When Is the Best Time to Buy a Miner?

Is it too late to purchase a miner?

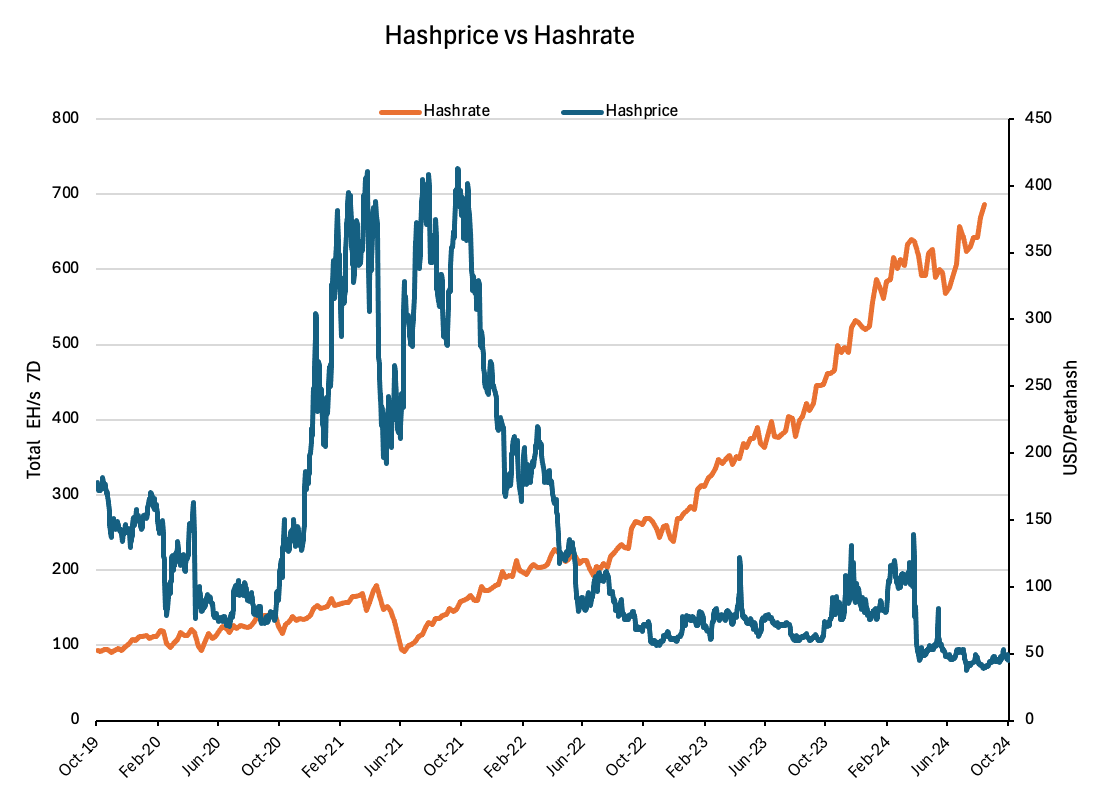

With hashprice climbing ( ~ $46 PH/s at time of writing), is it still possible to secure a profitable mining position?

Hashprice was considerably lower in early August 2024, dropping to ~ $36 PH/s.

This was the lowest since the halving in April 2024.

Hashprice refresher:

Why does hashprice matter?

It is “going market ask” for a unit of hash.

Hashprice directly determines how much capital you need to get an ASIC.

If hashprice is high, ASICs are going to be priced higher, and vice versa.

