The Future of Transaction Fees

What happens if the “mempool” clears?

The mempool is a holding area for transactions that have been broadcast to the network but have not yet been confirmed and included in a block.

There is no one mempool (like what you see on mempool.space).

Each mempool is associated with a node.

The mempool “clearing” would mean there are little to no pending BTC transactions.

Miners would still add the empty blocks to receive the block reward and maintain the longest chain.

The mempool will likely never entirely clear, unless your node is using highly selective filtering.

There will always be at least one transaction in each block.

Lower fees mean decreased demand to move BTC on-chain, but it doesn’t mean it has dried up entirely.

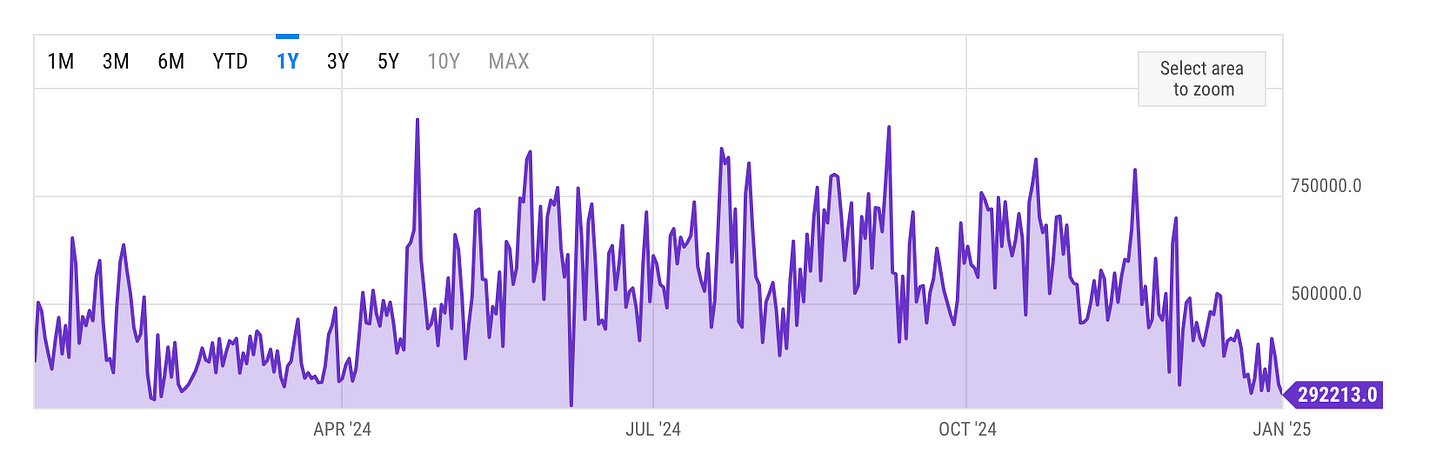

This chart is Bitcoin Transactions Per Day:

292,213 transactions yesterday.

Not even close to “clearing”.

This brings up three questions in my mind:

• Could lower transaction fees mean transactions are moving off-chain to layer-2 solutions like Lightning?

• How will miners earn revenue as block reward trends to 0?

• Will layer-2 solutions like the Lightning Network (LN) decrease miner revenue?

Three very important questions worth thinking about as a miner.

