Mining Pools Explained

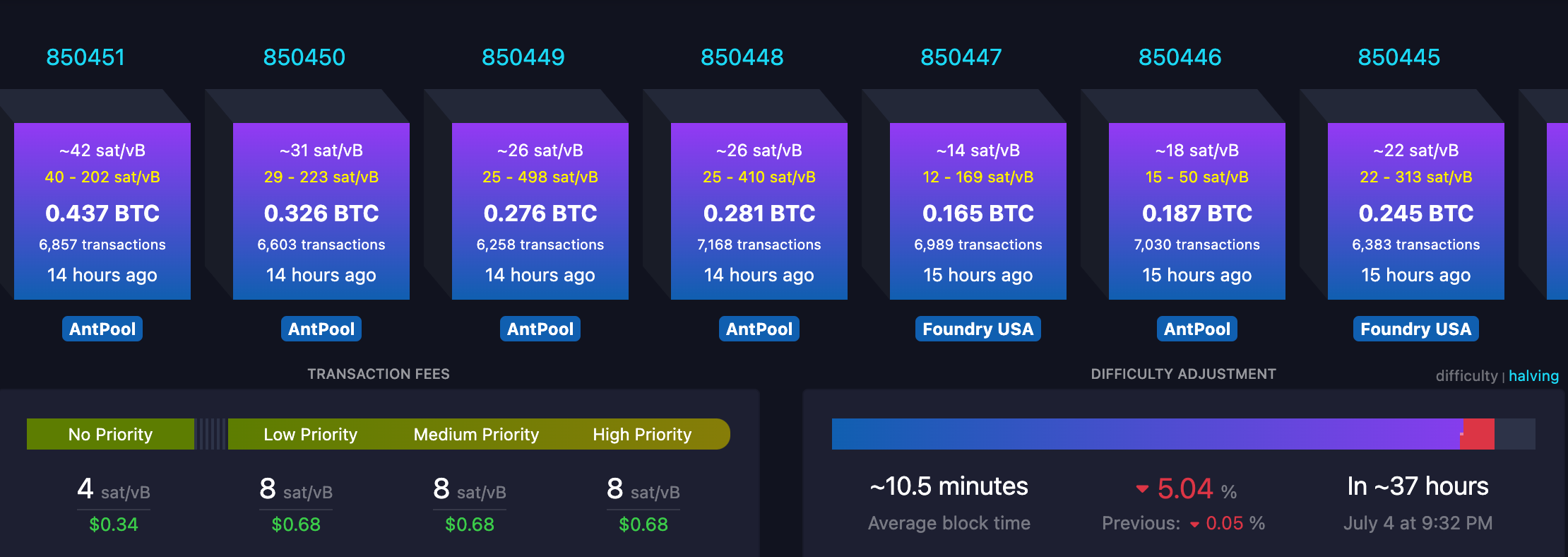

This screenshot is worth at least a thousand words:

A few takeaways:

