Get Bitcoin at a Discount

In the last 15 days:

Bitcoin is up 25%

Gold is up 7%

S&P500 is down 0.5%

In the last 30 days:

Bitcoin is up 9%

Gold is up 8%

S&P500 is down 5%

Is Bitcoin the new risk-free asset amidst political turmoil?

Ever feel like you’re always buying Bitcoin at full-price?

You know what I’m talking about:

You check your phone and see the price starting to climb.

You smash “Buy.”

Minutes later, the chart climbs again, and you feel disappointed – you could have got more BTC for less $.

You feel like you bought overpriced Bitcoin (even though there is no such thing).

If you keep doing this each rally, it is really going to cost you.

Bitcoin doubles, and your buying power cuts in half.

That’s a one-way ticket to less Bitcoin and nonstop FOMO.

But what if you could lock in a wholesale rate—no matter what the price is—by turning cheap electricity into discounted Bitcoin?

Let’s see how:

Every shopper loves a good deal, and investors are no different.

The catch: spot-buying Bitcoin rarely feels discounted. Even if you set up a DCA (Dollar-Cost Average), your purchasing power is at the whim of price swings.

Price shoots up, you pay more, you stack less.

Mining effectively ignores the price action.

When you plug in an ASIC, you’re no longer buying BTC at the sticker price; you’re producing it at your electricity rate. You get hard money at wholesale prices.

Below are four discount-psychology moves that help you see (and seize) the hidden markdowns inside Bitcoin mining.

1. Anchor on Cost—Not Quote Price

The concept:

Retail investors fixate on Bitcoin’s USD pricetag. Miners anchor on input cost—¢/kWh. This cognitive shift turns every block reward into “clearance merchandise.”

When BTC doubles, the DCA buyer’s cost per coin doubles too.

For the same to happen with mining, your electricity rate needs to double, or the hashrate needs to double.

Example:

From October 2024 to December 2024, the Bitcoin price increased by 59%

In the same period, hashrate increased 14%.

This means a DCA returned 59% less BTC while mining returned 14% less BTC (due to increased competition for the same block reward).

Miners' purchasing power is determined by hashrate. Spot buyer's purchasing power is determined by USD/BTC exchange rate.

Open our Mining Revenue Calculator → plug in your electricity rate → note the “DAILY COST” and “DAILY REVENUE.” If the daily cost is less than the daily revenue, you’re acquiring Bitcoin at a discount.