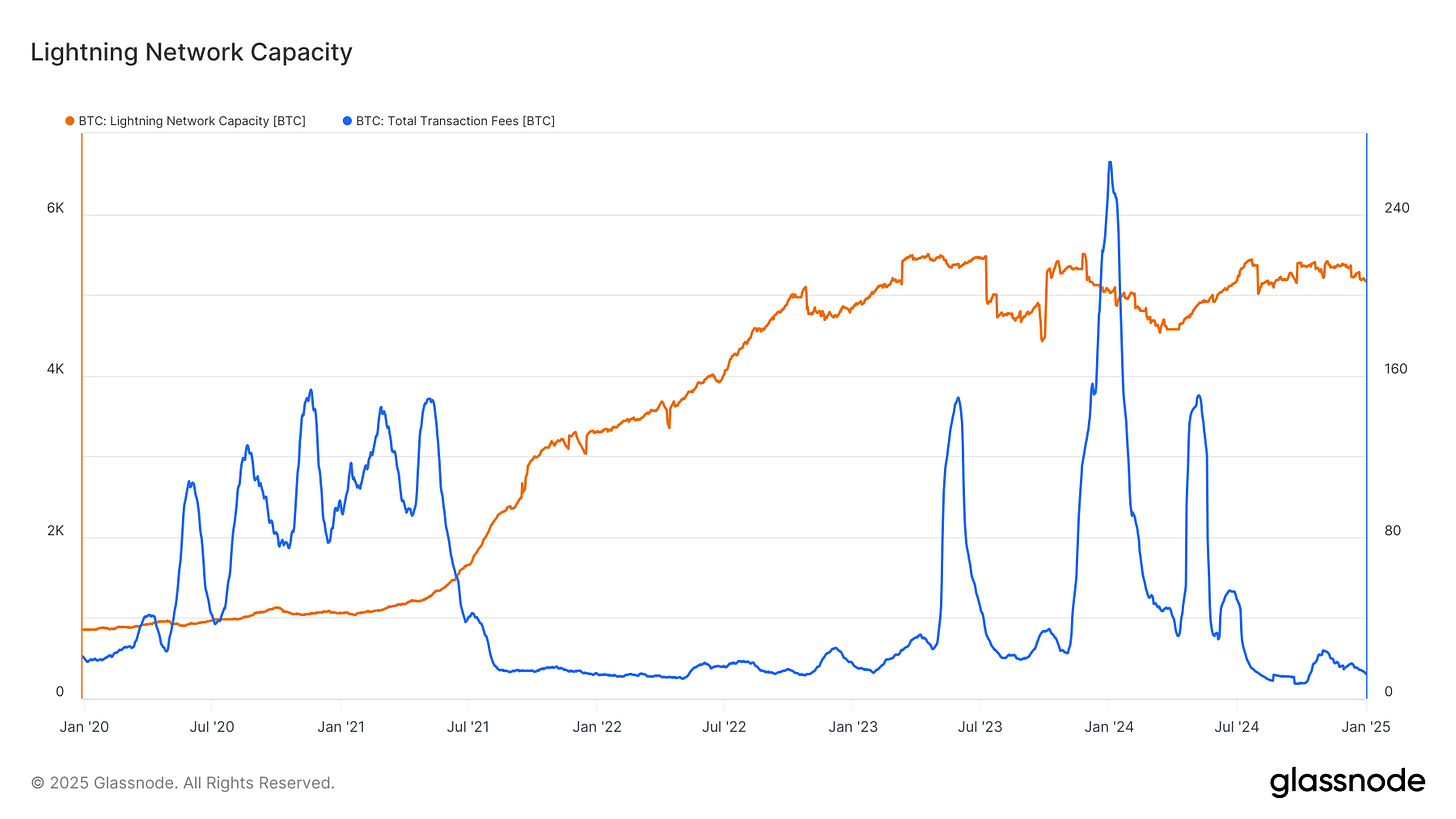

We can answer the first question by looking at this chart:

If lower transaction fees were a byproduct of users moving to the LN, we would expect to see an increase in LN capacity as fees drop.

You can see this was the case in July 2021.

However, there is no obvious relationship between the two variables since then.

This would tell us that the on-chain fee market does not purely drive the growth of the LN.

The LN allows Bitcoin to scale as a medium of exchange and facilitate day-to-day payments.

