Does The U.S. Have a Debt Problem?

“We cannot sustain $2T deficits. If this continues, America will go bankrupt.”

Concerned?

Debt ceilings, debt spirals, budget deficits, etc.

Politicians are scrambling to deal with the looming debt problem.

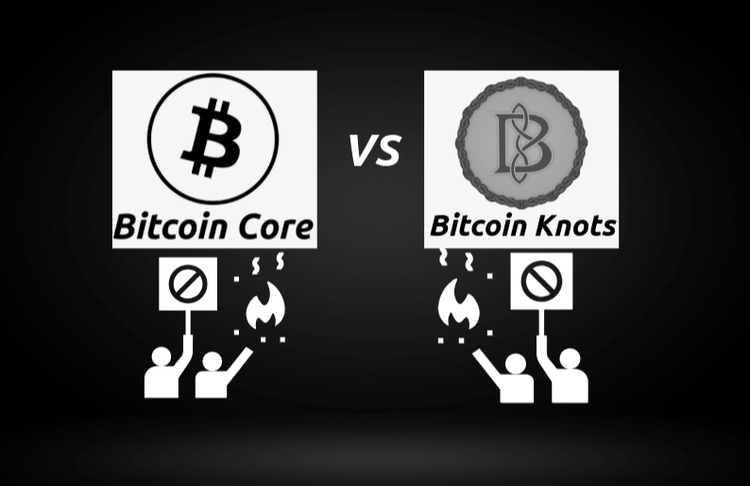

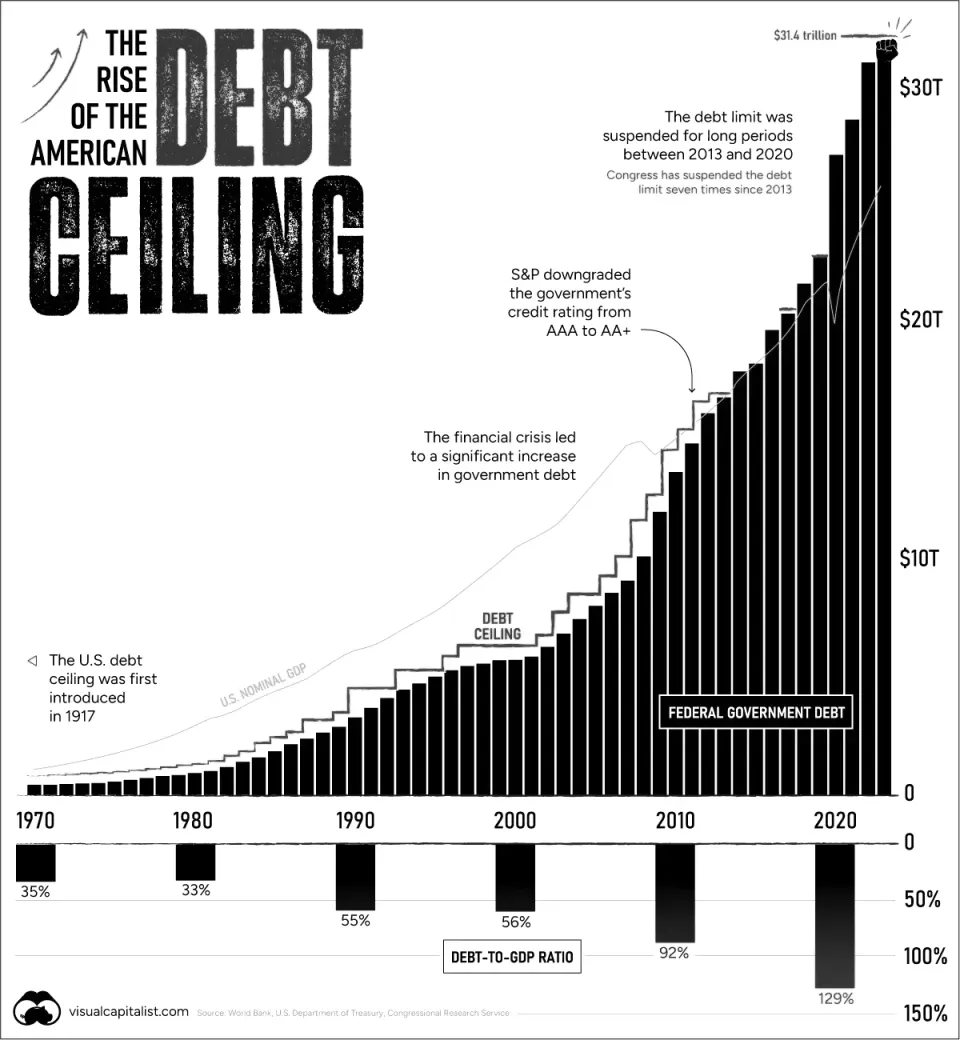

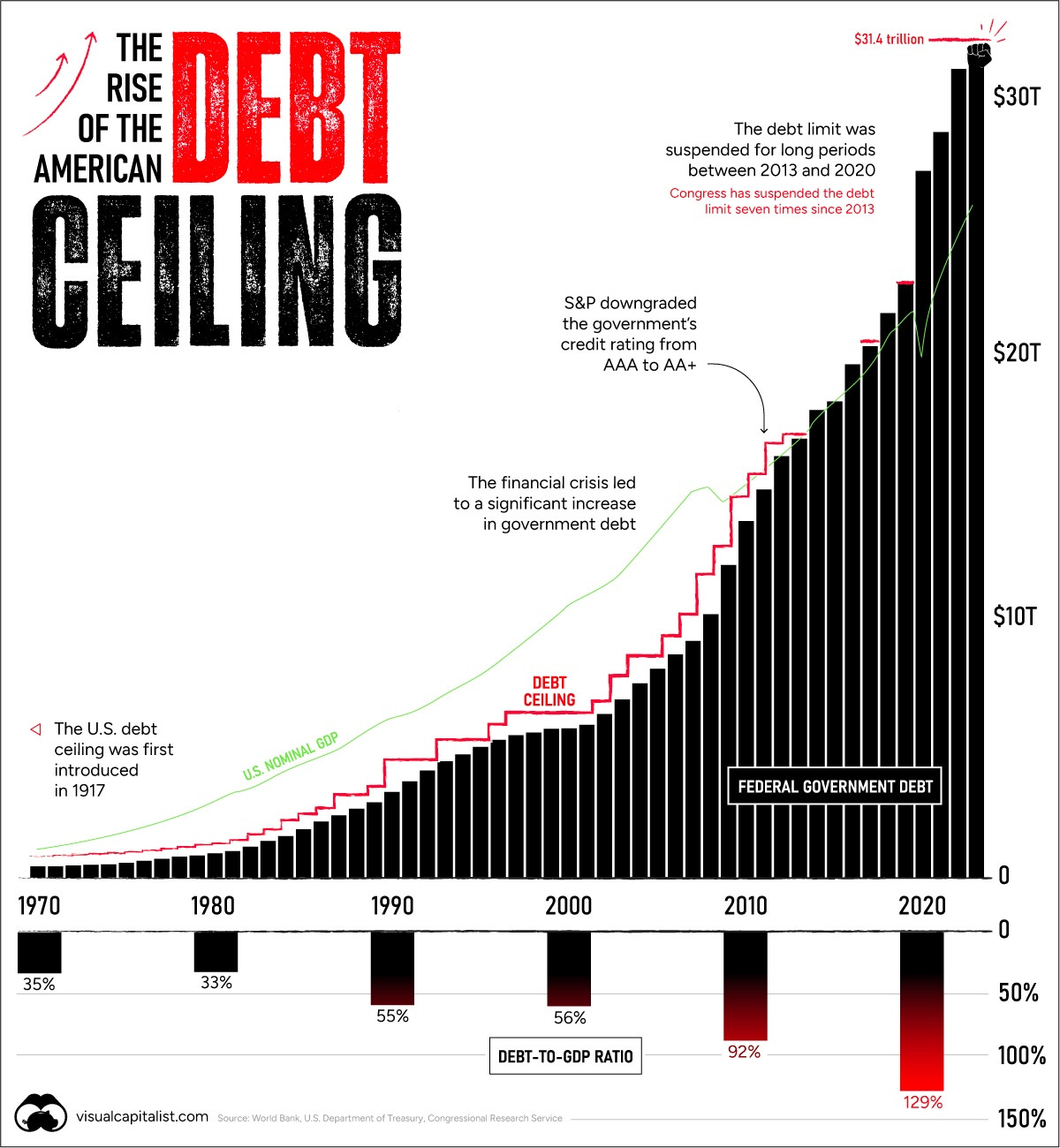

As you can see, the ceiling is not really a ceiling.

To provide a clear picture, here are the key figures as of February 27, 2025:

Current Debt Ceiling: $36.1 trillion

Total US Debt: ~ $36.52 trillion (this number increases by billions of dollars each day)

Debt-to-GDP Ratio: ~ 137%

Annual Deficit (Projected 2025): ~ $2 trillion

Treasury General Account (government checking account): $700 billion

Interest Expense (Annual): ~ $1 trillion

Tax Revenues (Est. 2025): ~$5 trillion

Estimated 2025 Spending: ~ $7 trillion

👆The difference between spending and revenue is the deficit.