- AntPool and Foundry USA are winning every block

- A much needed negative 5% difficulty adjustment in ~ 37 hrs

- High priority transaction is 8 sat/vB

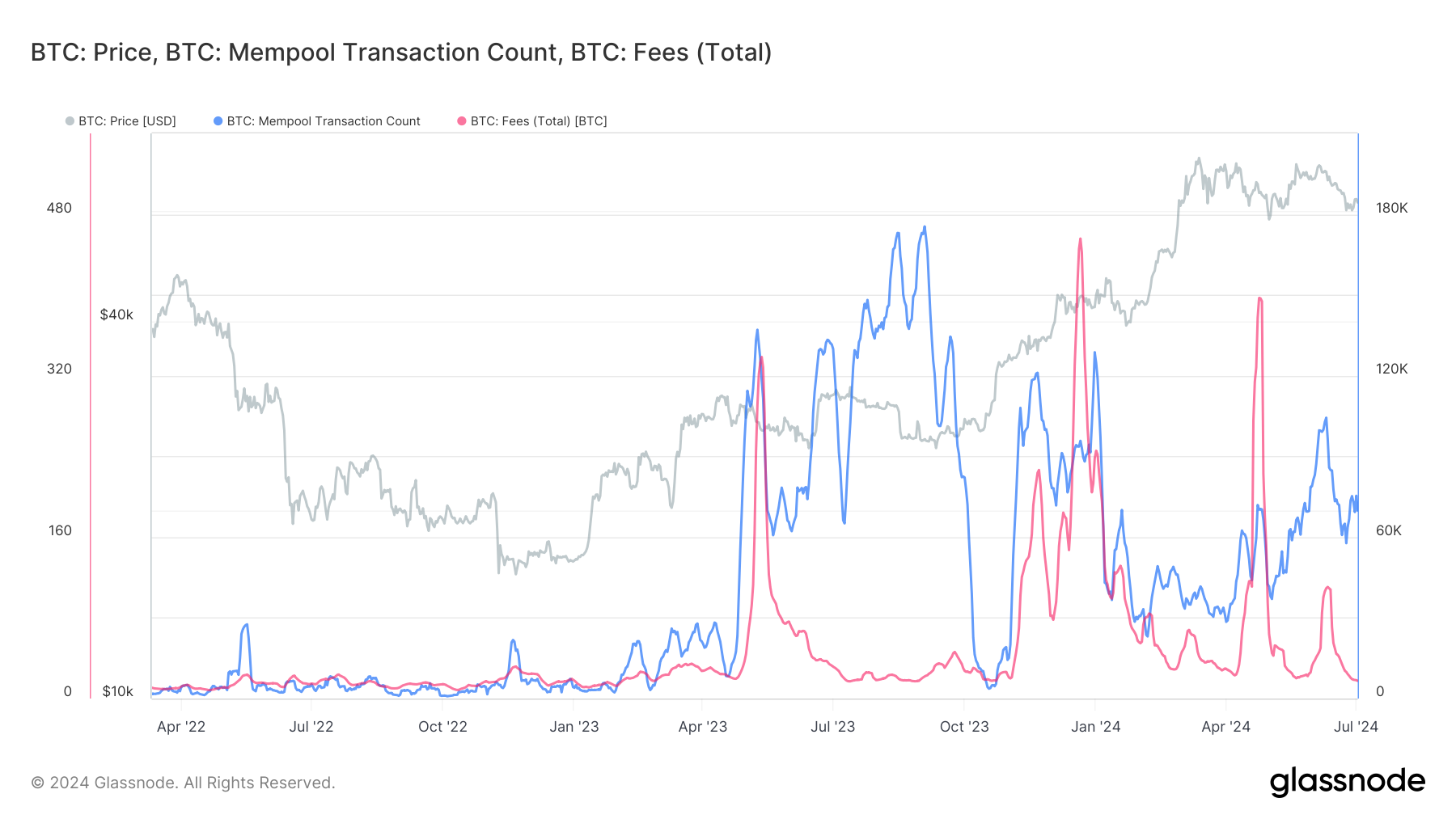

On-chain fees and transactions sitting in the mempool are indeed reduced, but nothing we haven’t seen before:

AntPool and Foundry are the two largest Bitcoin mining pools.