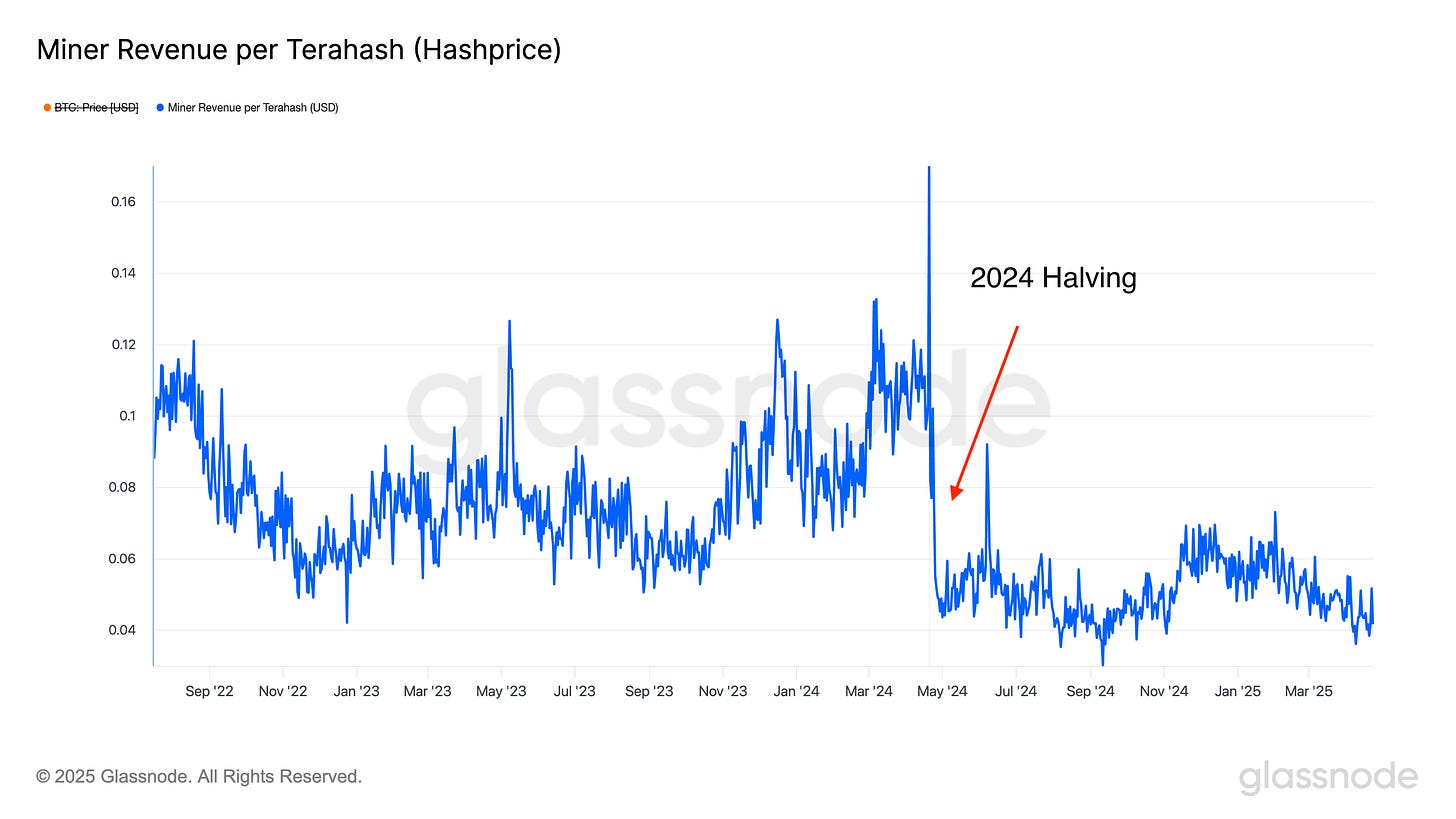

2. Exploit Loss Aversion With Hashprice Lows

The concept:

Humans hate missing out more than they like winning. Hashprice (earnings per TH/s) bottoms after halvings. This is when the fewest investors are interested in Bitcoin mining.

Scooping machines in capitulation windows feels uncertain, but it sets you up for 200-300 % hashprice rebounds

Example:

October 2020 hashprice hit $0.07/TH. The S19 Pro was selling for roughly $3,000. By October 2021 hashprice rebounded to $0.40/TH; the same machine was valued at $11,000.

Bookmark Hashrate Index. Pay attention to where hashprice is relative to the most recent halving. If you secure your mining position when hashprice is low, you can set yourself up to earn Bitcoin at a discount when the market rebounds.

3. Rack Space Scarcity

Scarcity encourages urgency. This is part of why Bitcoin is appealing to investors. A level of scarcity that is inelastic to demand.

Hosting slots are finite; when price rapidly increases, so does demand for rackspace and cheap electricity.

Locking in contracts before demand spikes guarantees you discounted capacity when everyone else is in a bidding war to plug in.

This will only be exaggerated with tariffs.

4. Bitcoin Mining as Discounted BTC

With Bitcoin mining, you're not purchasing Bitcoin at the market rate; you're buying electricity, which is converted into Bitcoin.

This can dramatically reduce your BTC acquisition cost, especially when Bitcoin prices rise sharply.

Example:

- A new miner costs $7/day to run and mines $15/day in BTC.

- A daily dollar-cost-average (DCA) of $7 buys $7 worth of BTC daily.

If Bitcoin’s price doubles overnight:

- The miner still costs $7/day but mines $30 worth of BTC daily.

- A $7 DCA now only buys half as much BTC.

In this scenario, mining returns 4x more BTC than the DCA method.

Calculate your current daily BTC acquisition cost. Consider how switching to mining could reduce your effective BTC cost.

Mining turns price-takers into price-makers. You can chase exchange coupons (discounted trading fees) or run the machine that prints permanent markdowns.

Remember,

The deepest discount you’ll ever get on Bitcoin is the one you mine yourself.

Important post from this week:

Current tariff situation as of April 22, 2025:

Baseline 125% on imports from China

12.6% on imports from other countries

Unless new amendments are made before July 9, 2025, this will be the situation:

Thailand: 12.6% -> 38.6%

Indonesia, Taiwan: 12.6% -> 34.6%

Malaysia: 12.6% -> 26.6%

Many of our ASICs are sourced from Southeast Asia (Thailand, Indonesia, Taiwan, Malaysia).

This equates to almost a 40% increase in prices if nothing changes by July 9th.

Bitcoin recently passed $90k, a key resistance level.

What do you think happens next?

Bitcoin is getting more expensive, and so are ASICs.

Your market entry point has a significant impact on your profitability, and now might be one of the most obvious entry points.

We know ASIC prices are not going down unless Bitcoin goes to $50k,

and the market is clearly hinting Bitcoin is a safe haven asset amidst the political turmoil.

Zoom out, think like a savvy investor, and you'll be in a favorable position when 2025 Bitcoin starts to act like 2020 Bitcoin.