Which ASIC Should I Purchase?

Which miner is best for you?

Which type of machine will generate the best return on investment?

A recent Simple Mining report, Mine vs Buy BTC, evaluated profitability using a scenario with a new-generation machine (S21).

But what if you went the route of an older machine with less capital expenditure (CAPEX) upfront?

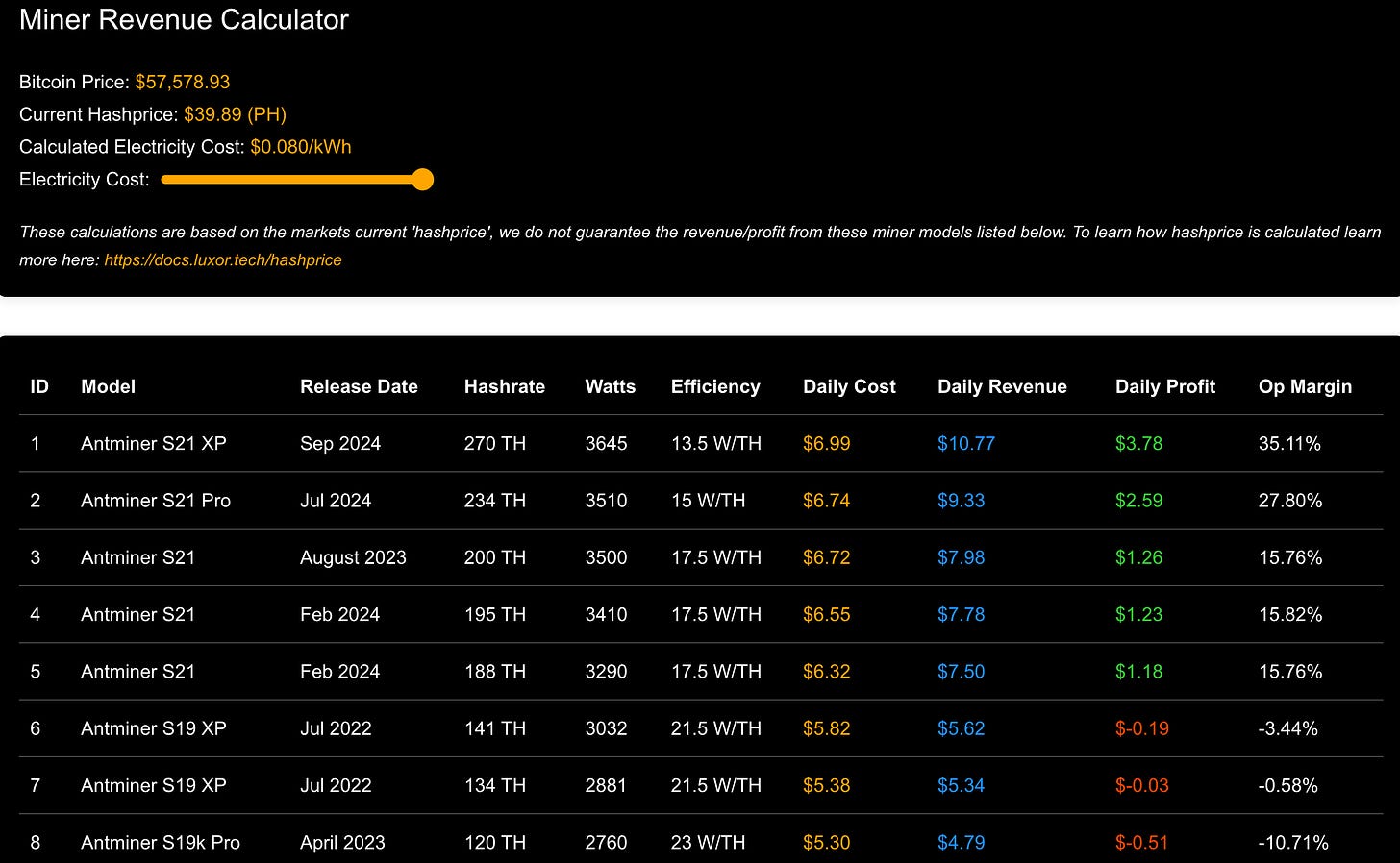

For context, when hashprice is at all-time lows, having the most efficient equipment is required if you want to mine Bitcoin above breakeven.

Our mining calculator illustrates this:

Currently, the S19 XP is underwater by -$0.19 (this is a great example of how you can utilize our Pause Period).