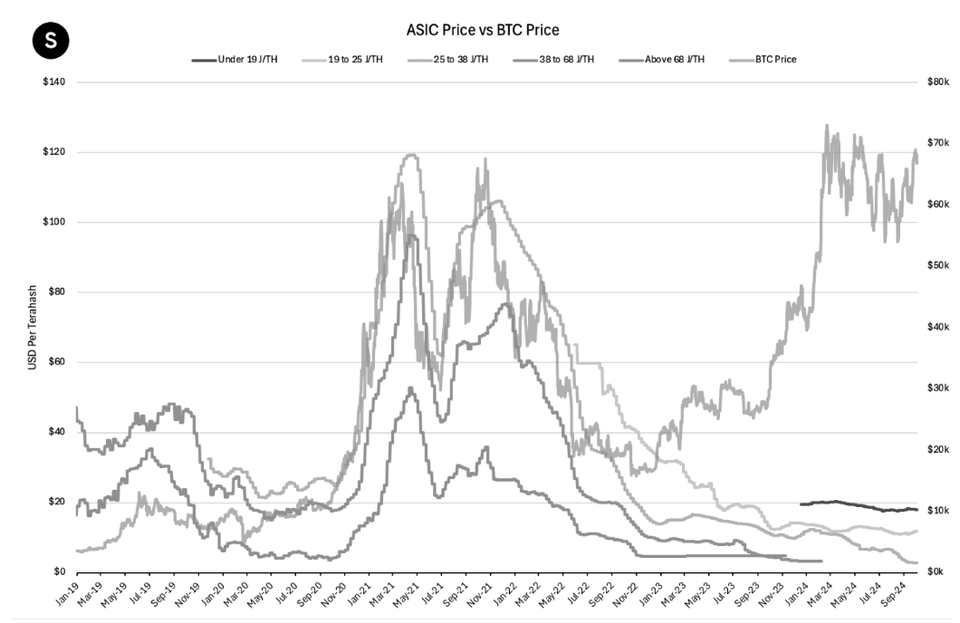

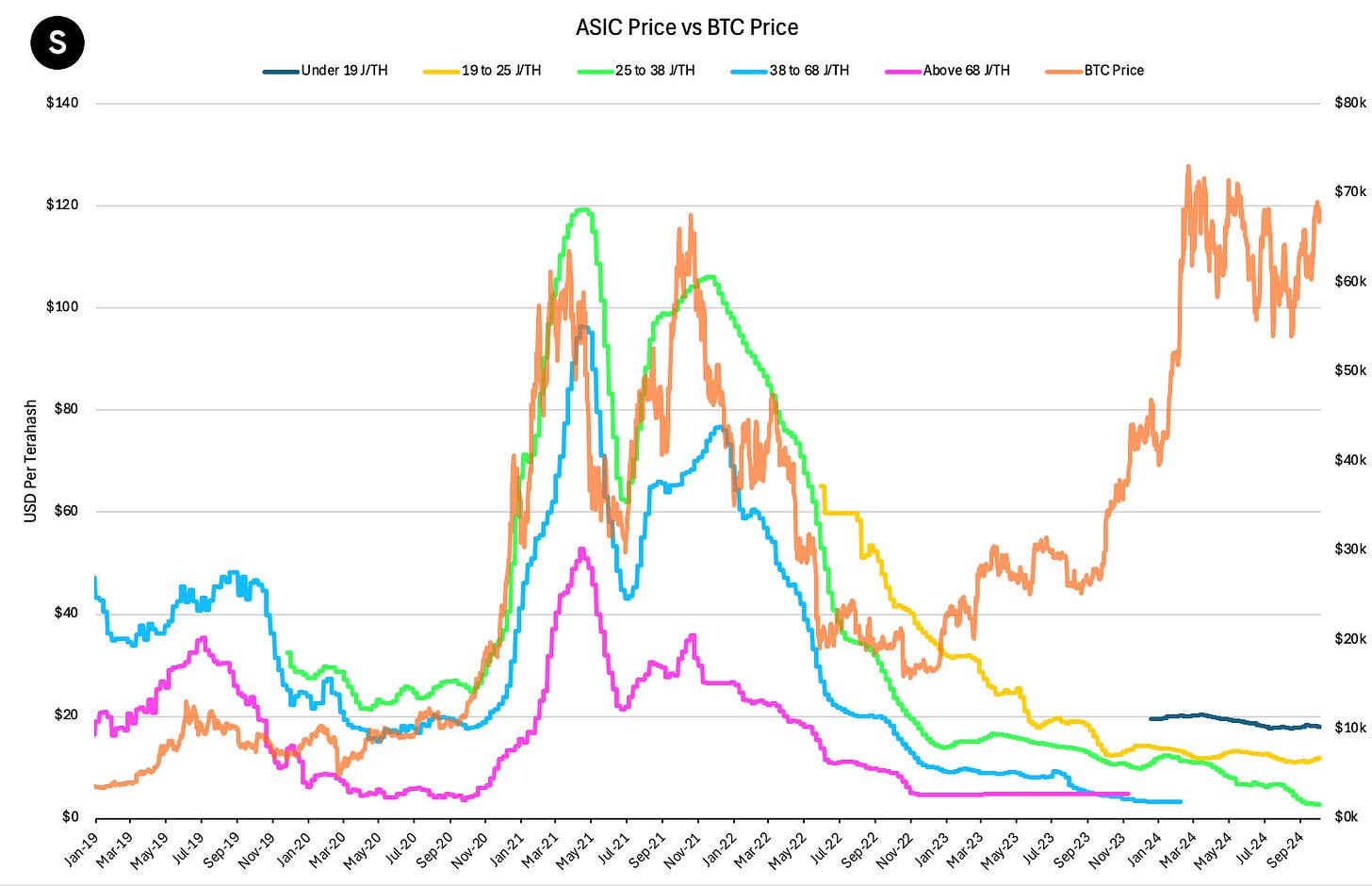

The price of an ASIC follows the price of Bitcoin:

(ASIC Price shows 5 tiers of machines based on efficiency)

Based on this chart, you will notice two things:

- ASICs are relatively inexpensive at the moment

- The Bitcoin price is up, but ASIC prices are not.

This is because hashprice is down due to increased difficulty (hashrate is up) and decreased block rewards (April 2024 halving).

Hashprice is the single best indicator of when a good time to get a miner is.

In the context of mining with Simple Mining, our clients pay 7-8 cents / kWh.

Timing is key if you want a better ROI than a simple DCA strategy.

If you bought an S19 at the 2021 top, your machine would have cost ~ $11,000 and be worth $261 today.

In terms of opportunity cost, a DCA would have outperformed.

Check out this report for a more in-depth example:

https://www.insights.simplemining.io/mine-or-buy-btc/

Purchasing efficient ASICs, securing a competitive cost of power, and maintaining a high uptime are all important.

But without a good market entry, you will have hindered success.

The right timing is how you outperform.

When is the right time?

If the wrong time is when hashprice is high (2021 highs), then the right time is when hashprice is low.

Hashprice is low when miners are capitulating.

