Ethereum vs Bitcoin: Why You Can Only Mine One

Key Takeaways

- Ethereum abandoned mining on September 15, 2022 via "The Merge"; Bitcoin remains the only major mineable network

- Bitcoin mining delivers ~30% margins ($3.08/day net on an S21 XP at $0.08/kWh) versus ETH staking at just 2.8-3.2% APY

- Mining rewards are liquid on receipt; staking requires unbonding periods that lock your capital for days or weeks

- Both the SEC and CFTC classify Bitcoin as a commodity; the SEC banned staking inside ETH ETFs, signaling regulatory risk

- Simple Mining offers hosted mining at $0.07-$0.08/kWh with on-site repairs, Section 179 tax benefits, and a 7-day free trial

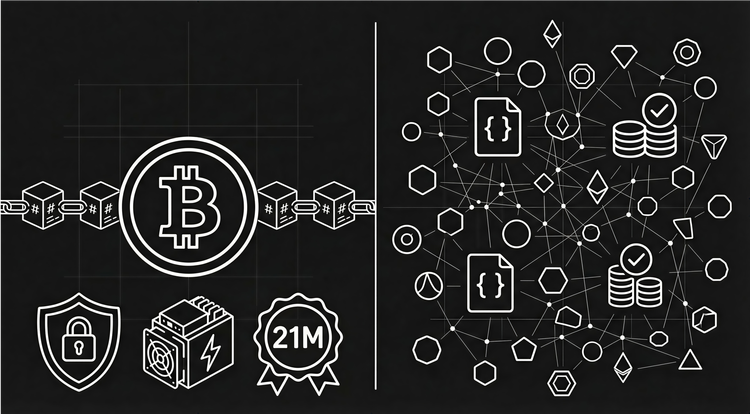

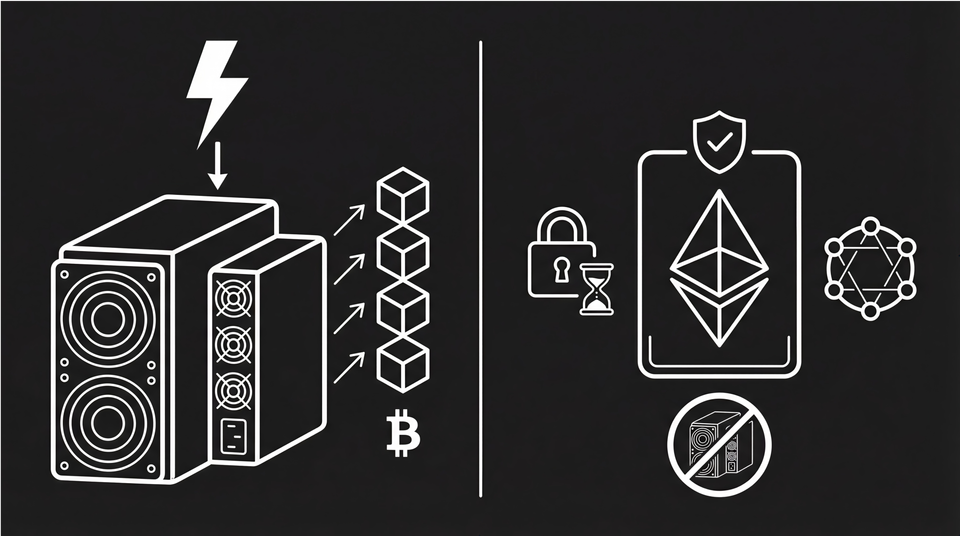

The Ethereum vs Bitcoin debate takes a sharp turn when you look at it through an investor's lens. On September 15, 2022, Ethereum abandoned mining forever. The network switched from Proof-of-Work to Proof-of-Stake in an upgrade called "The Merge." Bitcoin remains the only major network where you can own productive hardware and earn coins through computation. For hardware investors seeking clean property rights and regulatory clarity, this distinction matters more than price charts.

What Proof-of-Work and Proof-of-Stake Mean

Proof-of-Work is a consensus mechanism where computers compete to solve cryptographic puzzles. The winner adds the next block and earns newly minted coins. Think of it like a lottery where your number of tickets equals your computational power. Bitcoin uses this system and will use it forever.

