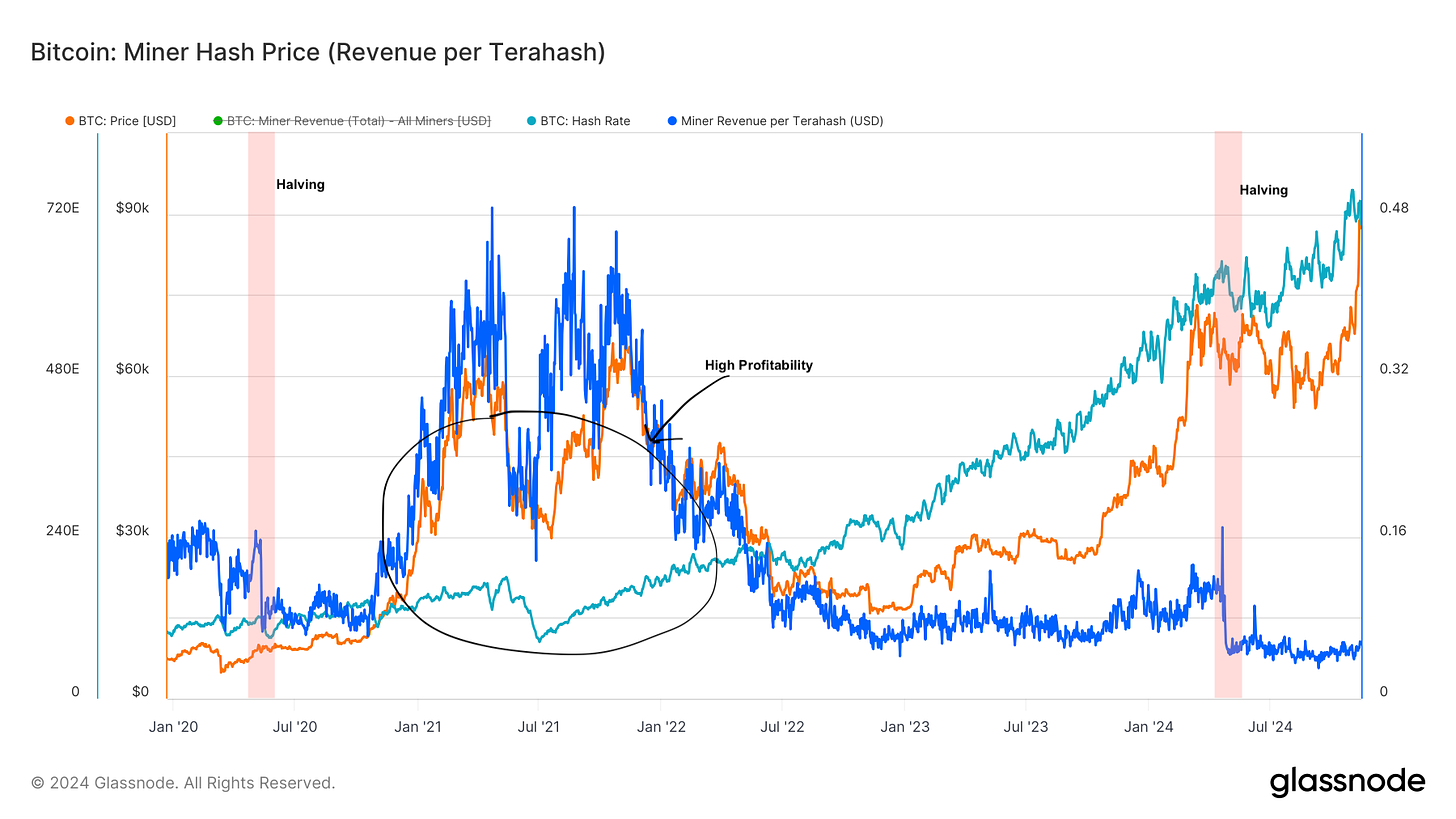

Price vs Hashrate

This article analyzes the relationship between Bitcoin price and hashrate.

The implications of this relationship have a major impact on mining profitibility.

