How Will Tariffs Impact Bitcoin?

The hot topic in the markets: Tariffs.

First, what is a tariff?

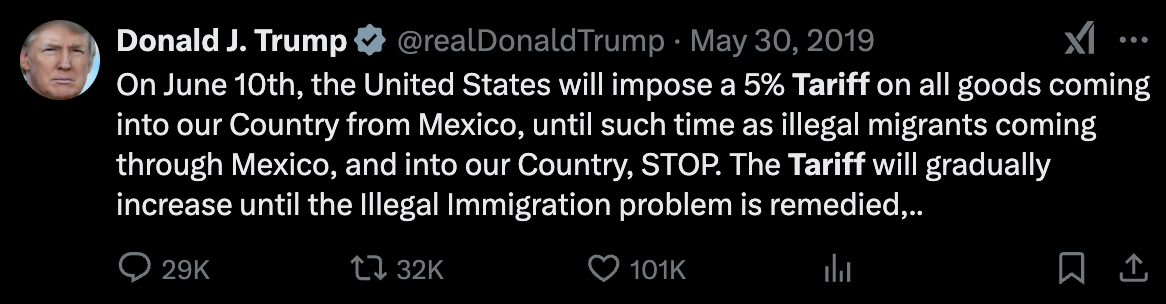

Prior to Trump assuming his second term, we knew tariffs were a strategy up his sleeve.

Per 2019:

Why the market was “blindsided” by this?

The market is irrational and often fails to zoom out.

The reality:

This is a game of chess on the global economic stage. Each nation not wanting to lose a piece.

Mainstream narratives frame tariffs as a measure to protect domestic industries.

But what is really going on here?

