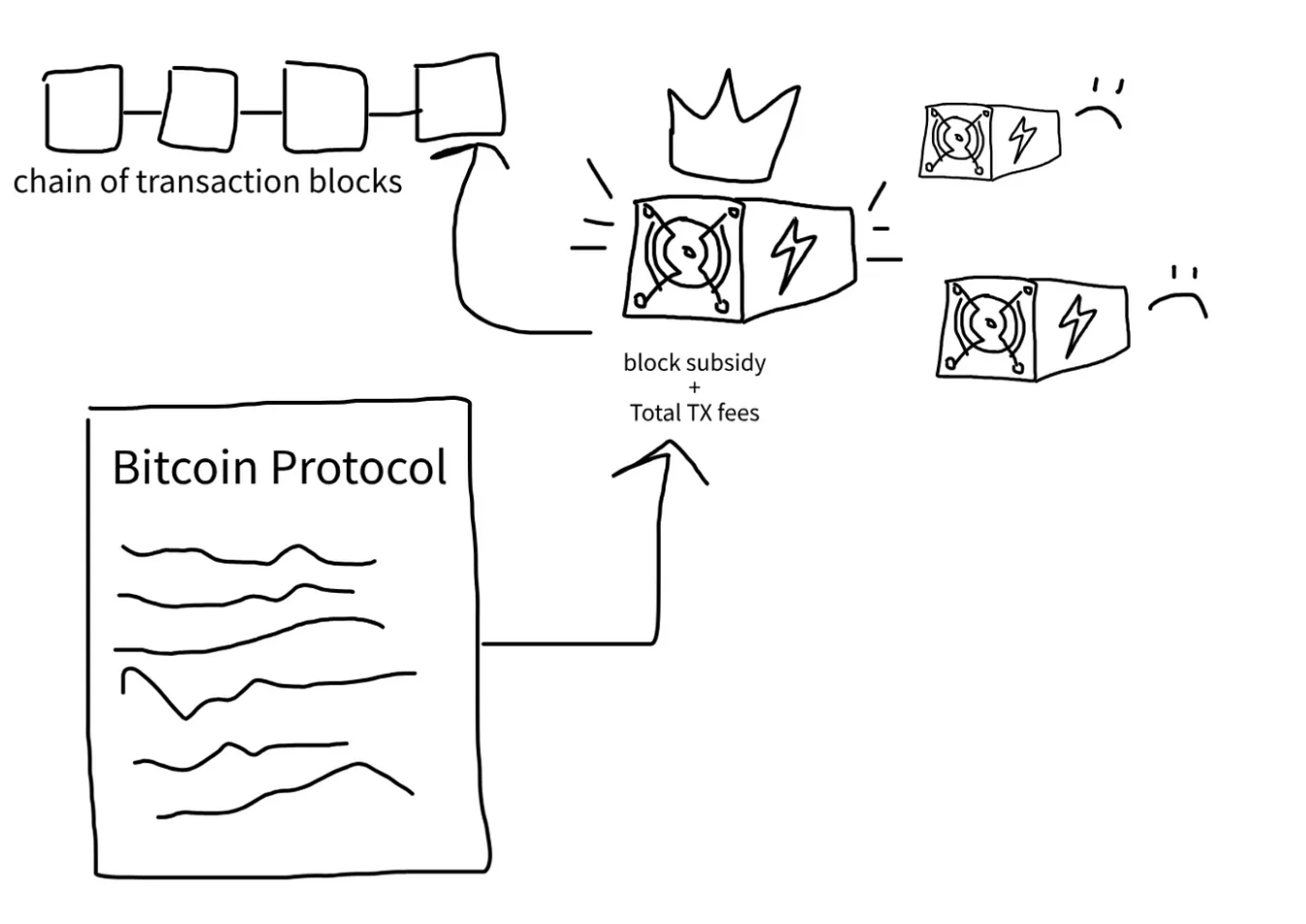

There is a digital chain of blocks that keeps a record of every transaction on the Bitcoin network. In order for a fresh block (bundle of transactions) to get successfully added to the others, a miner needs to do some work.

It is referred to as mining because, like traditional resource mining (gold, oil, etc.), it requires a large amount of energy and the process is difficult.

If it was easy, everyone would do it.

The reason for mining is because there is an incentive to go through all of that hard work: the valuable resource that can be extracted and sold, bitcoins in this case.

Only 1 miner gets the privilege of adding a block to the chain, creating somewhat of a computational competition.

Whichever miner finds the target number in the hashing algorithm (computer guessing process) first will be rewarded the block subsidy + a transaction fee.

The block subsidy is the specified reward in the Bitcoin code. This reward changes every 4 years, which is roughly the time it takes for 210,000 blocks of transactions to get added to the chain.

