The Relationship Between Bitcoin Price & Hashrate.

This article examines the relationship between the price of Bitcoin and hashrate. This is key to understanding the bull case for Bitcoin mining.

The implications can heavily influence mining profitability.

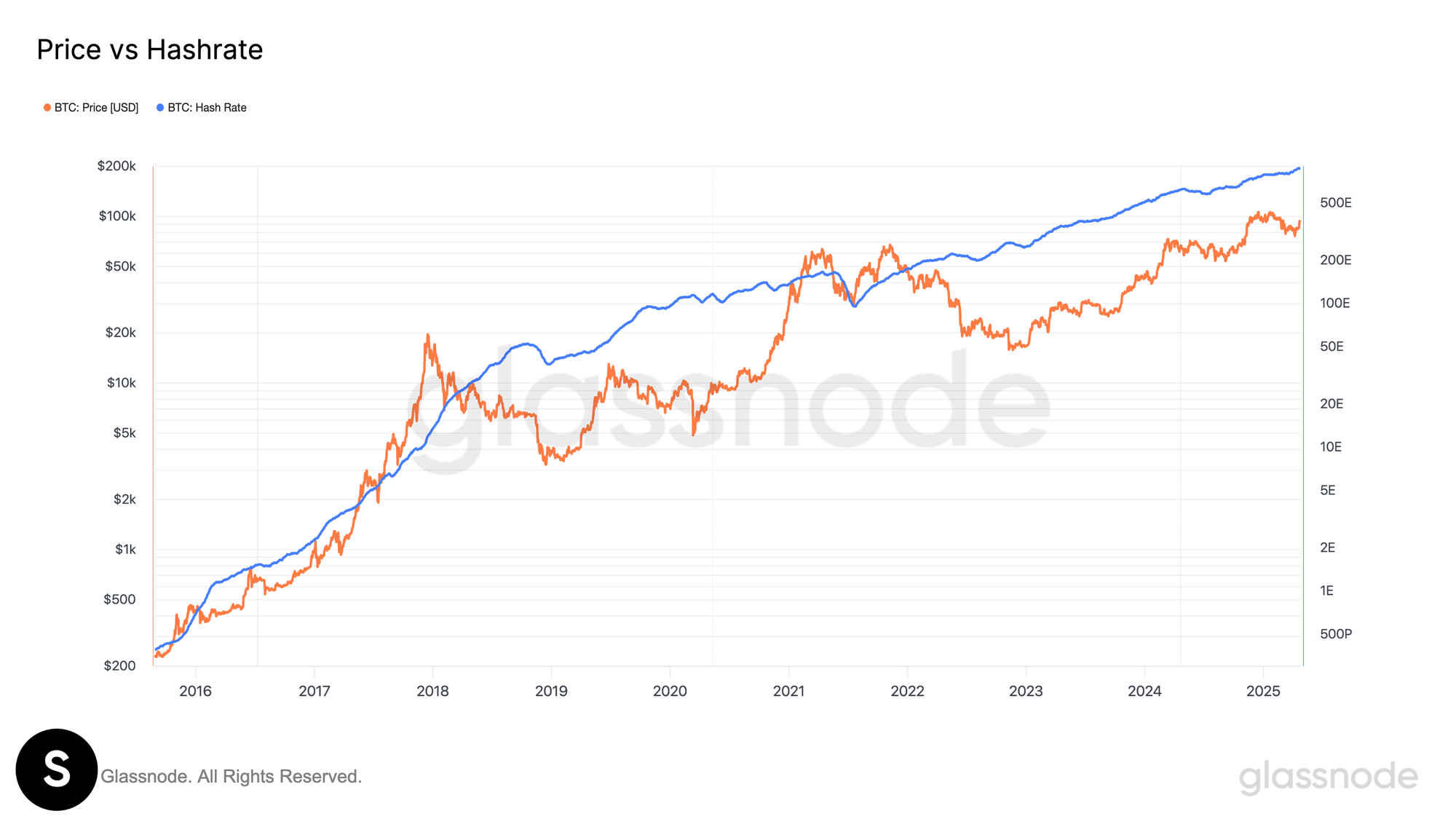

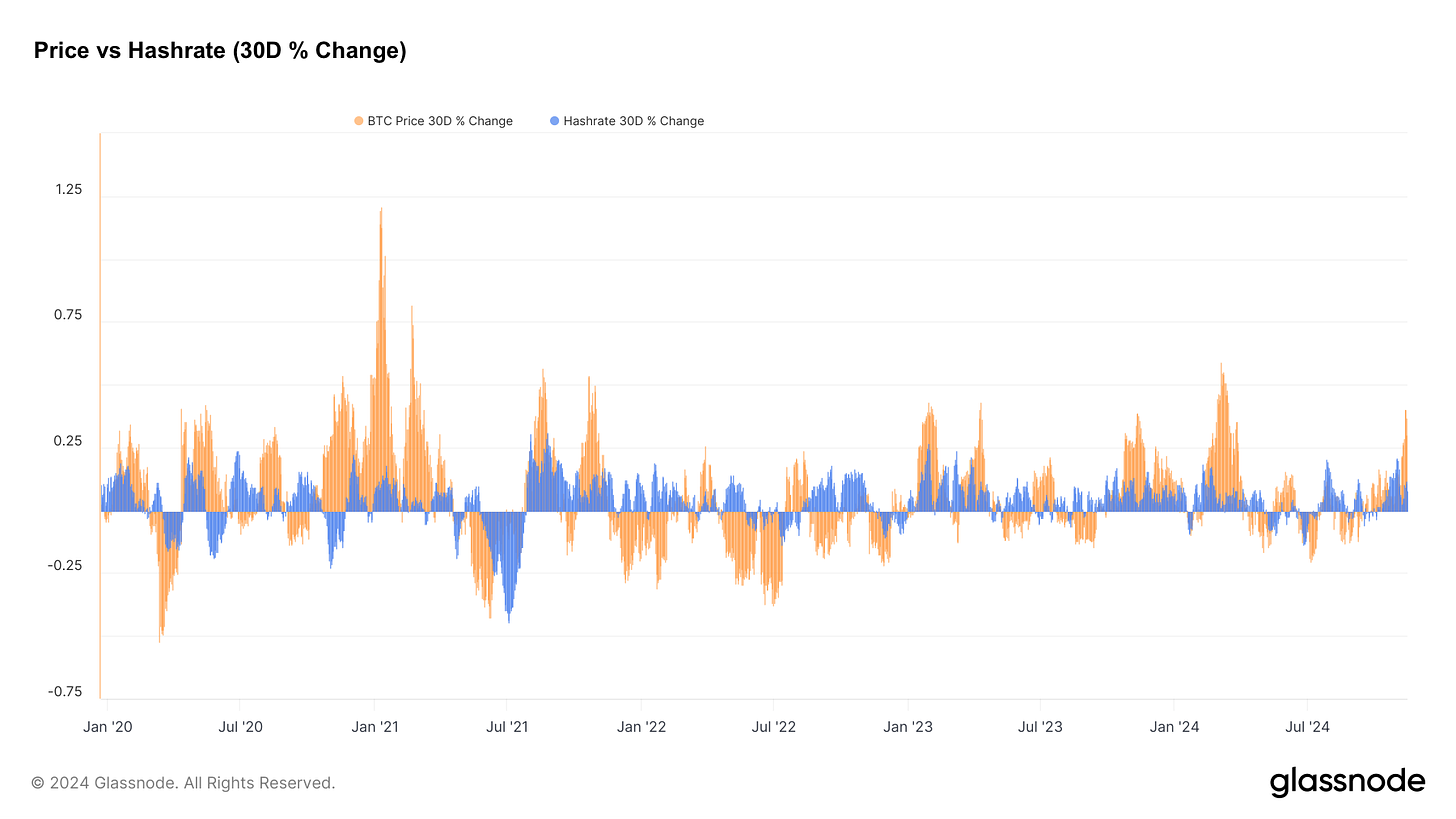

Over time, the Bitcoin price and Bitcoin hashrate have a positive correlation:

A mining position is a perfect hedge for when the BTC price rips through the roof and leaves hashrate in the dust.