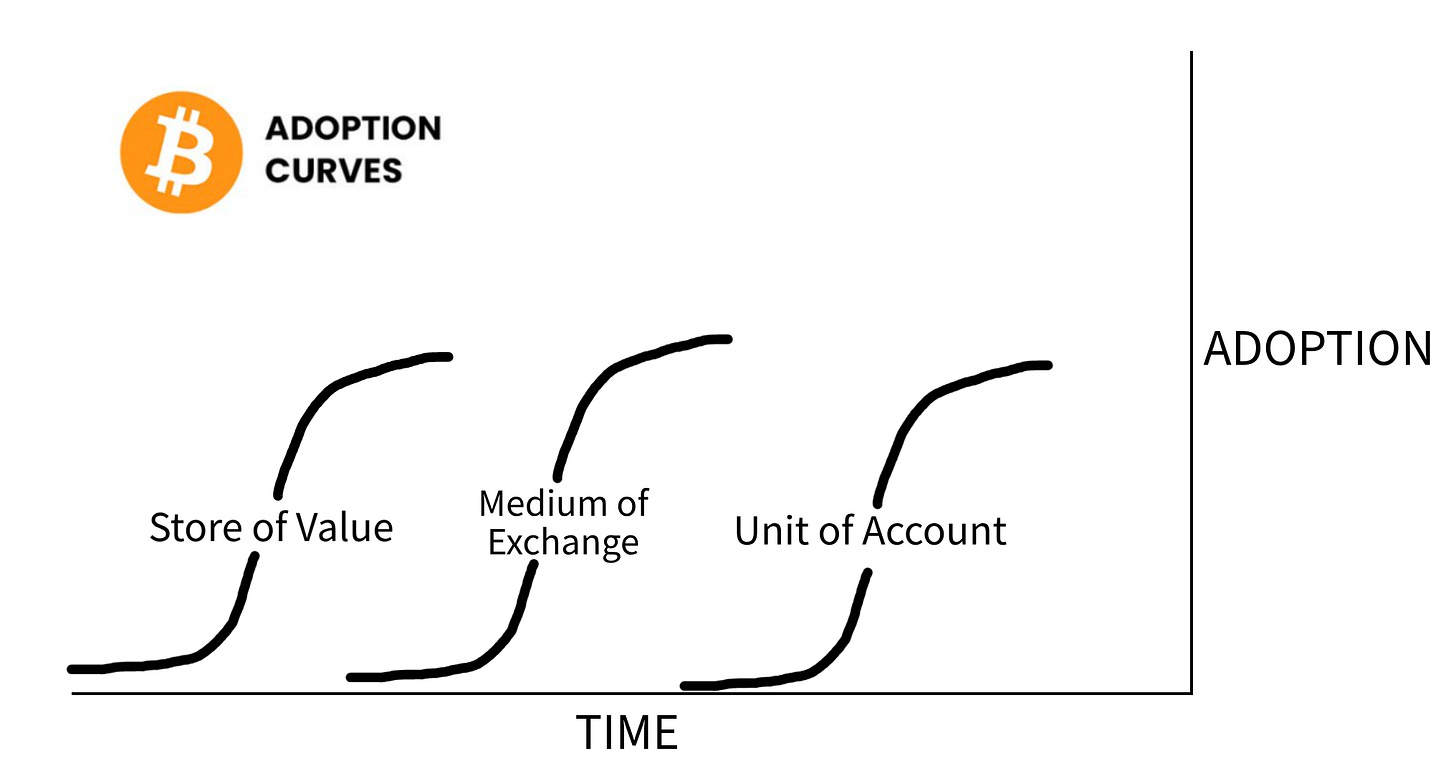

It takes time for each monetary property of Bitcoin to be adopted:

The Medium of Exchange use case is largely independent of fee fluctuation.

How will miners earn revenue as fees go to zero?