The first block ever added was the Genesis Block on January 3rd, 2009, which included a reward of 50 bitcoins.

Now at this point it is important to understand the supply details of Bitcoin.

The Bitcoin software is hard-coded with a permanent max supply of 21 million coins.

Bitcoin is decentralized, not one person or entity controls this rule, the software rules are distributed among network participants to ensure everyone is in agreement and playing fair.

Can someone change this number? It would be next to impossible because you would need to convince everyone else to use the software with your changed rule — like changing the rules of chess.

Now, the 21 million bitcoins have not all been released to the market yet.

The total supply started out at 50 bitcoins at block #0.

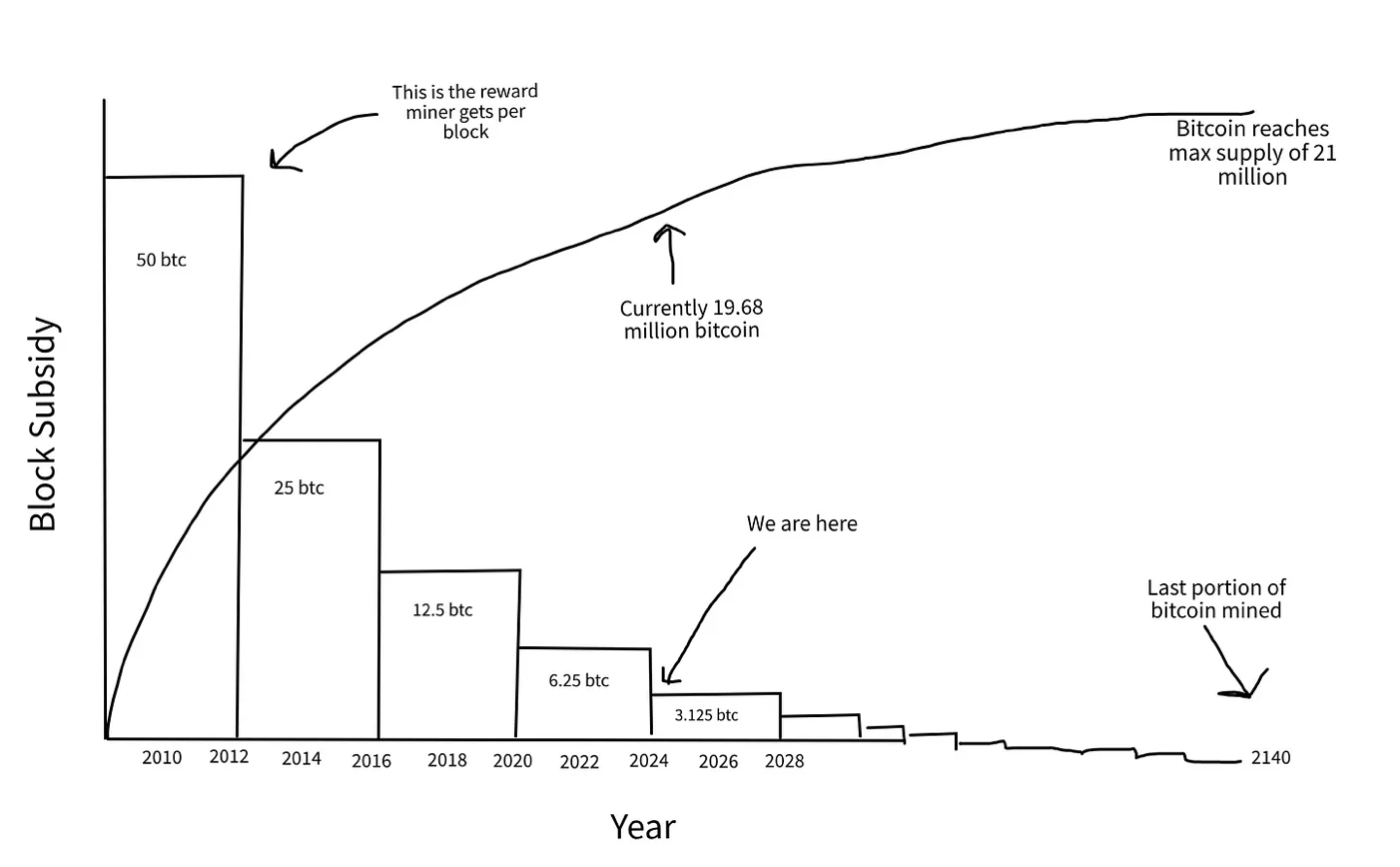

At the time of writing, there have been 19.68 million coins released since then.