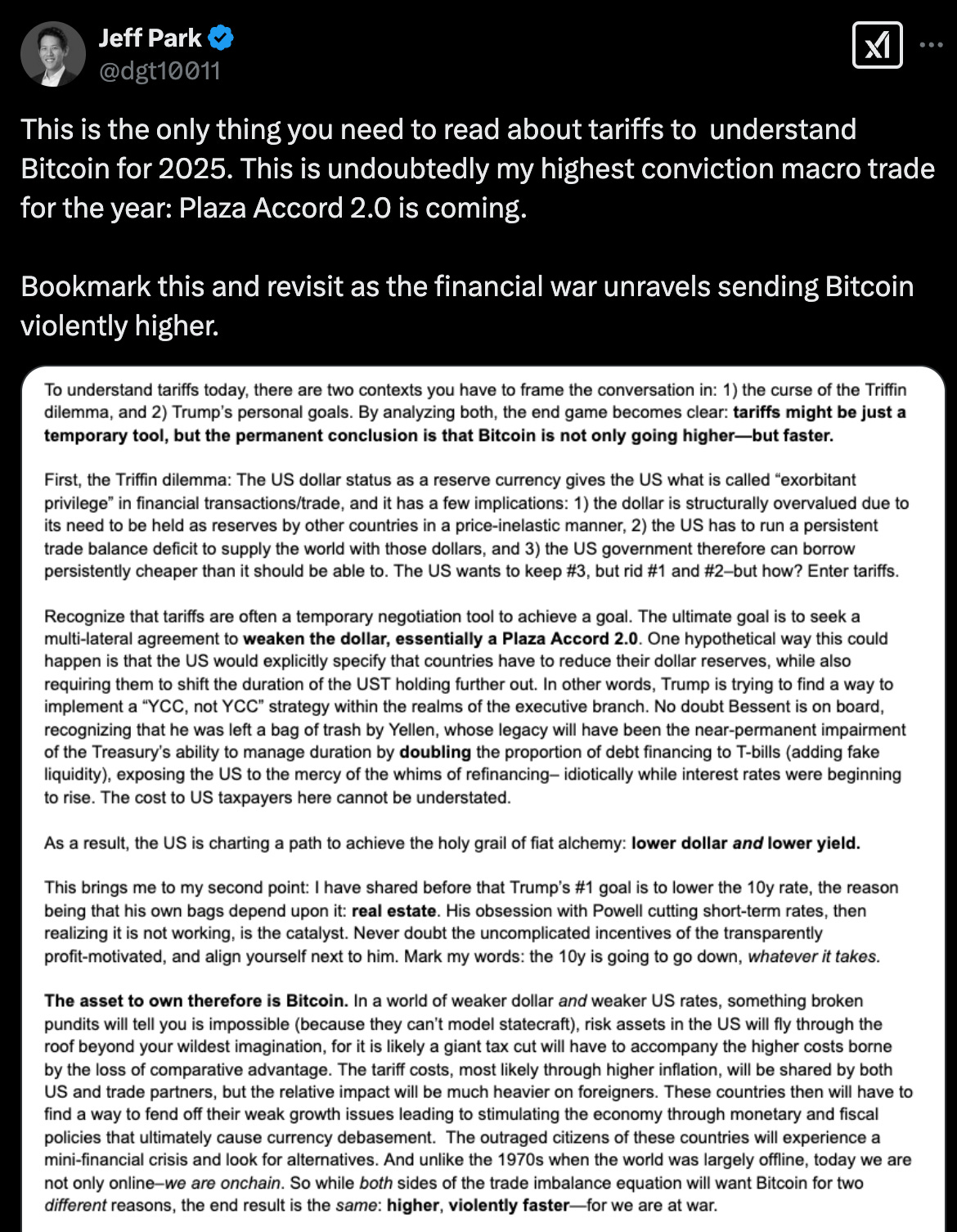

Reference post:

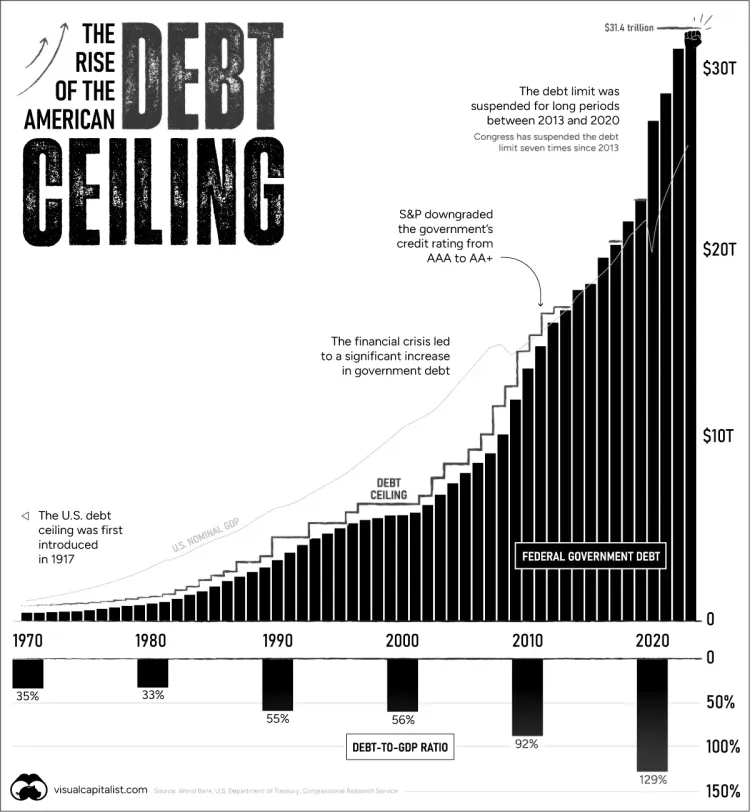

To truly understand the current tariff situation, we must frame it within two key economic contexts:

- The Triffin Dilemma: This explains the weakness of the U.S. dollar as the world's reserve currency.

- Trump’s personal and political objectives: Why is he focused on interest rates and monetary policy?

Looking through these lenses, tariffs are not an isolated policy measure.

They are a stepping stone towards a larger objective, one that will have interesting implications for global markets and Bitcoin.

Global Reserve Currency Tradeoff

The Triffin Dilemma is a problem (as the name would suggest).

Believe it or not, being the “printer” of the global reserve currency comes with downsides:

- The world needs U.S. dollars for trade and reserves, meaning there is constant demand for the dollar.

- To satisfy this demand, the U.S. must supply the world with dollars, which means running persistent trade deficits

A trade deficit means the U.S. is buying more from the rest of the world than it is selling. Over time, this weakens domestic U.S. production.

- Because of this, the U.S. government benefits from artificially cheap borrowing.

This setup forces the U.S. to maintain deficits.

Supplying foreign economies with dollars (imports) makes American exports less competitive.

The trade-off: the U.S. can either serve global dollar demand (and potentially hurt itself in the long run) or prioritize itself (and weaken foreign economies).

Tariffs are a way to restructure this.

Tariffs help push foreign economies into responses that weaken their currencies relative to the dollar.

For example, when the U.S. imposes a tariff, this can decrease exports from foreign economies. These countries might lower interest rates or increase the money supply to counteract this.