This data shows we spend more money than we make.

Let’s unpack where this runaway train might be headed.

The Debt Ceiling

Think of it like a credit card limit.

Congress gives the Treasury a “limit” on the debt they can take on.

Note that it does not authorize new spending but ensures the government can pay for commitments already made.

The problem is overspending. Bills come due, and the goalpost gets moved.

The US has raised this “limit” 78 times since 1960.

We hit the ceiling on Jan. 2, 2025.

The Treasury had to use accounting tricks (“extraordinary measures”) to avoid default.

These measures will be exhausted by early June 2025. The limit will need to be raised before then.

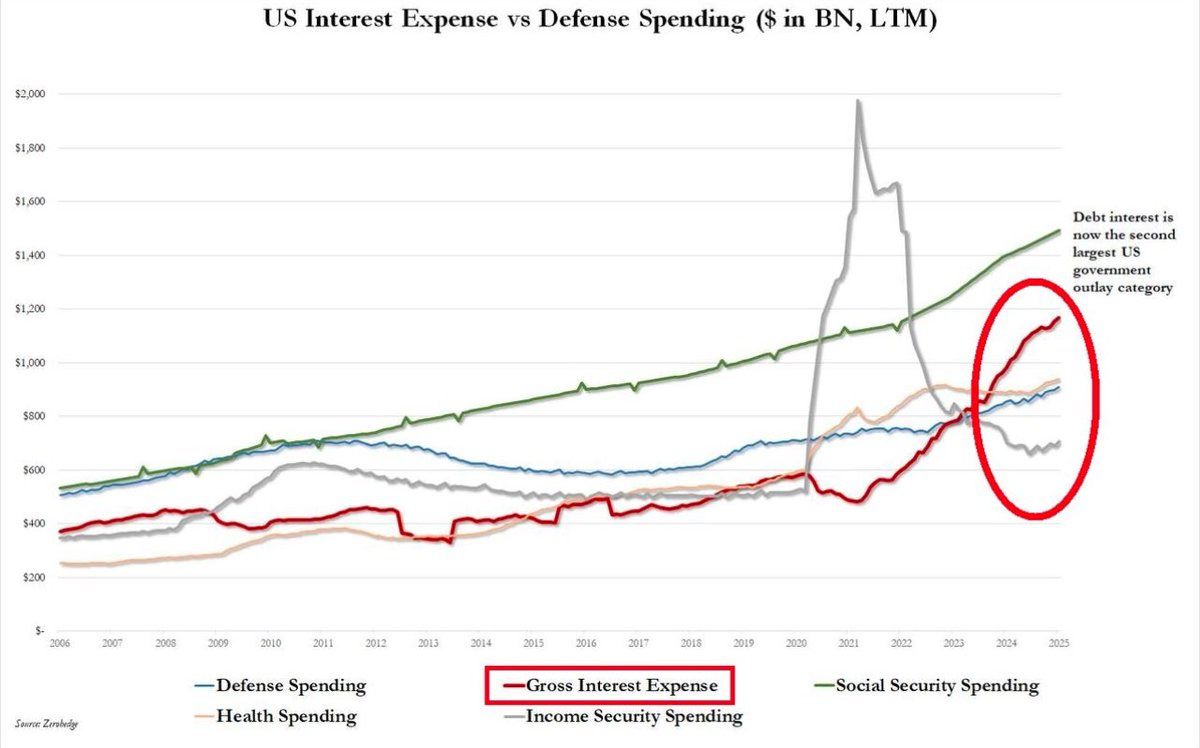

The Debt Spiral

We run deficits every year.

Annual deficits mean borrowing more to pay old debts.

Interest on this borrowing is over $1 trillion a year.

It is now the 2nd largest expense.

This can trigger higher interest rates, which means higher borrowing costs, which means bigger deficits.

A spiral.

The only way out is to reduce the debt burden.

This could be done by running a budget surplus (the opposite of a deficit).

This means cut spending, increase revenue(taxes), or run the printer to devalue the debt.

The Default Risk

Default means missing debt payments.

The US defaulted briefly in 1979 due to a late Congress vote. Rates jumped 0.6%.

Even a near-default can cause chaos (like in 2011 when stocks fell 5.5% the next day).

A full default in 2025? Unlikely—Congress loves last-second saves—but the risk’s not zero.