This is because millions of miners have been working to add blocks, and the difficulty to find a block is set so that it will always take 10 minutes for a miner to find a block, on average.

The remaining 1.32 million coins will be distributed according to the issuance schedule.

The last portion of bitcoin will be issued around year 2140.

Here is a basic chart to visualize this:

As you can see, the Bitcoin halving event is when that bar representing the miner reward per block gets “cut” in half.

The previous Bitcoin halving dates were:

November 28, 2012 — block # 210,000 (50 btc → 25 btc)

July 9, 2016 — block # 420,000 (25 btc → 12.5 btc)

May 11, 2020 — block # 630,000 (12.5 btc → 6.25 btc)

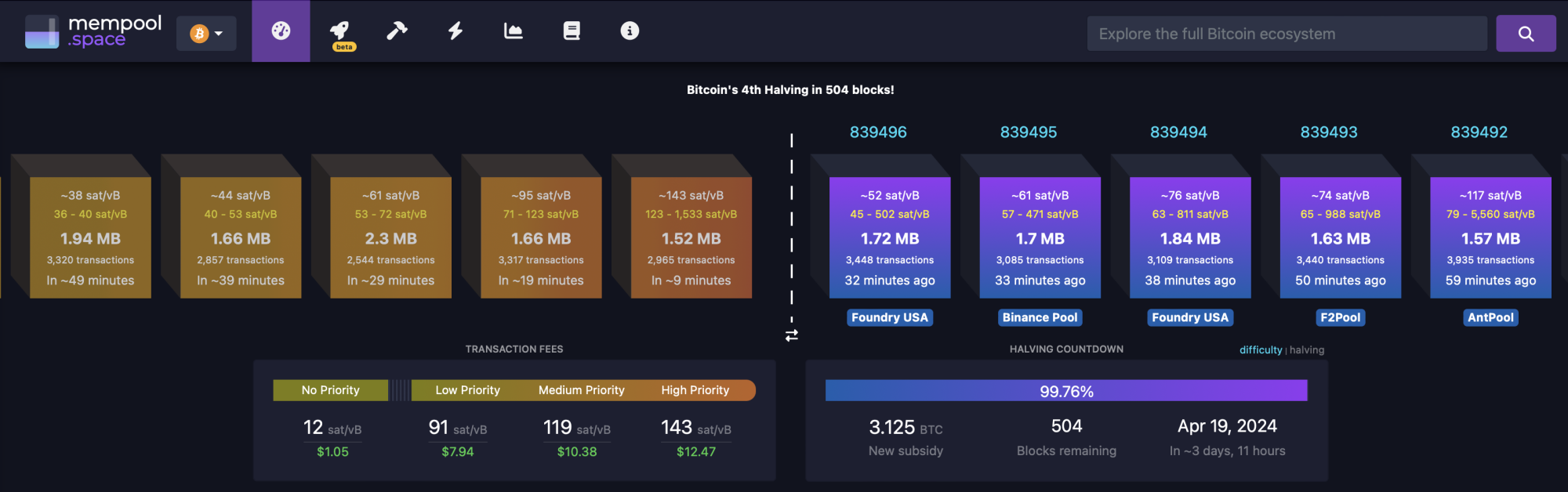

With the next one estimated to occur on April 20th, 2024 — block # 840,000 (6.25 btc → 3.125 btc)

This may raise the question of the sustainability of mining come year 2140 when thelast portion of bitcoin is issued to miners.

What will the incentive be if there is no more block reward?

Bitcoin miners are also motivated by transaction fees and block space was carefully designed in the Bitcoin code.

Only so many transactions can fit in a block and as more people want to send money on bitcoin, the bid/transaction fee to make it happen will go up.

As more and more institutions move large sums of value on the Bitcoin network, the transaction fees will be more than enough to incentivize miners to add blocks.

The Bitcoin halving is also a deflationary episode.

It de-flates the amount of bitcoin introduced to the open market until eventually, every bitcoin in existence will be unlocked.

This is what makes Bitcoin different from other forms of money like fiat currency (government paper money).

The Federal Reserve is the central banking system of the United States and operates on much different rules.

There is no distributed agreement among all participants; the fate of the supply is at the will of the bankers at the Fed.

There is also no max supply in US dollars, so your portion of the total supply is completely dependent upon how much money the bankers decide to print each year.

It could be 20% or 2%. Nonetheless, your fiat wealth is melting.

Bitcoin provides an alternative to the subtle robbery of state controlled money.

It is a programmed system enforced by math, not a political system enforced by manipulation.

The Bitcoin halving is one of many aspects that support the brilliance of the technology.

If you are currently mining with us at Simple Mining and interested in selling your older generation ASICs or upgrading to more efficient miners, please reach out to sales@simplemining.io for more information.