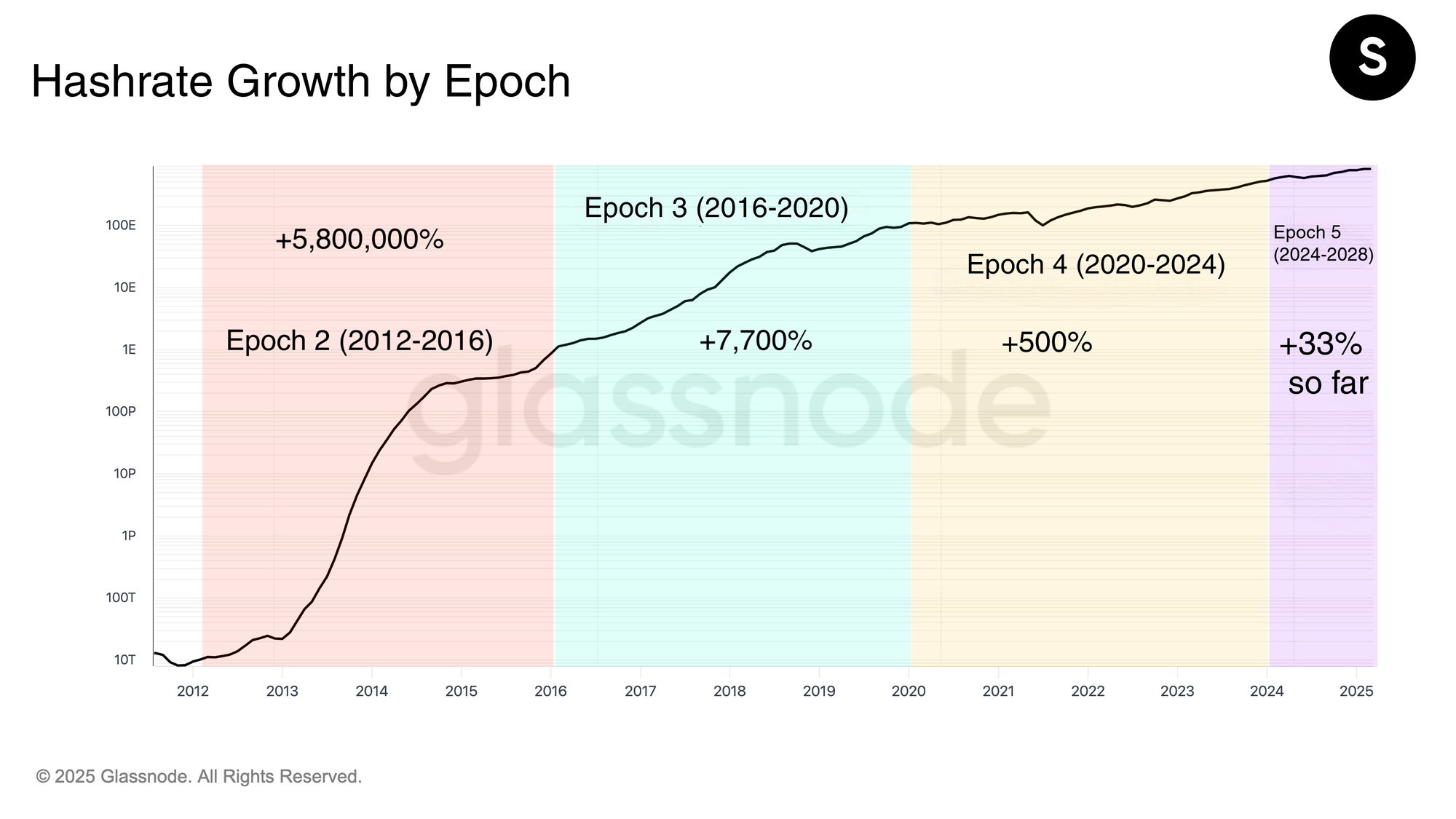