This does not mean it’s not worth hosting one of these machines with Simple Mining.

There are many factors to consider when deciding on which machine to purchase, including:

- Price: How much does it cost to purchase this ASIC? What is the opportunity cost in terms of Bitcoin?

- Hashpower: How much BTC can I expect the machine to mine? Higher hashrate = higher revenue.

- Efficiency: Is the machine energy efficient? How many watts does it consume per hash? Lower W/Th = more efficient.

- Life Span: What's this machine's expected lifespan? How long will it remain competitive before newer machines make it obsolete?

- Electricity Cost: How much will this machine cost in electricity each month? Will I be able to pay the monthly hosting out of pocket without having to sell any of my mining rewards?

- Profit: Revenue - Costs = Profit. What is the breakeven?

Each of these variables can be tuned to meet the requirements of the individual investor.

For the sake of this analysis, we will dive into the scenario of choosing an older machine.

Why would anyone choose an inferior machine in the first place?

The benefit of getting an older machine is the drastically reduced upfront CAPEX. This results in an accelerated payback period.

Let’s run an example of purchasing the S19k Pro 120 Th/s.

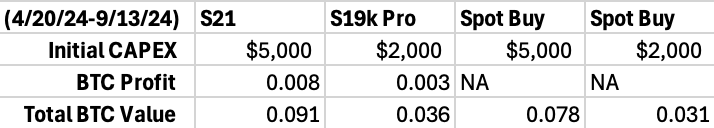

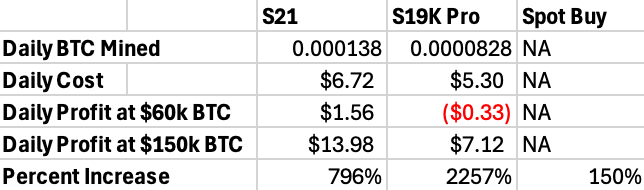

We will compare this to the S21 model and a spot buy, with a starting point of the most recent halving on April 20th, 2024.

This example assumes the machine maintains a similar BTC-denominated value today as when deployed on 4/20/24.

This also calculates pure profit as revenue - costs.

The S19k Pro has paid back ~ 8.75% of the initial $2000 CAPEX. This is also considering this machine has been paused since 08/01/24, due to unprofitable conditions.

The S21 has paid back ~ 9.5% of the initial $5000 CAPEX. This machine has not dropped below daily breakeven and is currently mining ~ $1.25/day in profit.

The spot buy has paid back negative 6% due to the drop in the Bitcoin exchange rate.

($64k on 04/20/24)

This showcases the resilience of new-gen units.

Although there’s a catch.

Things look different in a bullish environment.

Bitcoin going from $60k (~ present value) to $150k is a 150% increase.

Here’s how much the daily profit for each ASIC would increase:

This assumes a rapid price increase and does not account for the increases in mining difficulty.

The % profitability of each ASIC increases by a multiple depending on the machine.

Older machines will have a higher multiple.

This would also result in an accelerated payback period:

S19K Pro → $213 monthly profit → ~ 10.65% monthly ROI

S21 → $419 monthly profit → ~ 8.4% monthly ROI

These insights should help inform ASIC selection based on your level of bullishness.

Here are the pros and cons:

Old Machine

Pros:

- Lower CAPEX

- Faster ROI

- Greatest upside in a bullish environment

Cons:

- Unprofitable when hashprice is low

- Not as efficient

- More susceptible to repairs

New Machine

Pros:

- Can weather unfavorable market conditions

- Fewer repairs and greater efficiency

- Slower hardware depreciation

Cons:

- High initial CAPEX

- The timing of market entry has a greater impact on profitability.

TLDR:

If you expect the Bitcoin exchange rate to catapult in the coming months, you may want to consider an older-gen machine. You can capture the tremendous upside with minimal upfront investment. The tradeoff is older machines are currently on the daily breakeven fence.

If you have access to less than $0.08/kWh electricity, getting an older machine could also make sense. We can ship physical units to clients’ upon request.

If you do not have a particularly firm expectation of how the Bitcoin exchange rate will play out but still want to secure a profitable mining position, acquiring a new-gen machine is the sure-fire way to accomplish this. The tradeoff is a higher capital expense, but you’re highly profitable even at the current hashprice.

There are many variables and risks to consider when deciding how to allocate your capital efficiently.

Simple Mining is here to provide you with all the facts so you can make the best decision.

If you are interested in the machines we currently have for sale, you can visit the Simple Mining Marketplace or contact sales@simplemining.io