Is Bitcoin Mining Still Profitable in 2026?

Key Takeaways

- Bitcoin mining is still profitable in 2026, but only with low electricity costs ($0.05 to $0.10/kWh) and efficient ASIC hardware (sub-20 J/TH).

- The April 2024 halving cut block rewards to 3.125 BTC, compressing margins for all miners.

- Your electricity rate is the single biggest factor. Use the formula (wattage / 1,000) x 24 x $/kWh to calculate your daily cost, then compare it to daily revenue from a mining calculator.

- Hosted mining beats home mining for most investors due to lower electricity rates, professional repairs, and better uptime.

- Mining is a bet on operations. If you can't secure cheap power and reliable infrastructure, buying Bitcoin on an exchange is the simpler path.

Bitcoin mining is still profitable in 2026, but only for operations with the right setup. Large-scale miners with low electricity costs and efficient hardware continue generating strong returns. Individual home mining has become more difficult since the 2024 halving cut block rewards in half.

The difference between profitable and unprofitable mining comes down to a few key variables: your power rate, hardware efficiency, and whether you run equipment yourself or use a hosted facility. This guide breaks down the real costs, the math behind bitcoin mining profitability, and how to decide if mining makes sense for your situation.

Is Bitcoin Mining Still Profitable?

Yes, bitcoin mining remains profitable, but primarily for operations with low electricity costs, efficient ASIC hardware, and professional infrastructure. Miners with power rates under $0.10/kWh and current-generation equipment continue to see positive margins. Individual home mining has become more challenging since the 2024 halving reduced block rewards by 50%.

Profitability is not binary. It depends on balancing your energy costs against Bitcoin's price and rising network difficulty.

- Large-scale operations benefit from economies of scale and negotiated power rates

- Individual miners can still profit by joining mining pools and using high-efficiency equipment

- Key threshold: electricity rates below $0.10/kWh and hardware efficiency under 20 J/TH typically separate profitable operations from unprofitable ones

The bottom line? Mining is still a viable path to accumulating Bitcoin. You just need the right setup. Check current hashprice and network conditions to see where margins stand today.

How the Bitcoin Halving Affects Mining Profits

A halving is a programmed event where the reward for mining new blocks gets cut in half. This happens approximately every four years, or every 210,000 blocks.

The April 2024 halving reduced the block reward from 6.25 BTC to 3.125 BTC. For miners, that means earning half as much Bitcoin for the same amount of work. The next halving is expected around 2028, when the reward drops again to 1.5625 BTC.

Here is what that looks like in practice: before the halving, a miner earning $1,000/month in Bitcoin revenue would now earn roughly $500/month at the same Bitcoin price. To maintain previous revenue levels, either Bitcoin's price needs to rise or operational costs need to fall.

Efficiency matters more than ever. Miners running older, less efficient hardware often find themselves operating at a loss post-halving. Miners with newer equipment and low power costs remain profitable.

Every halving triggers the same cycle. Unprofitable miners shut down. Difficulty adjusts downward. The surviving operators earn a larger share of the remaining rewards. This self-correcting mechanism is built into the Bitcoin protocol and has repeated after every halving in Bitcoin's history.

What Determines Bitcoin Mining Profitability?

Four primary variables make or break your mining operation.

Electricity Costs

Electricity is the largest ongoing expense, typically 75 to 85% of operational costs. Your power rate directly determines whether mining makes financial sense.

At $0.05/kWh, most modern ASIC miners operate with comfortable margins. At $0.07 to $0.08/kWh, margins are tighter but still viable with efficient hardware. At $0.10/kWh, margins shrink significantly.

Residential electricity rates in the U.S. average around $0.12 to $0.18/kWh. That is why home mining often struggles to compete with hosted operations running at $0.07 to $0.08/kWh.