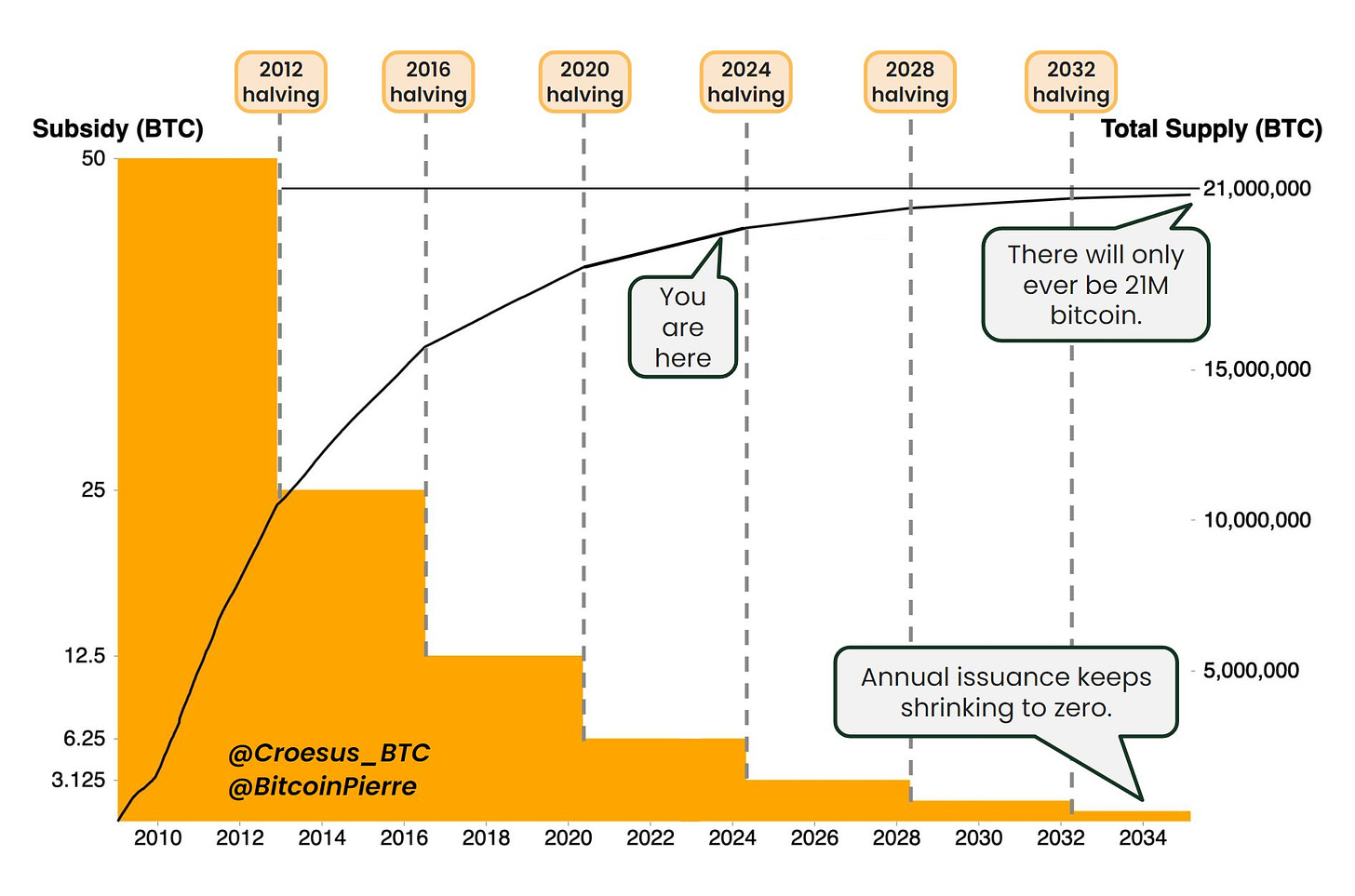

We know by ~ 2140, the block reward will be zero:

No more Bitcoin will ever come into circulation.

There will always be a block reward in our lifetimes (unless you think you're Bryan Johnson)

But it’s still interesting to think about how a miner’s “paycheck” will get restructured over time.

If miners are not adequately incentivized to complete the proof-of-work, the security of blocks may be jeopardized (double spending, 51% attack, etc.)

