Mining vs MSTY

You may have heard about the trending ETF, MSTY:

What is it?

How are they paying out 8% “dividends” per month?

Is it a ponzi?

How does it compare to Bitcoin mining?

This letter has the answers👇

How MSTY Works: Options

MSTY generates this return by trading options on Strategy (MSTR), a Bitcoin-holding company. Instead of buying MSTR shares directly, MSTY creates a “synthetic” position using options:

- Synthetic Long Position: MSTY buys call options and sells put options at the same strike price, replicating MSTR’s price action with less capital required.

- Covered Calls: MSTY sells additional call options monthly, generating regular income but capping the upside potential.

In simple terms – MSTY generates income from the volatility of MSTR stock.

Why options instead of direct stock ownership?

Options require less initial up-front investment. It’s like the off-brand version of MSTR that’s cheaper to make.

MSTY also uses anything leftover after buying options contracts for other investments, like treasury bills.

Granted, the allocation to T-bills is only responsible for 0.5% of the yield.

This means the fund technically only pays a 0.5% “dividend” in the eyes of the SEC. The other 80% is viewed as ordinary income.

The monthly income is based on volatility and market conditions.

If volatility dips, premiums shrink, reducing potential income.

Bitcoin Mining Comparison

Mining is similar in the sense that you make an initial capital outlay and receive payouts based on that investment.

Beyond that, the strategies have distinct differences.

Mining generates BTC rewards daily to your mining pool. MSTY generates income monthly in dollar terms to your brokerage account.

Mining profitability depends on electricity costs, hardware efficiency, and Bitcoin’s price relative to hashrate.

MSTY profitability depends on the actions of the fund managers, volatility of MSTR, and your tax situation.

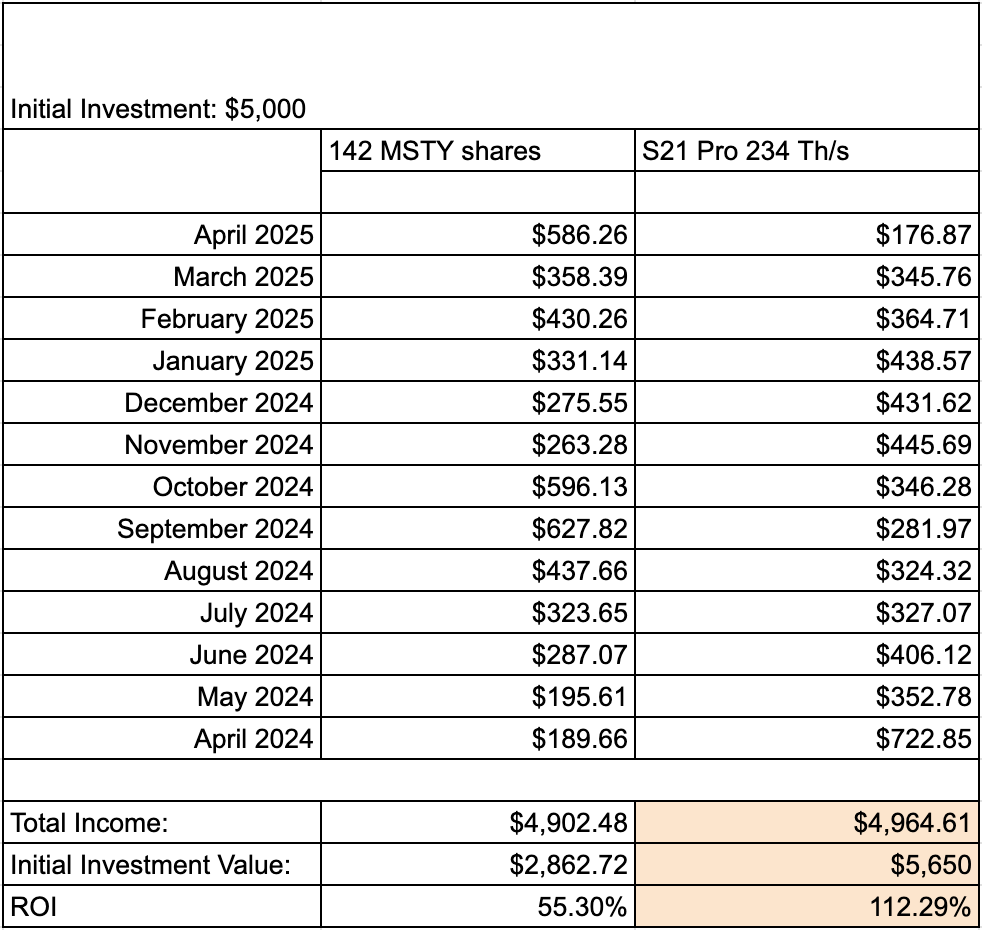

Comparing MSTY and Bitcoin mining from April 2024 with a $5,000 investment (the cost of an S21 Pro miner at the time), here's how they performed:

Without accounting for costs, mining significantly outperformed MSTY, especially in capital preservation.