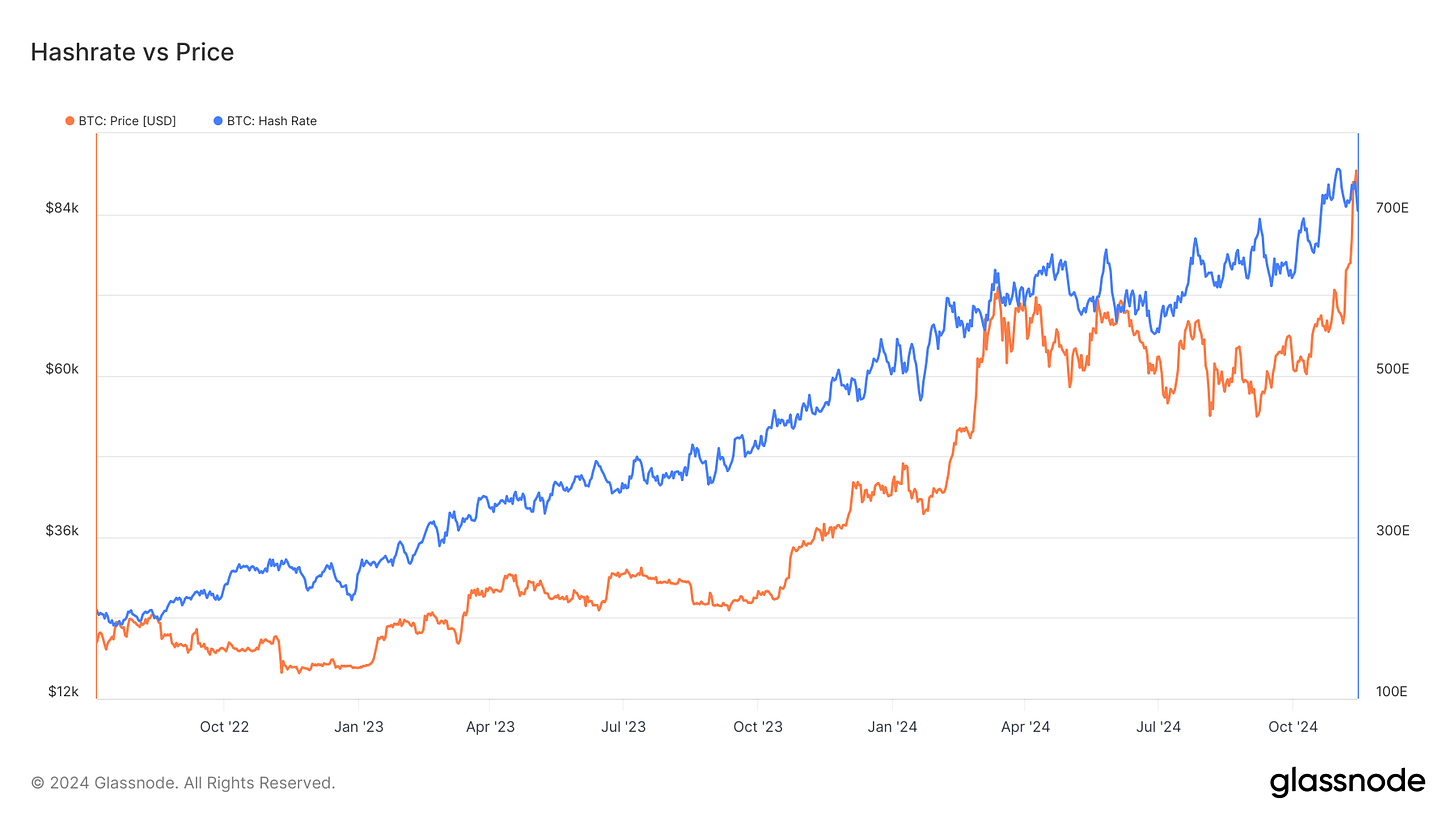

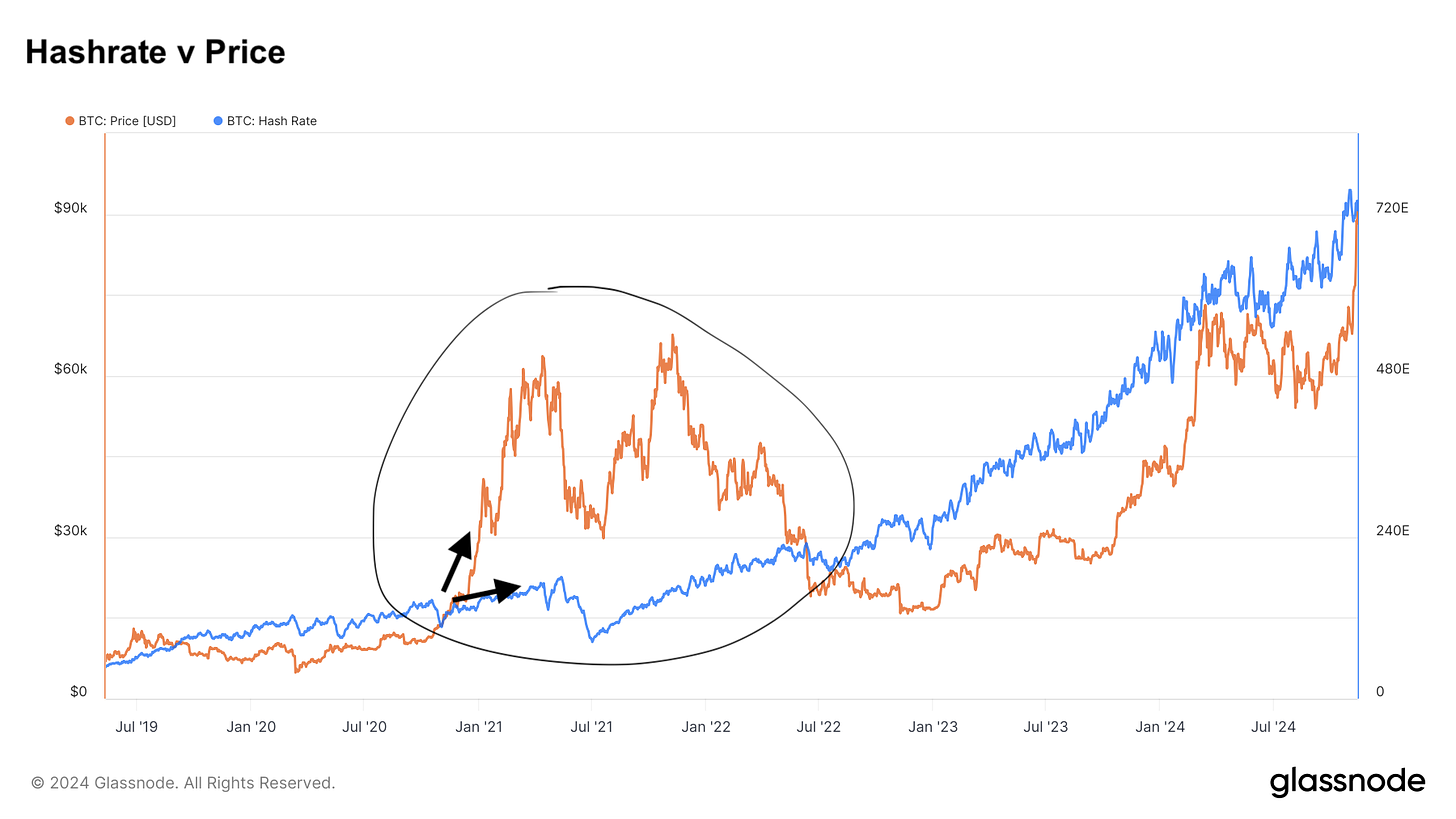

At the time of writing, hashrate is right on pace with price:

Since the halving on April 19th, a single S21 200Th/s machine has mined a total of ~ 0.033 BTC

This is NOT including the $200/mo Simple Mining hosting fee which covers electricity, maintenance, etc.

A dollar-cost-average into spot BTC is the benchmark for miners to outperform.

This $200/mo cost could have been dollar-cost-averaged into spot BTC.

A monthly DCA starting on April 19th, 2024 acquires a total of ~ 0.022 BTC

This is the real cost of mining.

If we subtract the cost of mining in BTC terms (0.022 BTC), we arrive at a total mining profit of 0.011 BTC.

This is HALF of what could have been acquired if you would have taken the DCA route.

BUT…

That’s not the whole story.

A mining position is a perfect hedge for when the BTC price rips through the roof and leaves hashrate in the dust.