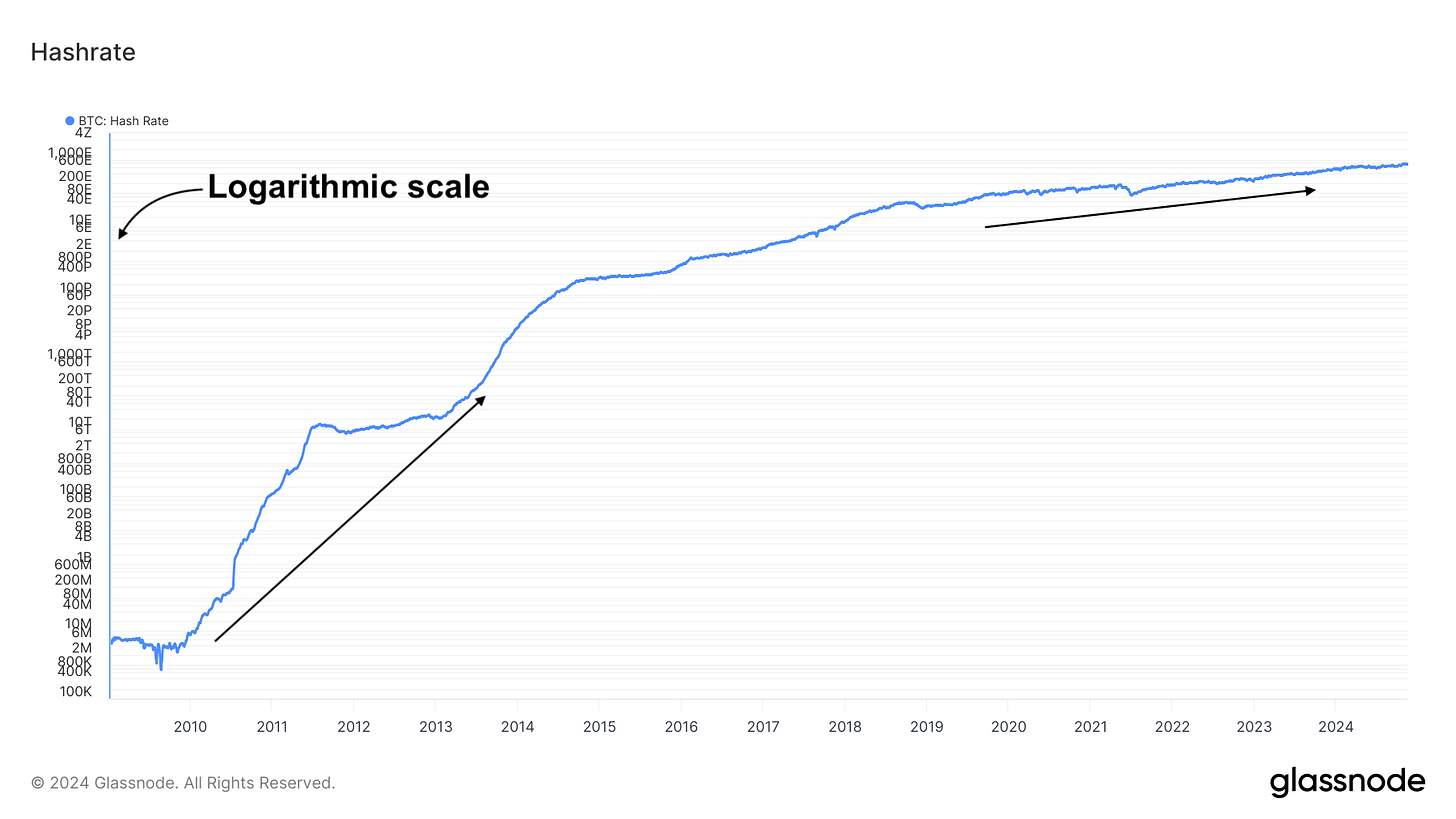

Hashrate growth is diminishing.