Performance in Bull Markets: MSTY vs Mining

MSTY gains are capped due to selling covered calls (if MSTR rises past a certain price, the fund loses exposure).

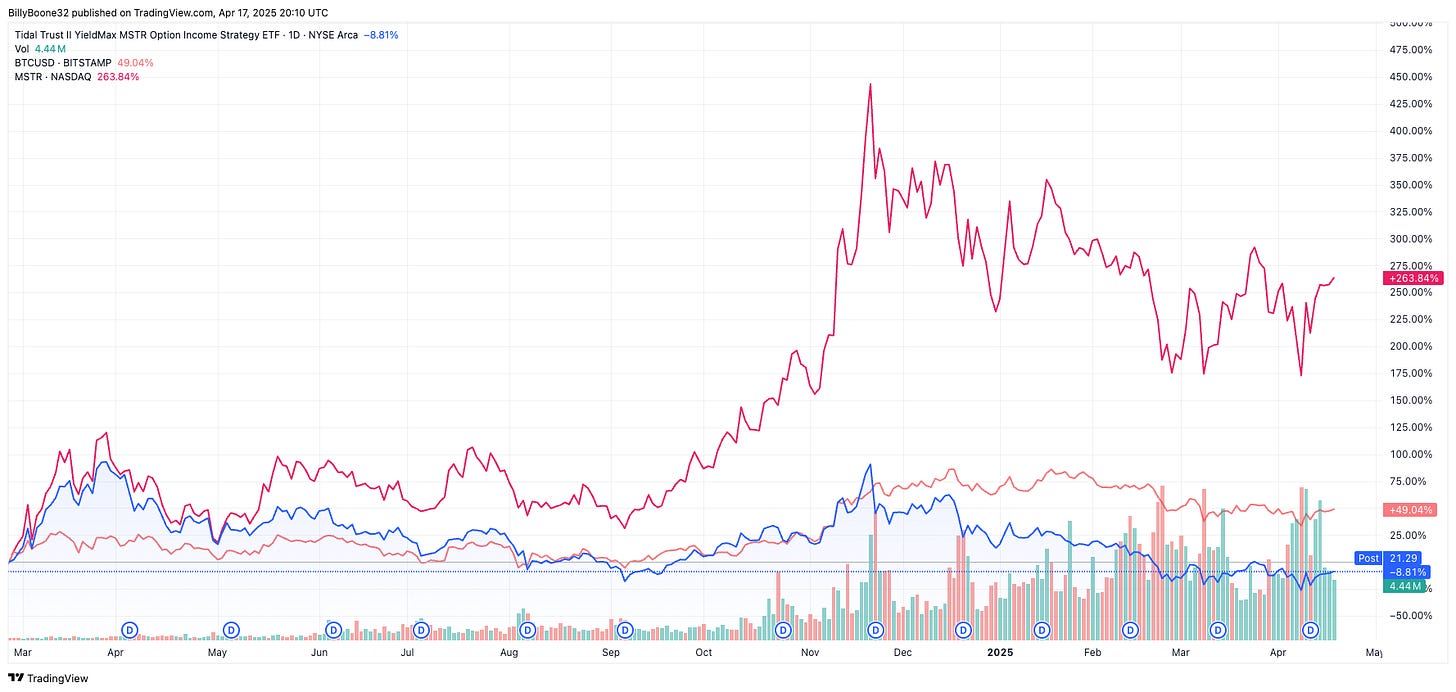

This means MSTY benefits from upward price movement but won’t capture the explosive rallies. You can see this when comparing the fund with MSTR and spot BTC:

With MSTR, investors trade some upside potential for monthly income.

To contrast with mining, you retain exposure to Bitcoin the whole time (assuming you don’t sell any of your mined rewards).