Proof-of-Stake works another way. Validators lock up coins as collateral. The network selects validators to propose blocks based on the size of their stake. Think of it like a bank CD: you deposit funds and earn yield. Ethereum switched to this model in September 2022.

The technical shift has profound implications. Mining creates new coins through energy expenditure and hardware ownership. Staking generates yield through capital lockup. One gives you property. The other gives you a promise.

How Bitcoin Mining Works

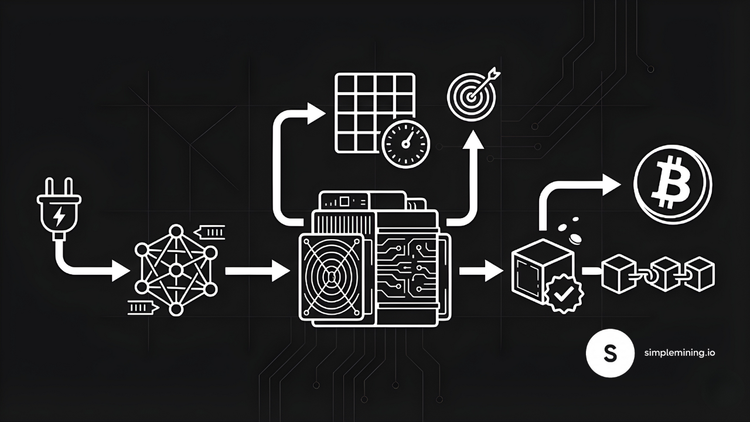

Bitcoin mining follows a predictable process:

Step 1: Purchase specialized hardware called an ASIC (Application-Specific Integrated Circuit). The Antminer S21 XP produces 270 terahashes per second at 3.6 kW. This air-cooled flagship represents the efficiency standard for 2026 investors.

Step 2: Connect the miner to power and internet at a hosting facility. Hosted mining eliminates the noise, heat, and infrastructure headaches of running machines at home.

Step 3: Join a mining pool. Pools aggregate hashrate from thousands of miners and distribute rewards based on contribution. Solo mining requires roughly 250 petahashes to find one block per month. That costs millions.

Step 4: Earn bitcoin. Here's the math for an S21 XP at current network conditions:

- Gross revenue: $10.07/day

- Electricity cost: $6.99/day (at $0.08/kWh)

- Net profit: $3.08/day

That works out to about $92/month in profit per machine. You earn roughly 30% margins on efficient hardware at competitive power rates.

Step 5: Withdraw to your own wallet. The coins belong to you. No intermediary holds them on your behalf.

The math stays transparent. Hashprice tells you exactly what a unit of hashrate earns each day. You can calculate profitability down to the kilowatt-hour.

Why Investors Care About Proof-of-Work vs Proof-of-Stake

The Ethereum vs Bitcoin choice involves more than technology preferences. It involves property rights, regulatory exposure, and liquidity.

Ownership structure differs. Bitcoin mining gives you physical hardware. You own an asset that produces coins. The IRS treats mining equipment as depreciable property under Section 179. You can write off the full cost of machines in year one. That tax benefit, combined with 30% operating margins, often beats passive staking yields on an after-tax basis. Staked ETH sits in a smart contract or with a custodian. You hold a claim, not a tangible asset.

Regulatory classification diverges. Both the SEC and CFTC classify Bitcoin as a commodity. This dual-agency consensus provides regulatory clarity unavailable to other digital assets. Ethereum's status remains murky. The SEC approved spot ETH ETFs in May 2024, but prohibited staking within those products. The explicit ban on staking signals ongoing regulatory concern about yield-generating mechanisms. Staking looks like a security to regulators. This ambiguity creates risk for institutions and serious investors.

Counterparty risk appears in staking. When you stake ETH directly, you risk slashing penalties if your validator misbehaves. When you stake through a service like Lido or Coinbase, you add custodial risk. The staking provider can lose your funds through hacks or operational failures. Bitcoin miners face no slashing risk. Hardware either works or it doesn't.