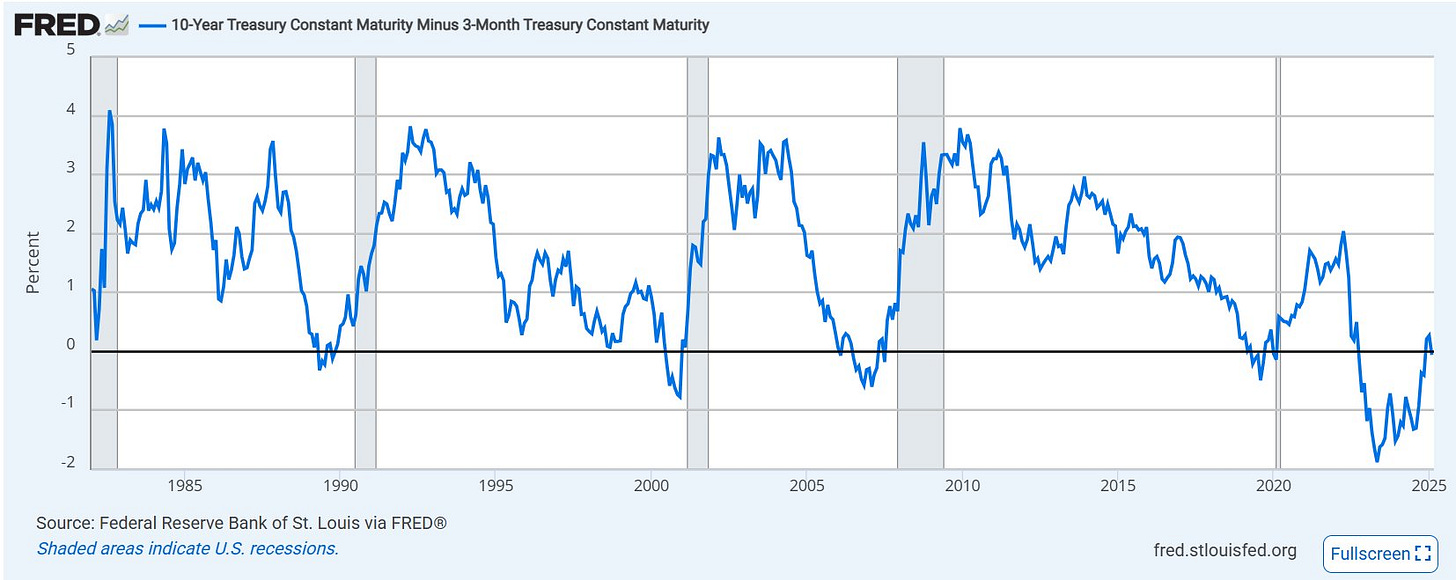

Market Signal

Short-term treasuries give clues.

Treasury auctions are shaky. We see lower Bid-to-Cover ratios and weak bidding.

- Treasury Yields: The 1-month T-bill is at 4.35%, beating the 3-month (4.31%) and 10-year (4.25%). This is a yield curve inversion (10-year yield passes below the 3mo) . It’s typically a recession indicator.This signals short-term distrust—investors expect inflation and want cash back fast.

- Credit Default Swaps (CDS): Insurance on U.S. debt default has doubled since January.

- Auctions: Recent 10-year auctions show weak demand. Low bid-to-cover ratios, 3.1 basis point tails, and dealers stuck with 24% of the haul. Buyers are hesitating.

Is Demand Drying Up?

Foreign buyers are now net sellers of US debt.

Banks got burned holding long-term treasuries (SVB 2023).

Institutions are dodging inflation risk when corporate bonds look better.

If no one buys, the Fed may need to do some quantitative easing. This means the Fed buys treasuries to inject liquidity and shore up demand.

We all know what happens when the Fed increases the money supply.

Refinancing Risk

About $8 trillion in debt rolls over in 2025. It will reset at higher rates.

That means bigger interest bills and bigger deficits.

Mortgage rates move in tandem, so home loans get pricier.

Big Picture

Treasury rates have JUMPED 100+ basis points since the Fed’s September 2024 cuts.

Banks and pensions are taking hits.

A strong dollar from tariffs dents exports, clashing with Trump’s growth goals.

Trump wants lower rates and higher asset prices, but Fed rate cuts aren’t working.

If banks, foreigners, and investors won’t buy, the Fed might have to.

Per Jerome Powell, “The U.S. is on an unsustainable fiscal path”

The U.S. is on an unsustainable fiscal path

P.S. A great portfolio solution to this problem is to buy scarce assets immune to debasement.

Even better, an asset that produces a scarce asset.

We have a limited quantity of S21 XP 270 Th/s in stock; you can book a call here