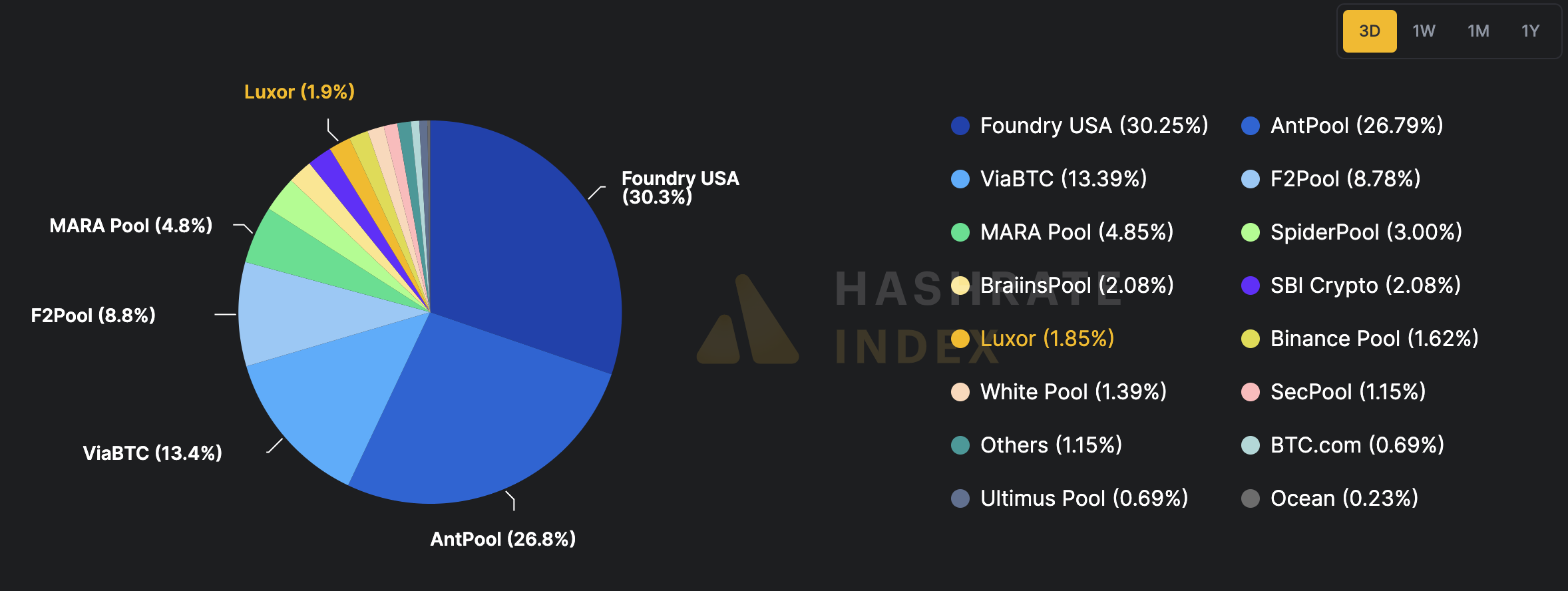

You may have seen this pie chart:

These are the most prominent mining pools responsible for the ~ 575 EH/s network hashrate.

Some questions may arise from this information:

- How is my miner getting paid if it is not winning blocks?

- Why do two pools control over 51% of hashrate?

- Is this a problem?

All valid questions.

It is important first to understand what a mining pool is.

Bitcoin mining pools are basically a node you point your Bitcoin miner (ASIC) to.

Why?

Because Bitcoin mining is cutthroat and as hashrate grows, the meaningful impact of a single miner shrinks.

Forming a pool ensures that a mining operation can win more blocks and receive consistent payouts instead of relying on luck as a solo miner.

It was 2010 when the first mining pool, Slushpool, was introduced.

You couldn’t just mine on your personal computer anymore.

Imagine playing a basketball game 1-on-5. It would be foolish.

You would be playing to lose.

Plugging a miner in and attempting to win a block is somewhat like this, except it is 1-on ~574 quintillion.

Pools exist to leverage teamwork and win block subsidies.

Hashrate is “pooled” together to increase the probability of winning a block.

Simple Mining partners with Luxor Mining Pool. They charge a 0.7% pool operator fee on our machines.

Our clients also have the option to point their hash elsewhere.

How do you get paid if the pool is not winning blocks?

Different pools have different payout structures.