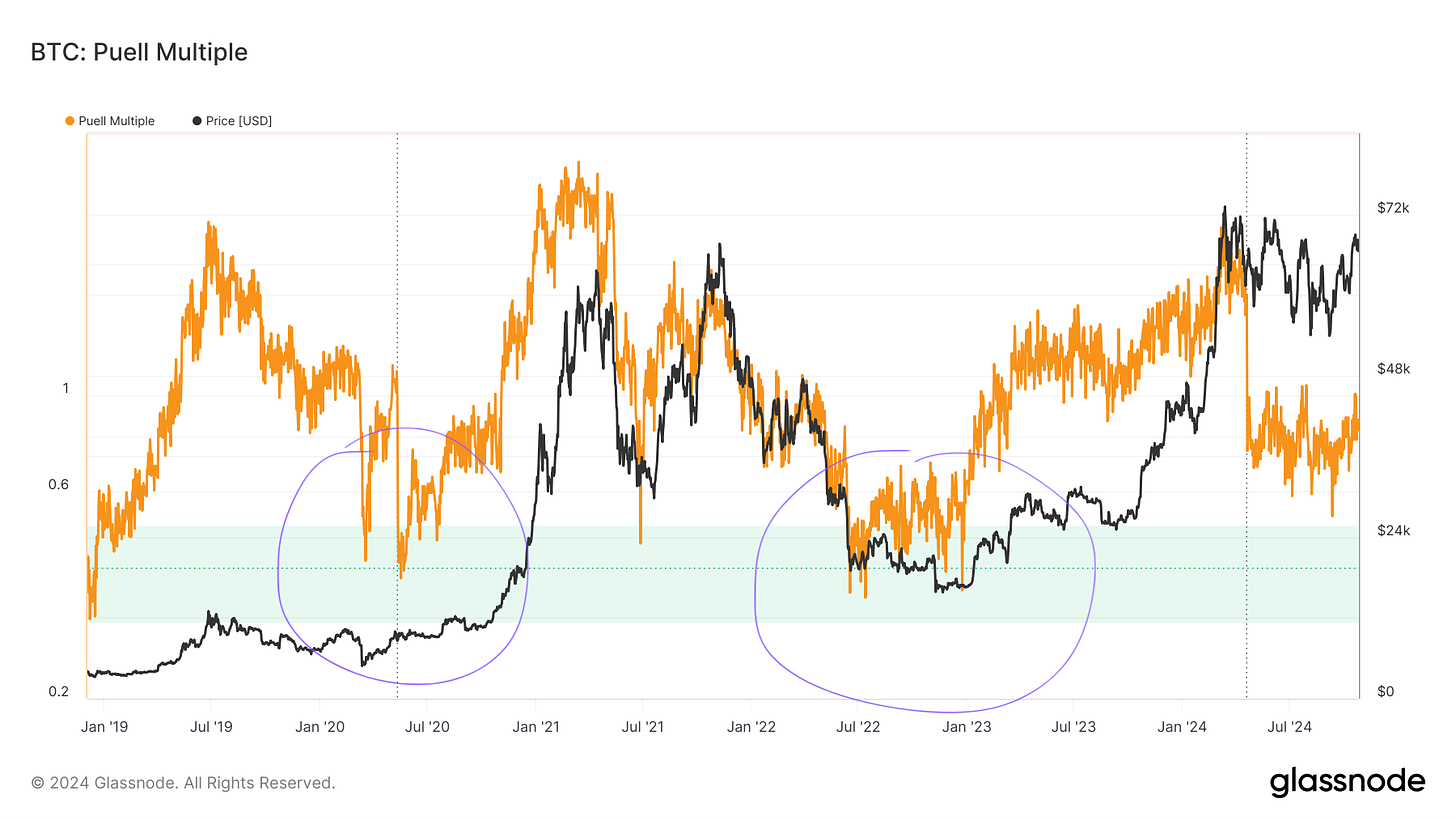

The Puel Multiple illustrates this well:

The Puell Multiple is the ratio of the daily miner income (in USD) to the yearly average.

When miners are earning less than 60% of their yearly average (the green zone), hashprice is likely low, and the overall sentiment is capitulation (unplug).

The best time to deploy capital is during periods of low profitability, when inefficient miners face problems and exit the market.

In short, double down when there’s blood in the streets.

This is how you maximize your stack with Bitcoin mining.

Hashrate cannot keep up with the price when it rips through the roof (price increases faster than miners can come online).

A decoupling of price and hashrate is when mining profitability is highest.

In the last three bull cycles, when price outpaced hashrate, it resulted in a 300% year-over-year increase in hashprice.

In summary:

- Hashprice is the best indicator to gauge market entry.

- Secure a mining position when hashprice is low (currently ~ 28% off all-time low).

- ASICs purchased at hashprice bottoms (when miner capitulation is the highest) appreciate during price pumps.

- Mined profits also appreciate because hashrate lags behind (it takes longer to build infrastructure than for price to change).

If you believe Bitcoin’s price will outpace the network hash rate in the foreseeable future, now is the time to get your miners in a row.

Hope this is helpful.