One detail most investors miss: the cheapest advertised rate is not always the cheapest total cost. Hidden fees, inconsistent uptime, and slow repair turnarounds all inflate your effective cost per kilowatt-hour. A host charging $0.075/kWh with 98% uptime and on-site repairs will often cost less per bitcoin produced than a host advertising $0.065/kWh with 90% uptime and two-week repair delays.

Hardware Efficiency

Efficiency measures how much power a miner consumes relative to its hashrate, expressed in joules per terahash (J/TH). Lower numbers indicate better performance.

- High-efficiency miners (13-17 J/TH): Latest-generation equipment like the Antminer S21 XP

- Mid-range miners (20-25 J/TH): Previous-generation models that balance cost and performance

- Older miners (30+ J/TH): Often unprofitable at current difficulty levels unless electricity is extremely cheap

A miner running at 15 J/TH produces roughly twice as much Bitcoin per dollar of electricity as one running at 30 J/TH.

Bitcoin Price and Network Difficulty

Network difficulty adjusts every 2,016 blocks (roughly two weeks) based on total hashrate. As more miners join the network, difficulty rises, requiring more computational power to earn the same amount of Bitcoin.

Bitcoin's market price directly impacts revenue. When price rises faster than difficulty, margins expand. When difficulty outpaces price appreciation, margins compress. These two variables are outside your control, which is why locking in low electricity costs and efficient hardware matters so much. You control your cost structure. You cannot control the market.

Mining Pool Fees

Mining pools combine hashrate from multiple miners for more consistent payouts. Instead of waiting months or years to solo-mine a block, pool participants receive smaller, regular payments proportional to their contributed hashrate.

Pool fees typically range from 0.5% to 3% of earnings. Simple Mining has partnerships with major pools like Luxor, NiceHash, and Ocean offering discounted pool fees (as low as 0.5%). While pool fees reduce overall revenue, the payout consistency makes financial planning far more predictable.

How Much Does It Cost to Mine Bitcoin?

Total mining cost includes hardware (CAPEX), electricity (OPEX), hosting or facility expenses, and ongoing maintenance. Missing any one of these in your calculation produces a misleading result.

| Cost Category | Description | Typical Range |

|---|---|---|

| Hardware | Upfront ASIC miner purchase | $2,000 to $15,000 per unit |

| Electricity | Ongoing power consumption | $0.05 to $0.10/kWh |

| Hosting/Facility | Space, cooling, security | Often bundled into $/kWh rate |

| Maintenance | Repairs, parts, downtime | 5 to 10% of annual revenue |

Hardware Costs

ASIC miners range significantly in price depending on efficiency and hashrate. Entry-level units start around $2,000. Top-tier models like the Antminer S21 XP can cost $5,000 or more. More efficient models cost more upfront but typically deliver better long-term returns through lower electricity consumption.

Electricity Costs

Electricity is the single largest factor determining whether mining is profitable or a money pit. Here is a simple way to estimate your daily electricity cost for any miner:

(Miner wattage / 1,000) x 24 hours x your $/kWh rate = daily electricity cost

For example, an Antminer S21 XP draws 3,645 watts:

| Your Rate | Daily Electricity Cost | Monthly Electricity Cost |

|---|---|---|

| $0.05/kWh | ~$4.37 | ~$131 |

| $0.07/kWh | ~$6.12 | ~$184 |

| $0.10/kWh | ~$8.75 | ~$262 |

| $0.15/kWh | ~$13.12 | ~$394 |

If daily revenue exceeds your daily electricity cost, you are mining profitably. If it does not, you are losing money every day the machine runs.

That monthly gap between $0.07/kWh and $0.15/kWh is over $200. Over a 12-month period, the difference is roughly $2,500 per machine. Your electricity rate is the single biggest lever you can pull.

Operational and Maintenance Costs

Miners generate significant heat and noise, requiring cooling infrastructure and occasional repairs. Hash boards fail. Fans wear out. Power supplies degrade over time.