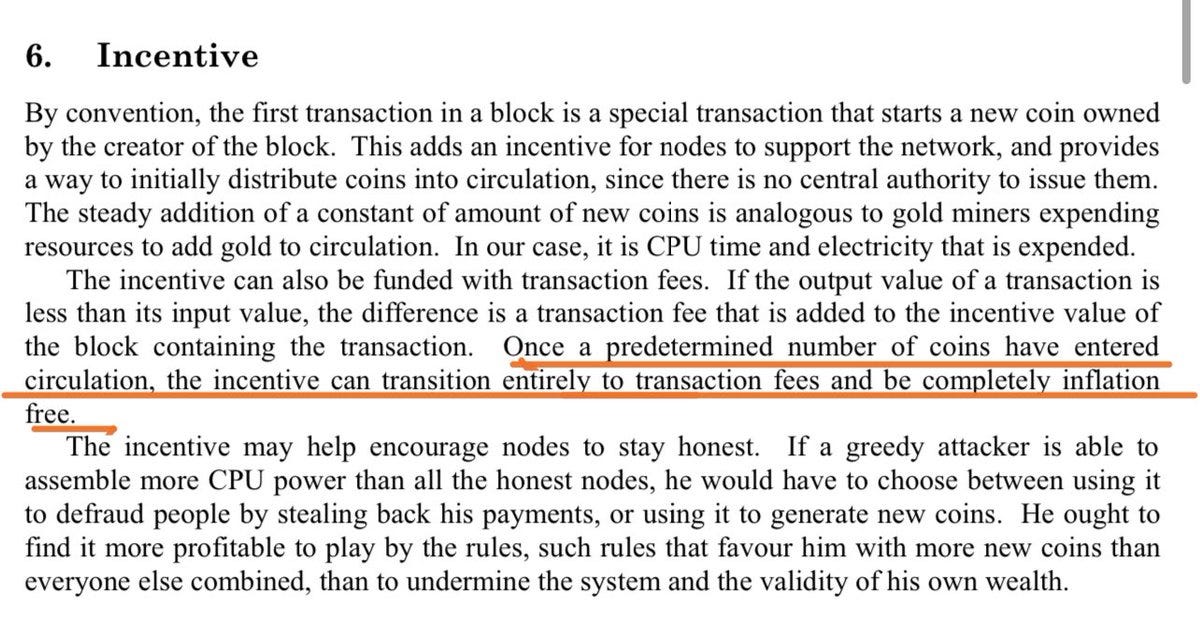

Following 2140, transaction fees will likely be the main incentive for miners to add blocks, per the Whitepaper:

Miners may also earn revenue from demand response agreements, HPC arrangements, etc.