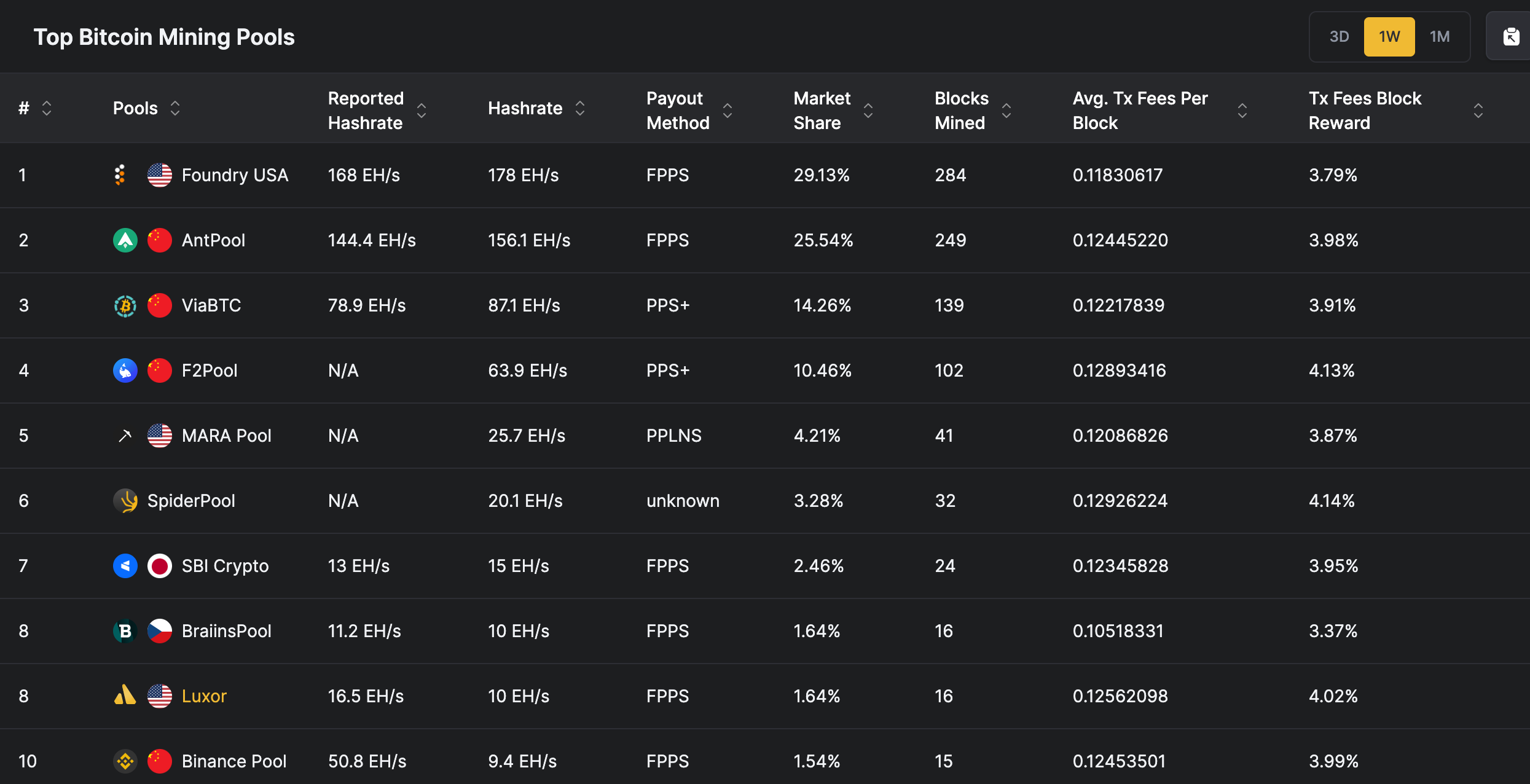

You can see what payout each uses here:

Full Pay Per Share(FPPS) is the most common (and what Luxor uses).

Miners are paid a fixed amount for each share they submit (total hash contribution). The pool operator assumes the risk of variance in finding blocks. Miners are paid not only for the block reward but also receive a share of the transaction fees included in the block.

This method offers stable and predictable payouts.