Hosted mining services often bundle repair and maintenance costs into an all-in rate, simplifying your budget. Self-hosted operations need to account for repair costs, replacement parts, and potential downtime. Expect 5 to 10% of annual revenue for maintenance. Every hour offline is revenue lost.

How to Calculate Bitcoin Mining Profitability

Running the numbers before investing separates successful miners from those who lose money.

The Profitability Formula

The basic calculation is straightforward:

Revenue (BTC earned x price) minus Costs (electricity + fees + maintenance) equals Profit

- Revenue: Based on your hashrate, current network difficulty, and block rewards

- Costs: Electricity consumption, pool fees (0.5 to 3%), hosting fees, and maintenance

- Profit: What remains after all expenses, which can be positive or negative

Using a Bitcoin Mining Calculator

Mining calculators simplify the math by letting you input your specific variables: hashrate, power consumption, electricity rate, and pool fees. The calculators pull current network difficulty and Bitcoin price automatically.

Simple Mining's Bitcoin mining calculator models profitability based on current market conditions. It helps you compare different hardware options and electricity scenarios before committing capital.

Tip: Run calculations at three Bitcoin price points: current price, 20% lower, and 20% higher. If your operation remains profitable across all three scenarios, you have a margin of safety. If it only works at the optimistic end, reconsider your assumptions.

Best Bitcoin Mining Hardware

Hardware selection directly impacts your returns. The right miner depends on your electricity rate, budget, and risk tolerance.

High-Efficiency ASIC Miners

Top-tier models offer the best J/TH efficiency, making them ideal for operations prioritizing long-term profitability.

- Antminer S21 XP: 13.5 J/TH at 270 TH/s

- Antminer S21+ Hydro: 15 J/TH at 395 TH/s

- Whatsminer M60S: 18.5 J/TH at 188 TH/s

High-efficiency machines cost more upfront but remain profitable through difficulty increases that push older hardware underwater. The lower your J/TH, the wider your margin of safety when conditions tighten.

Mid-Range ASIC Miners

More affordable options balance upfront cost with reasonable efficiency.

- Antminer S19 XP: 21.35 J/TH at 141 TH/s

- Antminer S19k Pro: 23 J/TH at 120 TH/s

- Whatsminer M50S: 26 J/TH at 126 TH/s

Mid-range miners work well for operations with moderate electricity rates or smaller initial budgets. They carry more risk as difficulty rises because their higher J/TH means thinner margins. At $0.07/kWh, a 21.35 J/TH machine has far less breathing room than a 13.5 J/TH machine running at the same rate.

How to compare hardware for ROI

When evaluating miners, compare the following specifications:

- Hashrate (TH/s): Higher means more computational power

- Power consumption (W): Lower reduces electricity costs

- Efficiency (J/TH): Lower numbers indicate better performance per watt

- Break-even timeline: How long until the miner pays for itself at current conditions

A miner with a 12-month break-even at $0.07/kWh might have an 18-month break-even at $0.10/kWh. Your electricity rate changes everything.