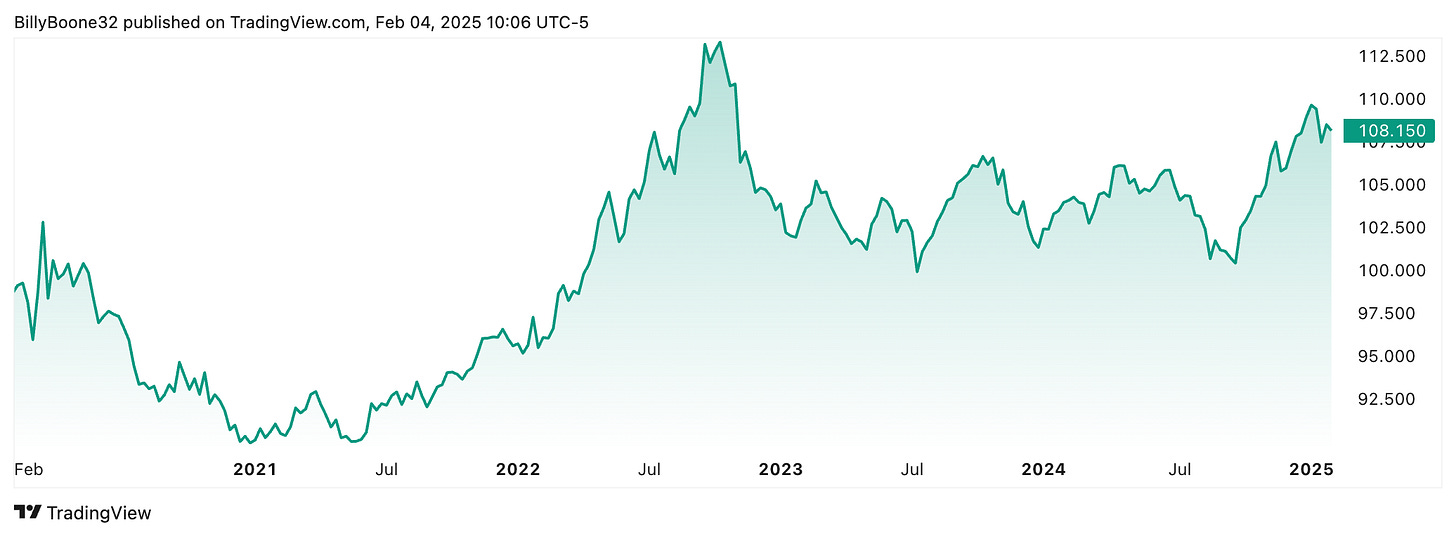

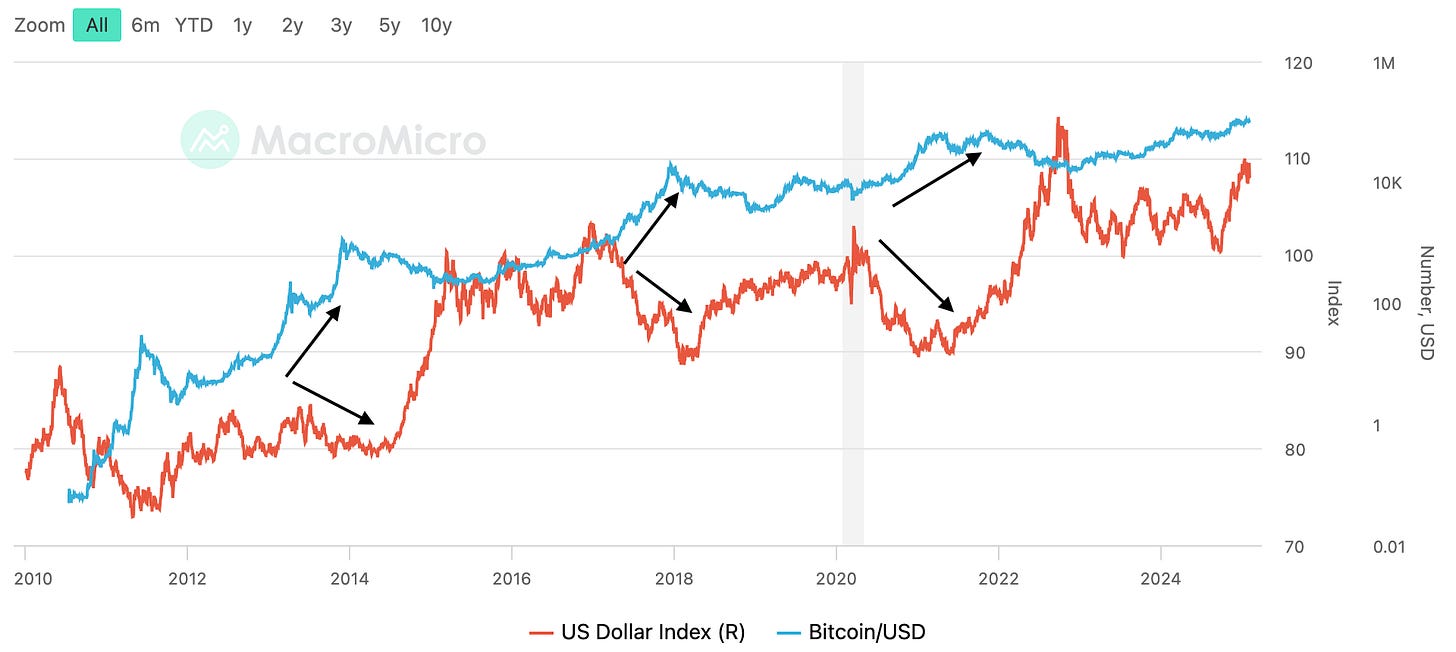

The U.S. Dollar Index $DXY shows this:

If DXY goes up, the dollar strengthens relative to foreign nation currencies.