If a block is not found for days at a time, the pool operator has to carry the burden, which is why a fee is charged.

Pay Per Last N Shares (PPLNS) is less common.

Miners are paid based on the number of shares they submit within a specific window ("N" shares) when a block is found.

This method doesn't pay for each share individually but rewards miners based on their contribution to finding that specific block. Miners can potentially earn more, especially if the pool finds blocks frequently. However, payouts can be inconsistent, depending on the pool's luck.

Pay Per Share Plus is a hybrid model combining PPS and PPLNS

The block reward is settled according to the PPS model. And the mining service charge /transaction fee is settled according to PPLNS.

This is how miners get paid from a pool even if the pool is not actively winning blocks.

This means pools must have a war chest of reserves and a balance sheet buffer.

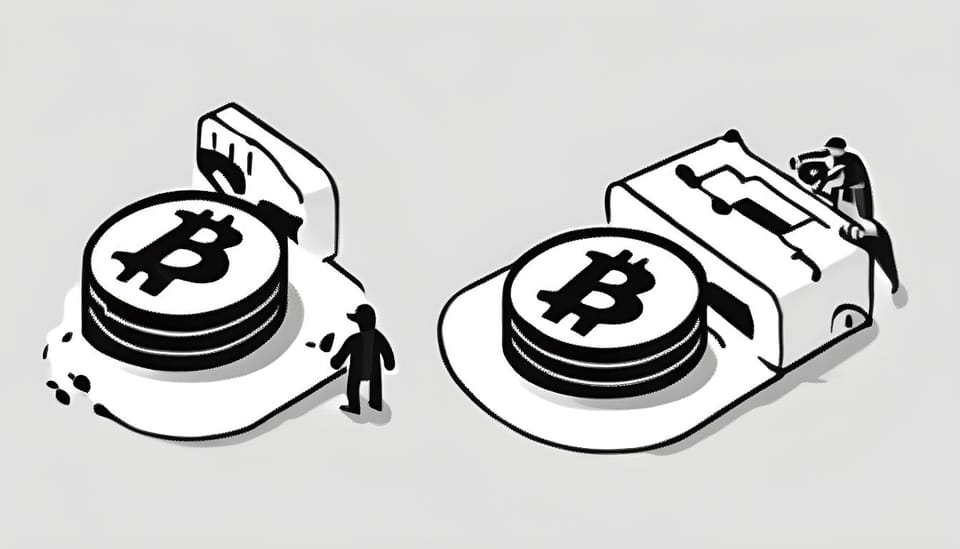

AntPool and FoundryUSA are the two biggest pools and are responsible for ~ 57% of hashrate.

They are not in physical possession of the hardware responsible for said hashing.

Here is the global presence of Bitcoin mining activity:

As you can see, 57% of machines are not all piled up in two warehouses.

An example of a single pool gaining roughly 55% of hashrate was Ghash in 2014.

This is a problem because if one entity creates the block template for 50% of the blocks that are mined, it is a threat to Bitcoin's censorship resistance.

Miners quickly realized the situation and pointed the hash on their physical machines elsewhere.

It also was discovered in April that a pool may be propped up by another pool.