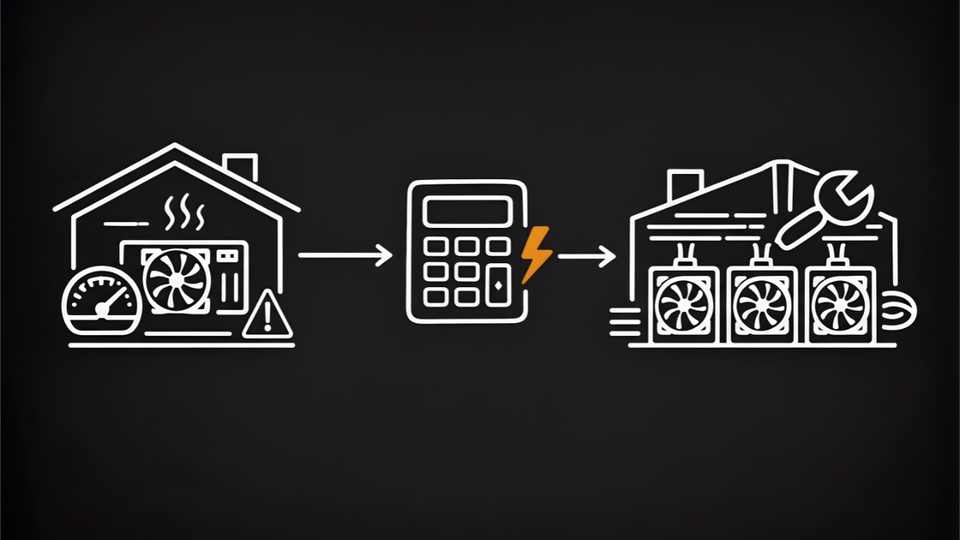

Mining Bitcoin at Home vs. Hosted Mining

Two primary paths exist for mining Bitcoin: running equipment yourself or having a professional facility host it for you.

Pros and Cons of Home Mining

Home mining offers full control and eliminates hosting fees. You own the hardware, manage the operation, and keep 100% of mining revenue minus electricity and pool fees.

However, challenges stack up quickly. Residential electricity rates often exceed $0.12/kWh. Miners generate 70 to 80 decibels of noise, comparable to a vacuum cleaner running 24/7. Heat output requires dedicated cooling. Electrical infrastructure may need upgrades. And repairs fall entirely on you.

Pros and Cons of Hosted Mining

Hosted mining removes the operational burden while you retain hardware ownership. Professional facilities provide lower electricity rates ($0.07 to $0.08/kWh), 24/7 monitoring and maintenance, optimized cooling and infrastructure, security, and uptime optimization (98%+ typical).

The trade-off is monthly hosting fees and less direct control. You trust a third party to manage your equipment. That is why choosing the right host matters. Look for transparent billing, on-site repair teams, and a track record of consistent uptime.

Which Option Delivers Better Returns

For most investors, hosted mining offers better economics. The electricity savings alone (often $0.04 to $0.06/kWh lower than residential rates) typically exceed hosting fees.

| Factor | Home Mining | Hosted Mining |

|---|---|---|

| Electricity Rate | $0.12 to $0.18/kWh (residential) | $0.05 to $0.08/kWh (industrial) |

| Repairs | Ship to a repair center, wait weeks | On-site technicians, same-day triage |

| Uptime | Depends on your setup | 95 to 98% with professional monitoring |

| Noise/Heat | 75+ dB, significant heat output | Handled by the facility |

| Control | Full control over hardware and pool | You own the hardware, host manages ops |

Here is a rough way to think about it: calculate the daily electricity cost of your miner at your home rate, then calculate it again at a hosted rate of $0.07/kWh. Multiply the difference by 365. That annual savings is the budget available for hosting fees. In most cases, the savings exceed the fees.

Common Bitcoin mining mistakes

1. Underestimating electricity costs

Many new miners calculate profitability using optimistic electricity rates, then discover their actual costs are higher. Residential rates vary significantly by location and often include demand charges, delivery fees, and taxes that push effective rates above the stated $/kWh. Calculate your true all-in power cost before purchasing hardware by checking your utility bill for the total cost divided by total kWh consumed.

2. Buying inefficient hardware

Older or cheaper miners with poor J/TH efficiency seem attractive due to lower upfront costs. However, the ongoing electricity expense often makes them unprofitable within months as difficulty rises. A $2,000 miner running at 35 J/TH might cost more in electricity over 12 months than a $5,000 miner running at 17 J/TH, while producing less Bitcoin.

3. Ignoring maintenance and downtime

Miners require repairs and experience downtime. Hash boards fail, fans wear out, and firmware needs updates. Every hour offline is revenue lost. Factor in 2-5% downtime for well-maintained operations, more for self-hosted setups without dedicated support.