Liquidity differs at the moment of reward. Bitcoin mining rewards arrive in your wallet ready to spend or hold. No waiting period. Ethereum staking often requires an unbonding period lasting days or weeks. During that window, your capital sits frozen. You cannot sell into rallies or rebalance your portfolio. This lockup risk compounds during volatile markets when you most need flexibility.

What can go wrong: Bitcoin mining profitability depends on hashprice. If network difficulty rises faster than Bitcoin's price, margins compress. The April 2024 halving cut block rewards by 50%, pressuring inefficient operators.

Mitigation: Lock in low electricity rates with a reliable host. Power costs below $0.08/kWh keep miners profitable through difficulty spikes. Understanding mining economics helps you time equipment purchases.

Decision Framework: Mining vs Staking

Use this framework to evaluate your options:

Choose Bitcoin mining if:

- You want tangible property rights with no counterparty

- Tax depreciation benefits fit your financial situation

- You prefer transparent economics (hashprice × hashrate = revenue)

- You seek regulatory clarity backed by both SEC and CFTC

- You value self-custody and immediate liquidity of earned coins

- You want active business income rather than passive yield

Consider ETH staking if:

- You already hold ETH and want passive yield

- You accept custodial or smart contract risk

- You tolerate uncertain regulatory treatment

- You can handle unbonding periods during volatile markets

Questions to ask yourself:

- Do I want to own productive equipment or loan capital for yield?

- Can I access electricity below $0.10/kWh through a hosting partner?

- How important is regulatory clarity for my investment thesis?

- Can I afford capital lockup during market downturns?

- What is my time horizon?

For long-term Bitcoin accumulation, mining offers a structural advantage. You acquire coins at production cost rather than market price. Over time, this compounds.

Comparing Returns: Mining vs Staking vs Holding

The numbers tell a clear story.

Ethereum staking yields: Current APY sits around 2.8% to 3.2%. This rate has declined from 8% post-merge highs as more validators enter the network. Roughly 30% of ETH supply now stakes, compressing returns for everyone. Yield will continue to fall as participation grows.

Bitcoin mining returns: A hosted S21 XP at $0.08/kWh produces ~$10.07/day gross revenue at current hashprice. Daily electricity runs ~$6.99. Net daily profit: ~$3.08. Monthly profit: about $92. Plus you own hardware that depreciates for tax purposes under Section 179. A business owner in a high tax bracket can recover 30-40% of the machine cost through deductions in year one.

The hidden math: Staking earns yield on capital already deployed. Mining converts electricity into coins. One approach taxes your existing stack through inflation dilution. The other adds to your holdings without selling existing positions. For investors building positions, this distinction drives long-term wealth.

Ethereum staking also concentrates power. Lido controls roughly 25% to 29% of all staked ETH. Such concentration contradicts decentralization principles and introduces systemic risk. A single protocol failure could cascade across nearly a third of network security. Bitcoin mining remains distributed across hundreds of operators and multiple continents.

The Simple Mining Angle

Simple Mining removes the friction between wanting Bitcoin exposure and running mining operations.

On-site repairs: Our Cedar Falls facility houses one of North America's largest ASIC repair centers. Machines break. Hashboards fail. Fast repairs mean higher uptime and more Bitcoin in your wallet.

Precision billing: You pay for actual power consumed. No estimates. No flat rates padding someone else's margin. At $0.07-$0.08/kWh, you capture mining economics unavailable to home operators paying residential rates.

Renewable energy mix: About 65% of our power comes from renewable sources. This matters for ESG-conscious investors and reduces exposure to carbon-related regulatory risk.

7-day free trial: Test hosted mining before committing capital. We send hashrate to your wallet. You verify the economics work for your situation.

Transparent operations: Real-time dashboards show your machines hashing. No black boxes. No surprises on your invoice.

Conclusion

The Ethereum vs Bitcoin comparison ends at one unavoidable fact: you cannot mine Ethereum anymore. Bitcoin remains the only major Proof-of-Work network where hardware ownership equals coin production. Mining delivers 30% margins, immediate liquidity, and tax advantages. Staking offers 3% yields with lockup risk and regulatory uncertainty. For investors who value property rights over yield promises, the choice makes itself.

Ready to own productive Bitcoin infrastructure? Explore our hosting options →