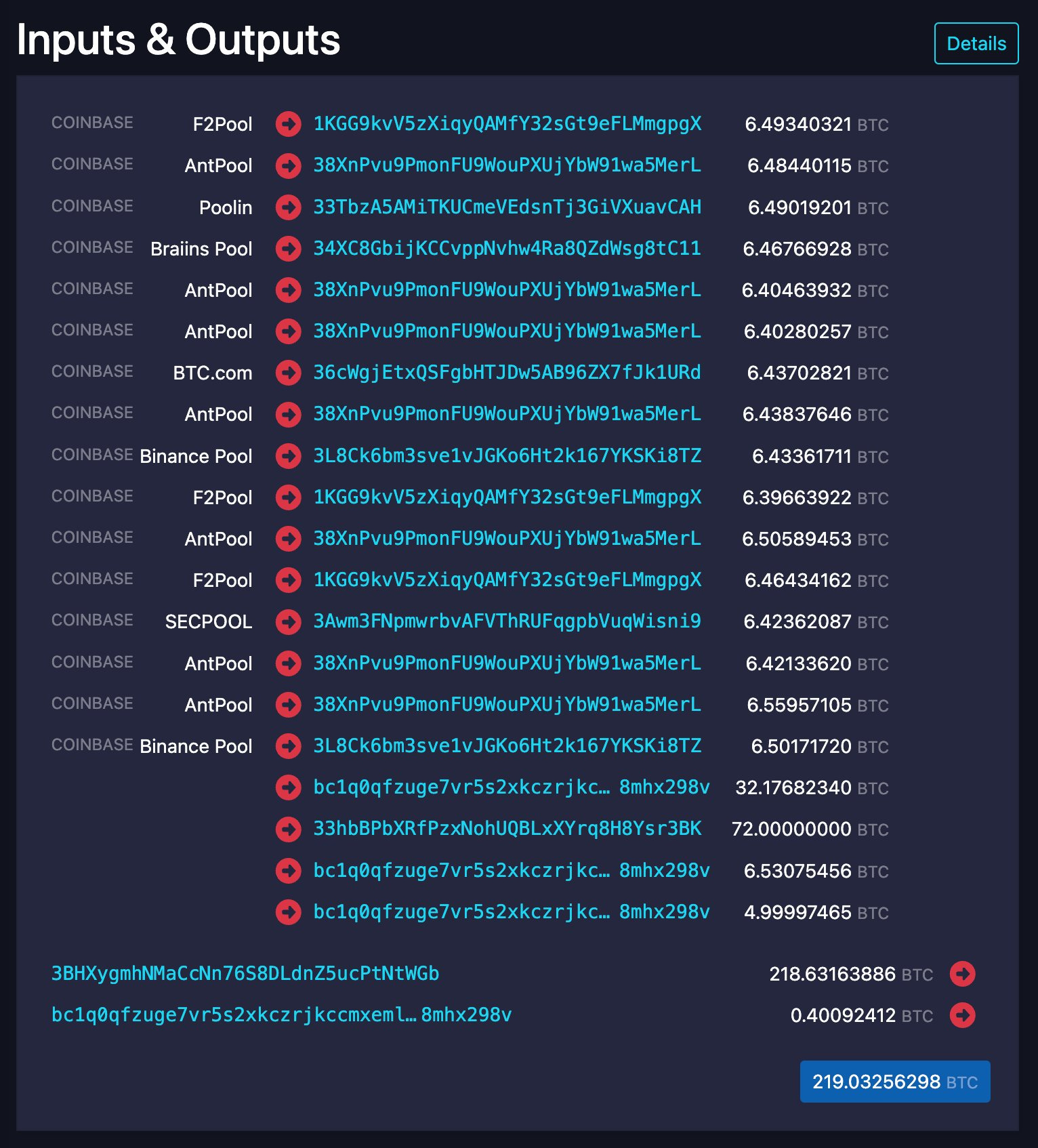

A single custodian controls the coinbase addresses of at least 9 pools, representing 47% of the current total hashrate.

Here is the consolidation of mining reward outputs from AntPool, F2Pool, Binance Pool, Braiins, btccom, SECPOOL and Poolin:

Mining pool backing may be slightly centralized, but miners are free to point their hash where they choose.

Here is a quote from Bitcoin core developer Luke DashJr,

“As for censorship, it is no longer a matter of actual resistance but merely if and when the pools choose to do it there are 11 entities who decide what transactions go in (or stay out) of almost every block, and simply the 2 largest can impose censorship on everyone else with 100% success. This is not some future risk but a present reality, and it’s not sustainable if Bitcoin is to remain a permissionless currency.”

There are plenty of pools out there to choose from.

At the end of the day, it is about preserving the principles of freedom in Bitcoin.