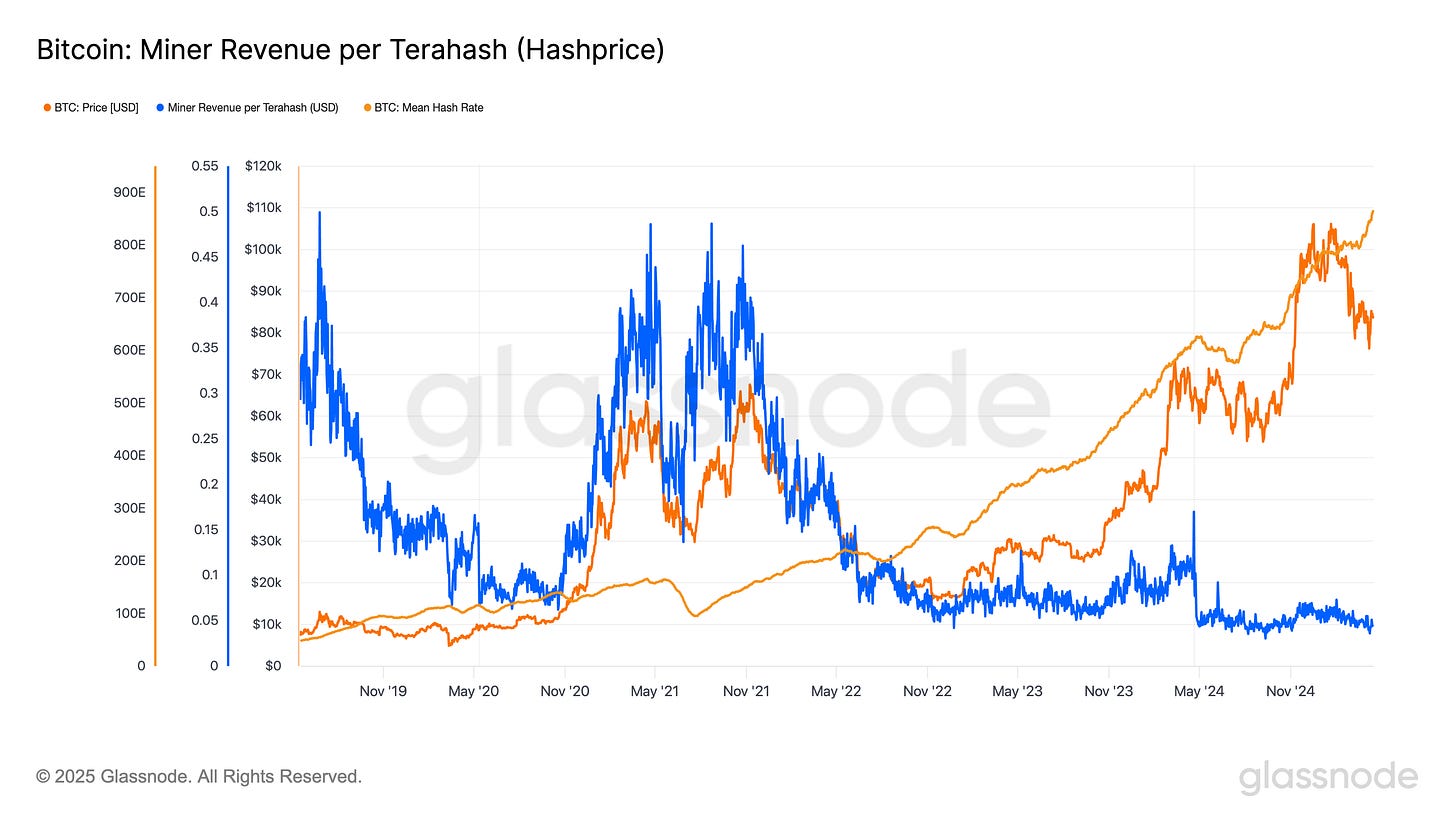

Mining capitalizes on the correlation between spot BTC price and hashrate.

Since mined earnings are denominated in BTC rather than dollar amounts, profits grow when Bitcoin's price grows.

For instance, miners during bull cycles have historically seen profitability spikes of 200% or more year-over-year.

We saw this in 2021:

Mining > MSTY in bull markets.

Neutral & Bear Markets

Bitcoin doesn’t always go up.

Extreme mining profitability doesn't last forever.

Eventually, more miners come online, increasing mining difficulty and reducing the revenue that can be captured from each hash.

In bear markets, both MSTY and mining face challenges.

MSTY’s synthetic exposure closely tracks MSTR, meaning declines in MicroStrategy’s stock impact MSTY significantly.

Income from selling calls provides a small buffer but won't fully cover substantial market downturns.

Neutral markets provide a different dynamic.

MSTY performs best in sideways or moderately volatile markets, consistently collecting the option premiums.

Mining can have an edge in neutral conditions if hashrate growth is small.

MSTY can offer a more “predictable” outcome in neutral and bear markets, but we know Bitcoin doesn’t stay neutral for long.