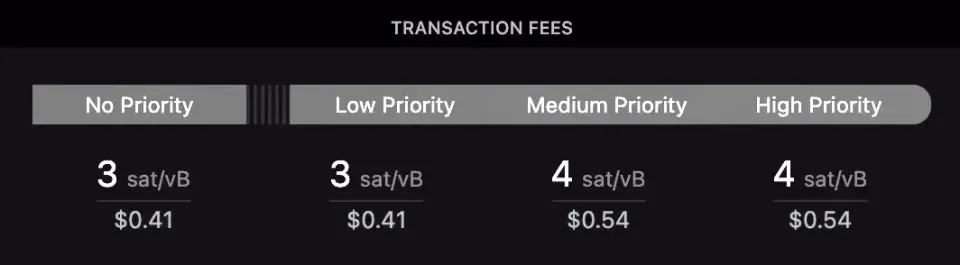

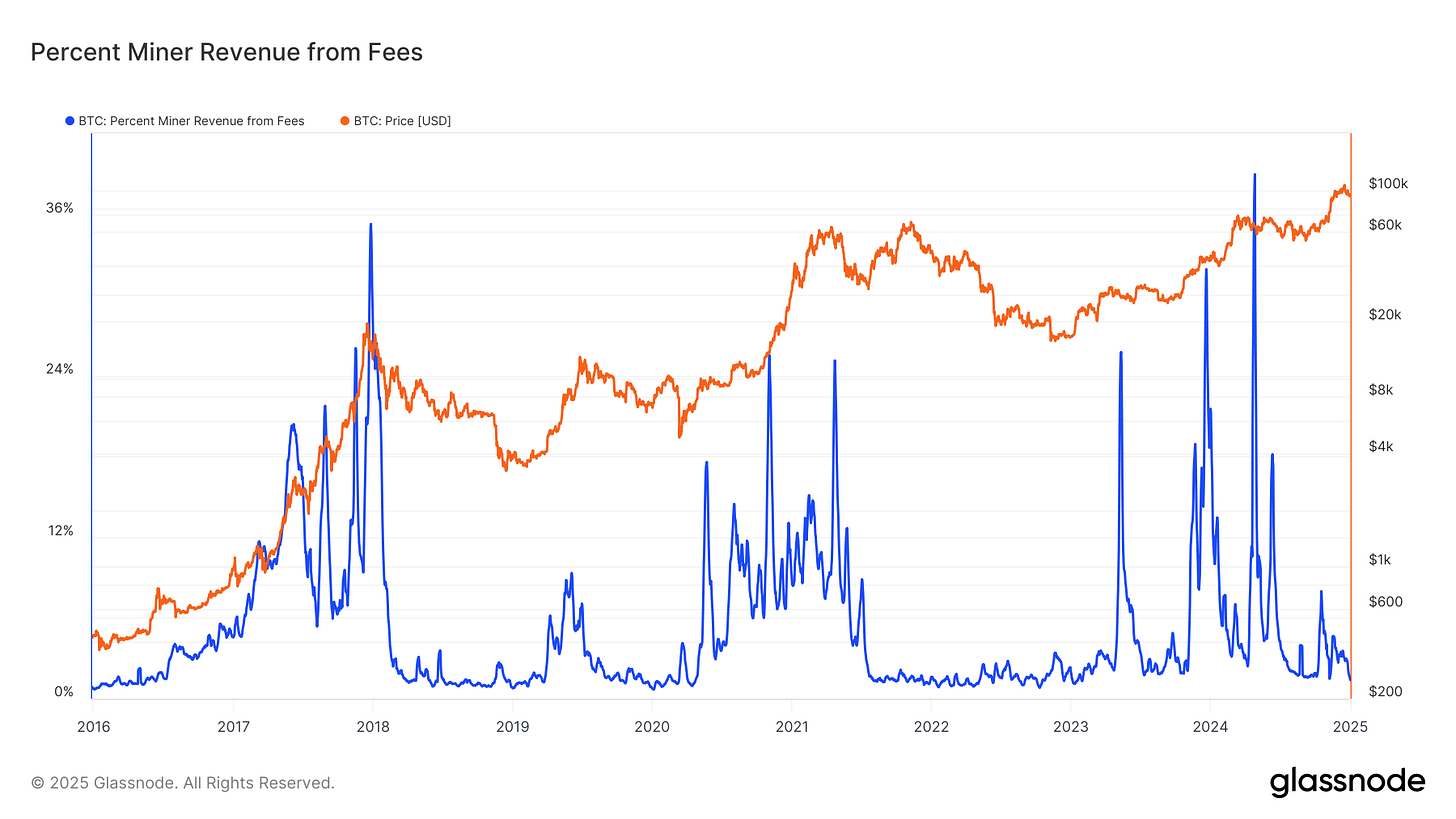

Fees currently make up less than 5% of miner revenue:

Bull markets push fees to ~15% of miner revenue.

