Does Bitcoin Mining Store Energy?

Bitcoin mining uses electricity to run a computer; the electricity is not destroyed but converted to heat.

The result of this energy conversion process is energy stored in a digital unit.

Every single satoshi was forged via proof-of-work.

This is what ties real-world scarcity to the digital realm.

👆This concept has been debated.

Does mining actually store energy in a Bitcoin like a battery?

No.

Check out this video to learn why:

Does Bitcoin teleport energy?

This is obviously very critical of Bitcoin as an “energy battery” or even mining as a useful activity.

There are several flaws in this analysis:

- More supply means we can store infinite energy.

- Bitcoin can’t store infinite energy because of restricted supply.

- Bitcoin mining is a zero-sum game.

- The money supply should be proportional to the amount of energy used.

- Energy is destroyed in Bitcoin mining.

- Proof of work is like lighting shoes on fire.

It is important to understand the connection between money and energy.

Energy is not “physically stored” in money, but money still stores energy.

You work hard and expend energy to produce value in society.

This energy has to be channeled somewhere to be used later.

Money is the tool we use to “store” this energy.

Energy can also be viewed as purchasing power.

People store purchasing power in money and can convert it to raw energy later (guns, nukes, missiles, yachts, etc.)

The US Dollar can transport energy without wires. If you transported $100 million to a place where it is accepted as money, it could be converted to energy.

If we create as much money as we want, can we store as much energy as we want?

No.

Money : Energy is not a 1:1 ratio.

1 US Dollar stores more energy than 1 Venezuelan Bolívar.

We cannot store infinite energy in money because we associate the energy value of money with scarcity.

If a money is easy to produce, it will be given a lower energy allocation.

And if the supply is increased, it is less scarce and, therefore, leaks energy.

Any government-controlled money leaks energy.

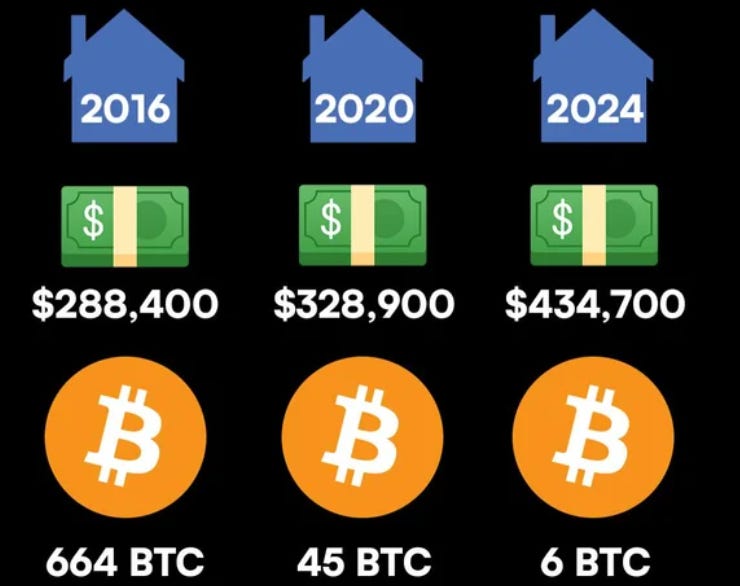

Bitcoin (a mathematically controlled money) preserves and appreciates energy.

The fixed supply allows each unit of Bitcoin to store more energy over time as the demand (and work required) for each unit increases.

Each unit will just store more energy.

This is why Bitcoin's purchasing power (energy storage) increases over time.

In its early days, Bitcoin required less energy expenditure (CPU mining) and did not have significant purchasing power.

Today, it uses more energy and computing power and has a higher purchasing power.

Bitcoin mining is not a zero-sum game (one person’s gain is another person’s loss).

It is a positive-sum game (one person's gain results in another person's gain).

As more people mine Bitcoin, each block reward is more sought after.

But with each block, new value is created that didn’t exist before, and it’s not taken away from anyone else.

Even though one miner wins the block, the total supply of Bitcoin increases.

This also increases the energy associated with all existing units (purchasing power goes up).

Proof of work is not a battery but rather an energy receipt.

It shows that each Bitcoin was minted through hard work and energy use, not by the whim of a bureaucrat or fraudulent tinkering.

You cannot get Bitcoin unless you exchange energy in the form of money or expend energy to mine it.

The ultimate question is this:

What is a waste of energy?

Do you think gold mining is a waste of energy?

Do you think the NFL is a waste of energy?

Energy is the most distilled form of value.

Anything of value has a kWh price tag.

If you want high purchasing power, you must have high energy.

Bitcoin mining uses high-performance computing to secure this energy, not burnt shoes.

Hope this helps.