4. Skipping the profitability math

Running calculations before investing is essential. Use a mining calculator to model realistic scenarios, not best-case assumptions. Model scenarios at current Bitcoin price, 30% lower, and with 20% higher difficulty. If your operation remains profitable across multiple scenarios, you have a margin of safety.

Is Mining Bitcoin Better Than Buying?

This question comes up constantly. The honest answer: it depends on your goals and circumstances.

Mining offers potential tax benefits through equipment depreciation (consult a tax professional), ongoing BTC accumulation rather than a single purchase, a productive asset that generates returns over time, and the possibility of acquiring bitcoin below market price when margins are healthy.

Buying offers simplicity with no operational complexity, no hardware risk or maintenance concerns, immediate exposure to Bitcoin's price, and a lower minimum capital requirement.

One way to think about it: buying Bitcoin is a bet on price. Mining Bitcoin is a bet on operations. If you can secure low electricity costs, efficient hardware, and reliable uptime, mining lets you acquire BTC at a discount to spot. If any of those three break down, buying on an exchange is simpler and cheaper.

For a deeper comparison, see our analysis on mine or buy BTC.

Many investors do both. They hold spot Bitcoin while also mining to accumulate additional BTC at a lower effective cost.

How to Start Mining Bitcoin Profitably

Ready to move forward? Here is a clear path from research to revenue.

- Research hardware. Compare ASIC miners based on efficiency (J/TH), hashrate (TH/s), and price. Focus on models that remain profitable at your expected electricity rate with a reasonable margin of safety.

- Calculate profitability. Use a mining calculator to model costs and potential returns. Input your actual electricity rate, not an optimistic estimate. Run scenarios at multiple Bitcoin price points.

- Choose your setup. Decide between home mining and hosted mining based on your electricity rates, technical capacity, and available space. For most investors, hosted mining offers better economics and less operational burden.

- Purchase equipment. Buy miners from a reputable source that offers support and warranty coverage. Avoid used equipment without verified hash board testing. Failed components are common in secondhand sales.

- Start hashing. Deploy your miners, configure your mining pool, and monitor performance via a dashboard. Track uptime, hashrate, and earnings against your projections.

Simple Mining offers miner sales, hosting at $0.07 to $0.08/kWh with 98% average uptime, and 12 months of free repairs for hosted units. Test the platform risk-free with a 7-day trial providing 100 TH/s of hashrate at no cost.

FAQ

How long does it take to mine 1 Bitcoin?

The time to mine 1 BTC depends entirely on your hashrate relative to network difficulty. Solo mining with a single ASIC could take years. Most miners join pools for smaller, more frequent payouts that accumulate over time. Difficulty changes and Bitcoin price fluctuations make precise timelines impossible to predict. Use a mining calculator with your specific hardware to estimate current accumulation rates.

Can you still make money mining Bitcoin at home?

Home mining can be profitable if you have access to very low electricity rates (under $0.10/kWh), efficient ASIC hardware (sub-15 J/TH), and appropriate space for noise and heat management. Most residential miners find hosted mining more economical due to lower power costs and professional maintenance.

What happens when all 21 million Bitcoin are mined?

Once all Bitcoin is mined (estimated around 2140), miners earn revenue from transaction fees rather than block rewards. Transaction fees already contribute to miner revenue today and are not affected by halvings. As Bitcoin adoption grows, fee revenue is expected to sustain network security even without block subsidies.

Is Bitcoin mining declining as an industry?

Bitcoin mining is not declining. Global hashrate and infrastructure investment continue reaching new highs. However, individual profitability has become more competitive, favoring efficient operations with low electricity costs. The industry is consolidating around professional operators with scale advantages.

Conclusion

Profitability in Bitcoin mining comes down to a simple equation: earn more per kilowatt-hour than you spend. The operators who control their electricity cost, run efficient hardware, and minimize downtime are profitable. Everyone else is guessing.

Want to compare miner revenue side by side? Use our Mining Revenue Calculator to model different scenarios, or schedule a call to see how hosted mining fits your strategy.