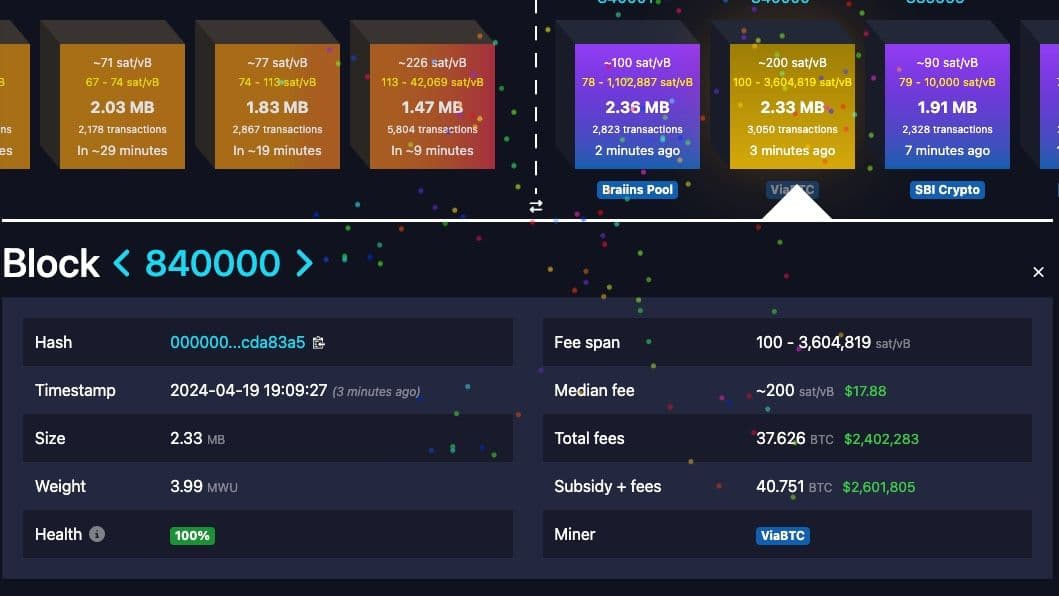

The ordinals mania pushed fees as high as 90% on the halving block":

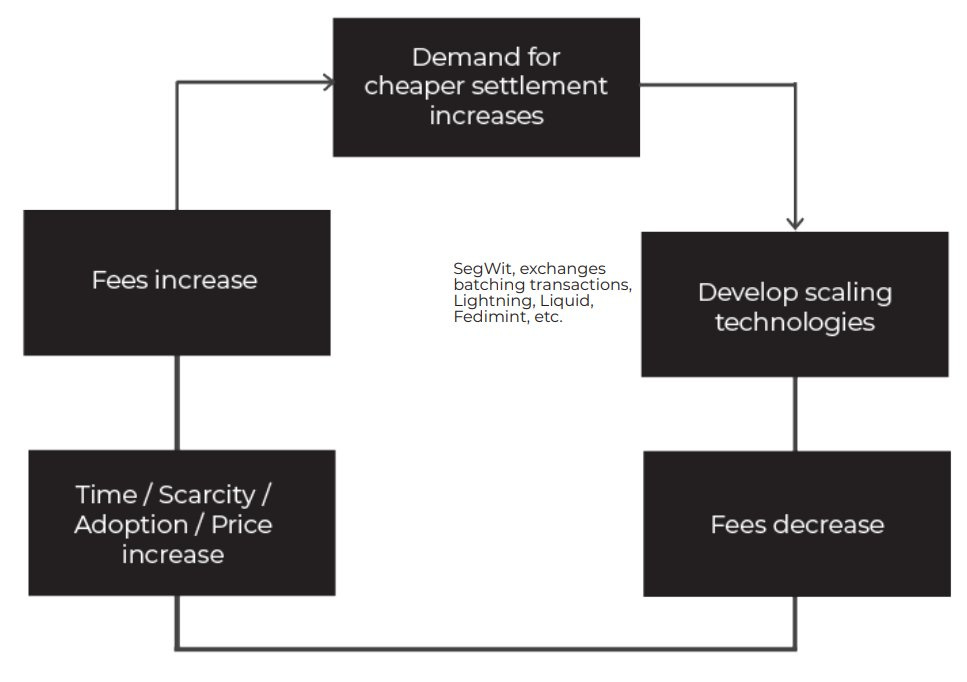

Bitcoin goes through scaling cycles:

Eventually, time, scarcity, adoption, and price will not drastically increase fees as Bitcoin becomes fully monetized.

The market will naturally find an equilibrium for on-chain fees.

There will always be a demand to move BTC on-chain to achieve complete and immutable final settlement.

It would be logical to conclude that if Lightning lowers the transaction fees, this could remove the incentive to send BTC on-chain at a higher fee, thus decreasing miner revenue.

The Lightning Network will not decrease miner revenue.

To use Lightning, you have to open at least one channel.

Channel opens are on-chain multi-sig transactions between you and your channel peer.

They are valid pre-signed transactions representing legitimate on-chain BTC.

More LN adoption -> more channel opens/closes -> more on-chain transactions -> more fees for miners.

There will still be demand for on-chain transactions even when Lightning gains significant global adoption because every channel open/close must be tied to an on-chain transaction.

And as long as on-chain settlement is attractive,

The proverbial "mempool" will never clear.