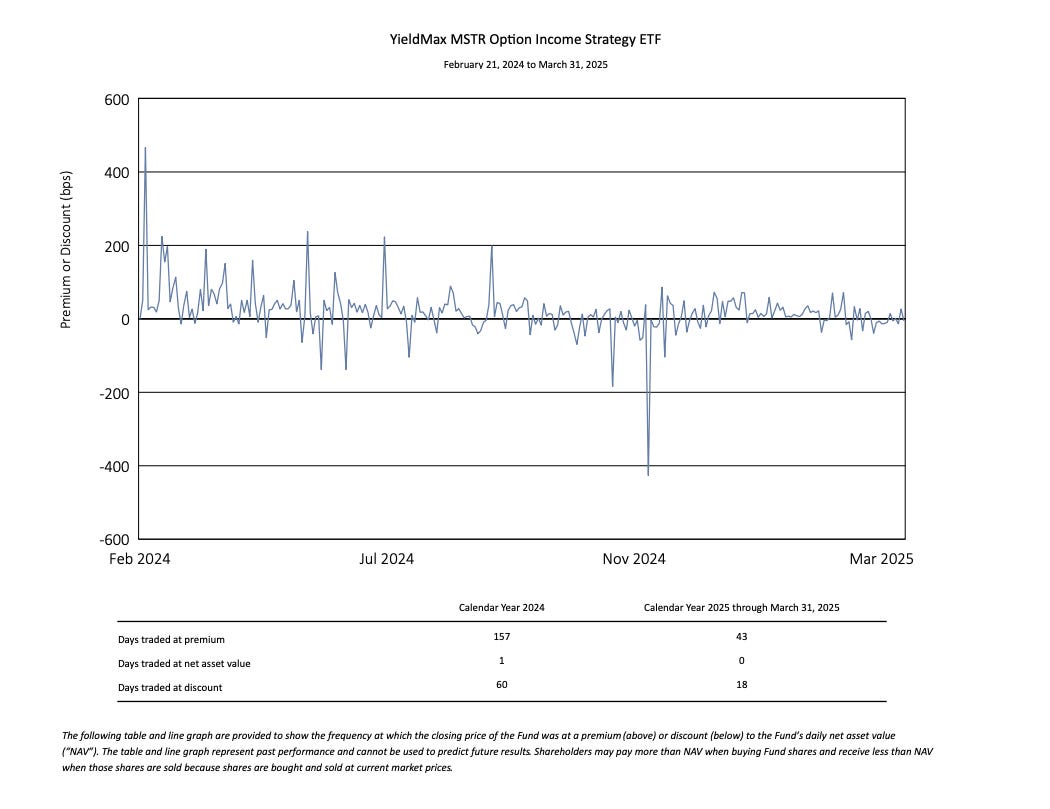

NAV Erosion

Net Asset Value (NAV) erosion is not to be overlooked.

NAV reflects an ETF's underlying assets divided by outstanding shares.

MSTY distributes income monthly, typically lowering NAV by the distribution amount.

If MSTY doesn't earn enough through its option strategy to cover distributions, it returns investor capital directly—termed "Return of Capital" (ROC).

Over time, consistent ROC payments diminish NAV, effectively cannibalizing investors' original investment.

NAV is clearly compressing:

This means compressed income payouts over time.

This creates a negative cycle: lower NAV, lower income generation, smaller option premiums, and smaller future payouts.

The value of ASIC miners can also erode over time.

For example, you could buy a miner for 0.1 BTC and sell it for 0.5 BTC later.

But the opposite can also be true. It depends on when you purchase your miner.

Advantages of Mining

Mining Bitcoin offers several add-on benefits:

- Tax Benefits: Mining equipment qualifies for depreciation → reducing taxable income. For instance, a miner earning $100k annually who purchases a $5,000 ASIC can deduct this fully over time, lowering taxable income to $95k. You can’t do this with MSTY shares.

- Financing Options: Financing ASIC purchases reduces initial cash outlay, potentially improving ROI (depends on your interest expense).

- Privacy (Non-KYC): Depending on your pool, mining generates BTC directly from Bitcoin blocks, free from transaction history and Know-Your-Customer (KYC) surveillance. Non-KYC Bitcoin often trades at a premium.

MSTY doesn't provide these advantages. Its returns are straightforward income streams without tax, financing, or privacy benefits. Investors prioritizing these factors will find mining a superior solution to their income needs.

Conclusion: MSTY or Mining?

I always say it depends on your personal goals, risk tolerance, and market outlook.

It could be a combination of both.

I am biased, but it seems like mining is the clear winner from a tax perspective, and most investors need to pay taxes.

If you can hold onto your mined rewards for at least a year, they will be subject to long-term capital gain tax (15% currently).

MSTY payouts are taxed as ordinary income, so if you are in a high tax bracket, you are getting a sizeable haircut.

- MSTY: Offers *consistent* USD income but caps upside potential. It's ideal for investors seeking regular cash flow through a brokerage account.

- Mining: Offers *consistent* BTC income, and yields exponential returns in bull markets. Offers tax, privacy, and financing benefits. Profitability heavily depends on entry, hardware efficiency, and electricity costs.

Choose wisely based on your priorities—ownership, profitability, liquidity, and privacy.

Every $ has an opportunity cost of what it could be in BTC —choose a strategy that builds wealth in hard money terms.