If DXY goes down, the dollar weakens relative to foreign nation currencies.

Let’s look at a historical example of intentional dollar manipulation👇

The Plaza Accord: Weakening the Dollar by Design

In 1985, the U.S. and several major economies (Japan, West Germany, France, and the U.K.) signed the Plaza Accord, an agreement to intentionally weaken the dollar.

Why?

The dollar had become too strong, hurting U.S. exports and fueling trade imbalances (Triffin’s Dilemma).

These nations successfully devalued the dollar, making U.S. goods more competitive globally.

Fast forward to today → The dollar remains strong, U.S. domestic production is struggling, AND there is a looming debt burden.

Unlike in the 1980s, the world today is deeply entrenched in a debt-based fiat system, where weakening the dollar too quickly could trigger financial instability.

Trump’s Goals: Lower Dollar, Cheap Borrowing

Trump’s strategy seems to have two main goals:

- Weaken the dollar to make U.S. exports competitive and reduce trade deficits.

- Lower long-term yields (interest rates on 10-year Treasury bonds) to reduce borrowing costs. This is especially important to Trump, whose real estate motives depend on cheap debt.

A few things need to happen to achieve this:

Tariffs force foreign economies into currency devaluations. When countries like China or Germany see reduced exports due to U.S. tariffs, they lower their interest rates or print money to stimulate their economies. This weakens their currencies relative to the dollar.

As foreign economies weaken, the Federal Reserve steps in with monetary stimulus. This could involve cutting interest rates.

The U.S. also pressures foreign central banks to buy long-duration Treasury bonds, locking them into the U.S. dollar system while anchoring yields lower.

This balancing act achieves “the holy grail of fiat alchemy”: a weaker dollar and lower borrowing costs at the same time.

Winners and Losers

This strategy doesn’t come without costs. Here’s who wins and who loses:

- Winners:

- U.S. exporters: A weaker dollar makes American products cheaper and more competitive globally.

- U.S. borrowers: Lower yields mean cheaper loans for businesses, consumers, and the government.

- Losers:

- Foreign economies: Tariffs and currency devaluations destabilize countries reliant on exports to the U.S., leading to inflation.

- Foreign holders of U.S. debt: If the dollar weakens, the value of their U.S. Treasury holdings decreases in real terms.

- Consumers saving in the dollar: Running a weak dollar means inflation may run hot. Those saving in fiat currencies are the biggest losers.

Here’s where Bitcoin enters the picture.

Tariffs and monetary easing ultimately drive inflation.

Historically, Bitcoin benefits when the dollar weakens because it is seen as a hard-money alternative to fiat currencies.

As foreign economies struggle under the strain of U.S. tariffs and currency devaluations, their citizens and investors will seek refuge in an asset that can’t be printed.

Bitcoin can be traded 24/7/365, and if you have internet access, you have direct access to Bitcoin.

We are in a game with high stakes — currency, debt, and global power.

Bitcoin is the exit strategy to escape collapsing fiat systems.

Tariffs only accelerate the need for an exit.

Current tariff situation for Bitcoin miners as of April 22, 2025:

Baseline 125% on imports from China

12.6% on imports from other countries

Unless new amendments are made before July 9, 2025, this will be the situation:

Thailand: 12.6% -> 38.6%

Indonesia, Taiwan: 12.6% -> 34.6%

Malaysia: 12.6% -> 26.6%

Many of our ASICs are sourced from Southeast Asia (Thailand, Indonesia, Taiwan, Malaysia).

This equates to almost a 40% increase in prices if nothing changes by July 9th.

Bitcoin recently passed $90k, a key resistance level.

What do you think happens next?

Bitcoin is getting more expensive, and so are ASICs.

Your market entry point has a significant impact on your profitability, and now might be one of the most obvious entry points.

We know ASIC prices are not going down unless Bitcoin goes to $50k,

and the market is clearly hinting Bitcoin is a safe haven asset amidst the political turmoil.

Zoom out, think like a savvy investor, and you'll be in a favorable position when 2025 Bitcoin starts to act like 2020 Bitcoin.

Book a call with one of our specialists to see how mining could benefit your portfolio.