We are 25% into epoch 5, which means if hashrate maintains consistent growth, hashrate will increase 132% from 2024-2028.

It may even be less with tariffs and increased competition for energy from AI/HPC.

If hashrate growth starts to plateau, ASIC miners will become more of a commodity.

Fleet efficiency will have very little impact on profitability (at least until a quantum miner is released).

The competitive advantage of Bitcoin miners will come down to operations, low electricity rates, and savvy financial management.

How much do you think the Bitcoin price will increase from 2024-2028?

If you think more than 132%, you should give us a call.

This is where Bitcoin mining makes its case against buying spot.

All it takes is a couple of clicks to push price higher.

Which makes spot buying LESS EFFECTIVE.

And unless hashrate can match this increase, it makes mining MORE EFFECTIVE.

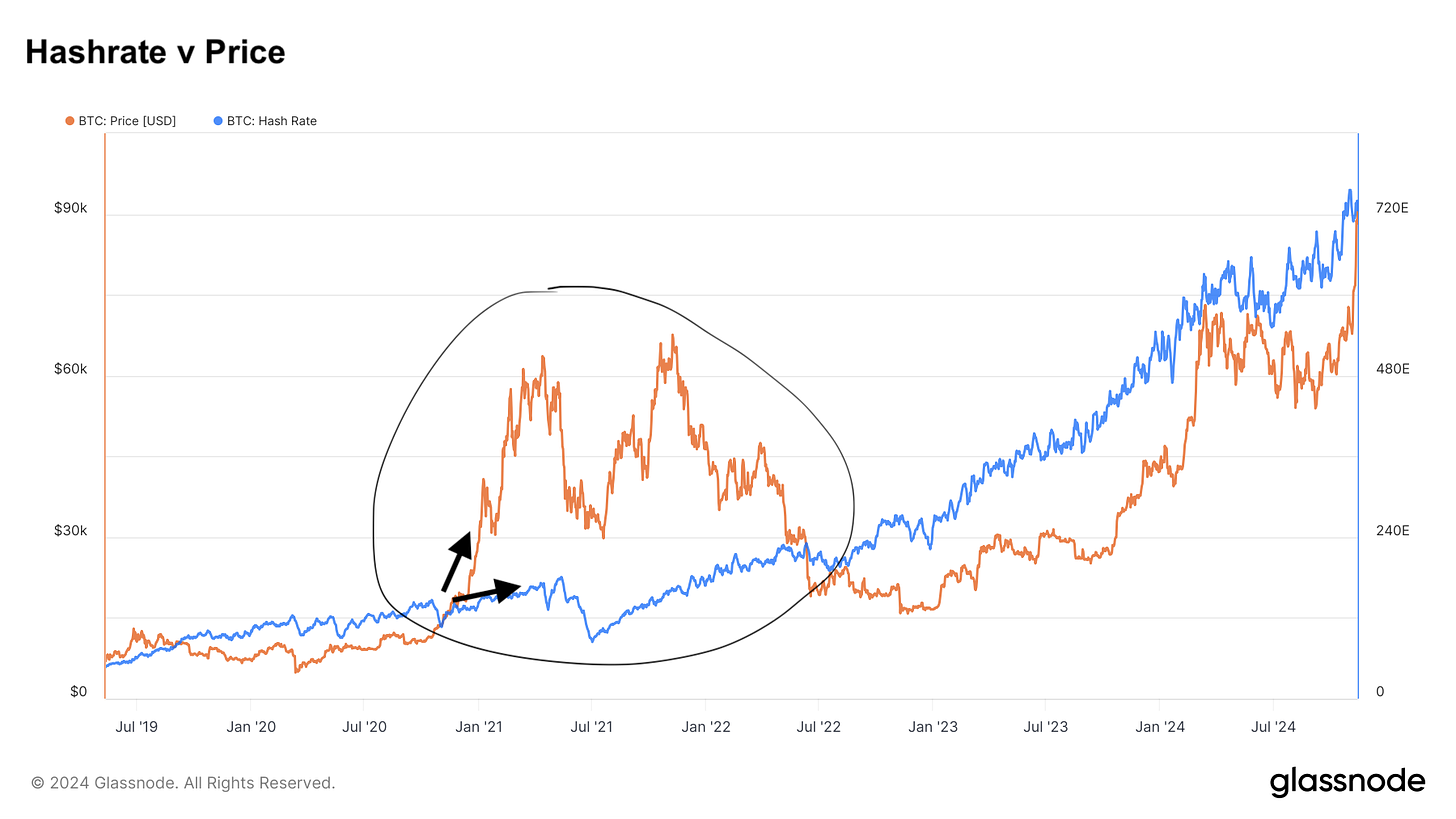

Mining becomes most profitable when the BTC price breaks away from hashrate:

When the orange bars are above the blue bars, mining is most profitable:

Hashrate cannot keep up with price in the short term because it is constrained by the time it takes to physically expand infrastructure.

I.e. it takes longer to plug in machines and build warehouses than it does for a whale to place a $100M bid.

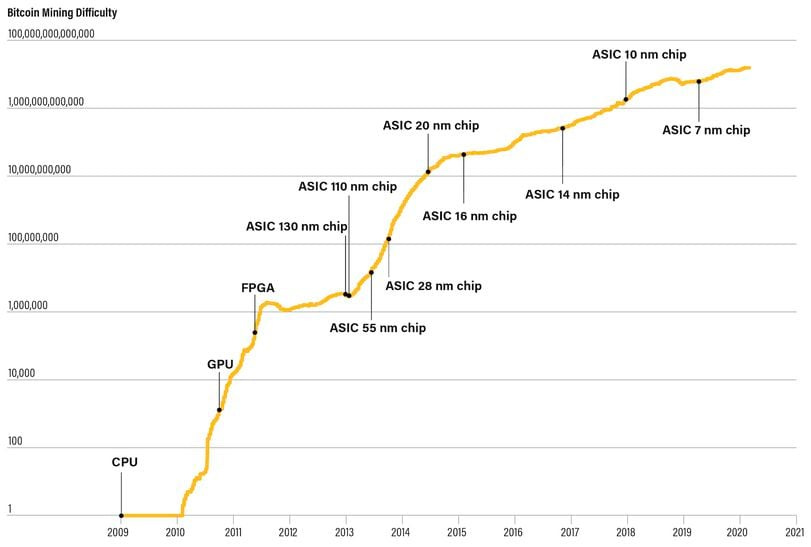

Hashrate has also been growing at a slower rate due to ASICs starting to reach maximum efficiency.

This image illustrates this well:

The 55nm chip to 28nm chip is a ~50% improvement.

The 10nm chip to the 7 nm chip is a ~30% improvement.

If ASICs are reaching a maximum efficiency threshold, then hashrate will start to plateau:

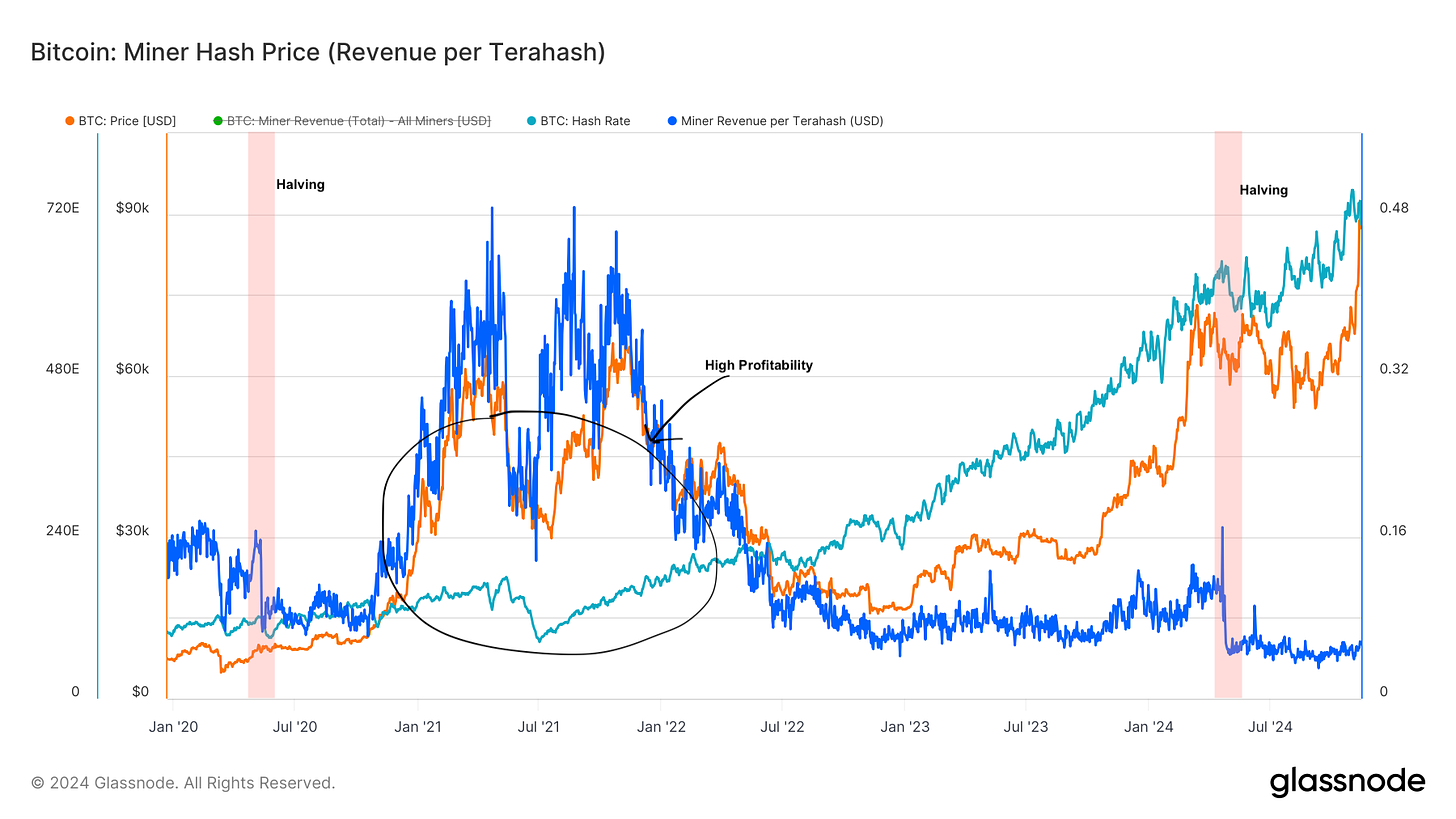

Hashprice is the number one indicator of mining profitability.

How does it respond when price outpaces hashrate?

Hashprice follows exponential price increases:

Miners plugged in and hashing during the ~ 12-20 month mania following the halving reap serious rewards. So much so, it makes it worth it to mine during periods when DCA outperforms.

When hashprice takes a stairway to heaven, it more than makes up for all the lost profits.

And if you have a miner plugged in during the exponential price increase, you mine in terms of BTC, not in terms of dollars.

This is a miners arbitrage.

The best time to mine is during the price - hashrate breakaway.