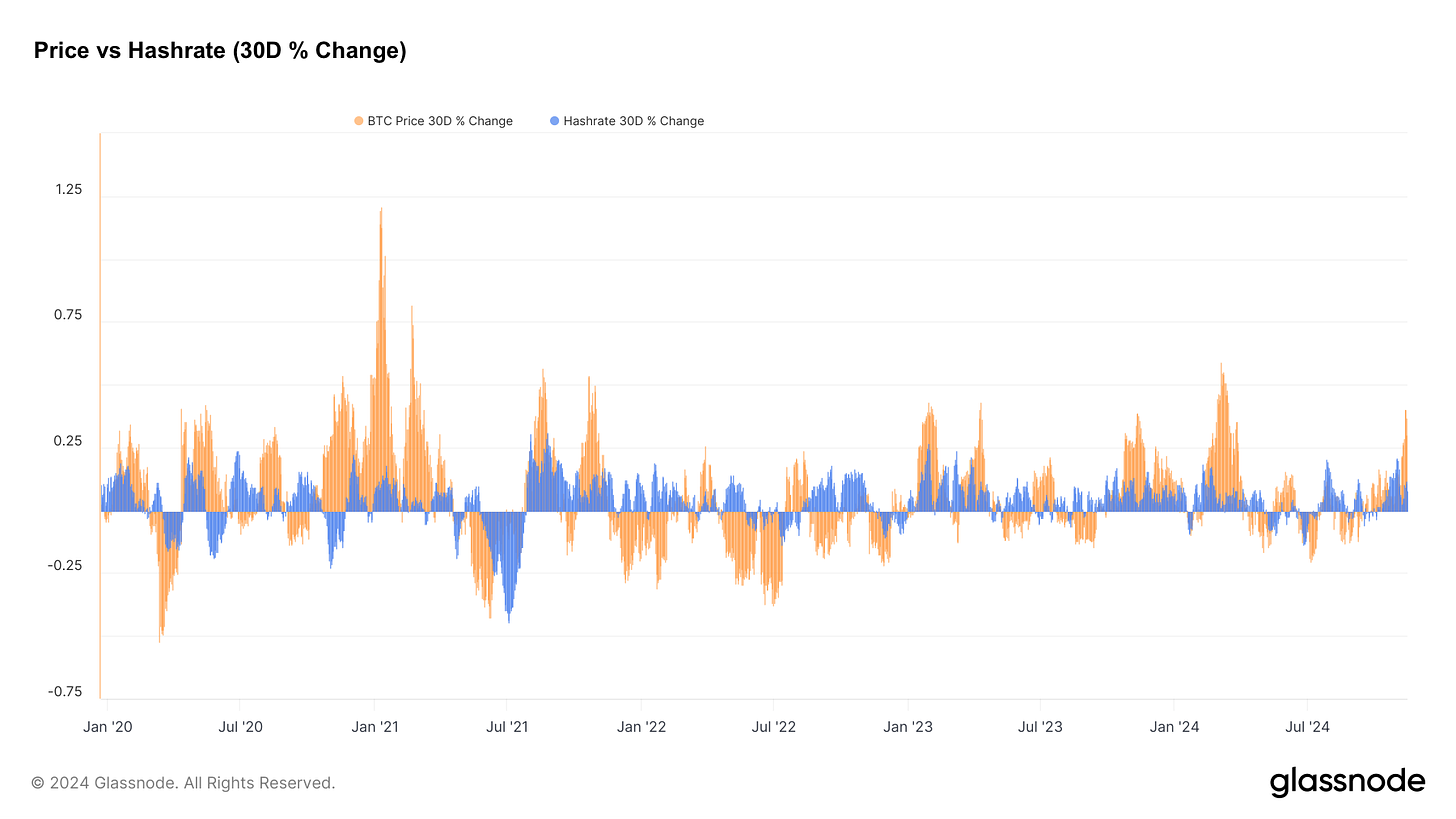

For example, hashrate in the last month is up 7.9%, and price is up 35%.

The golden opportunity for miners.

Mining becomes most profitable when the BTC price breaks away from hashrate:

When the orange bars are above the blue bars, mining is most profitable:

Hashrate cannot keep up with price in the short term because it is constrained by the time it takes to physically expand infrastructure.

I.e. it takes longer to plug in machines and build warehouses than it does for a whale to place a $10B bid.

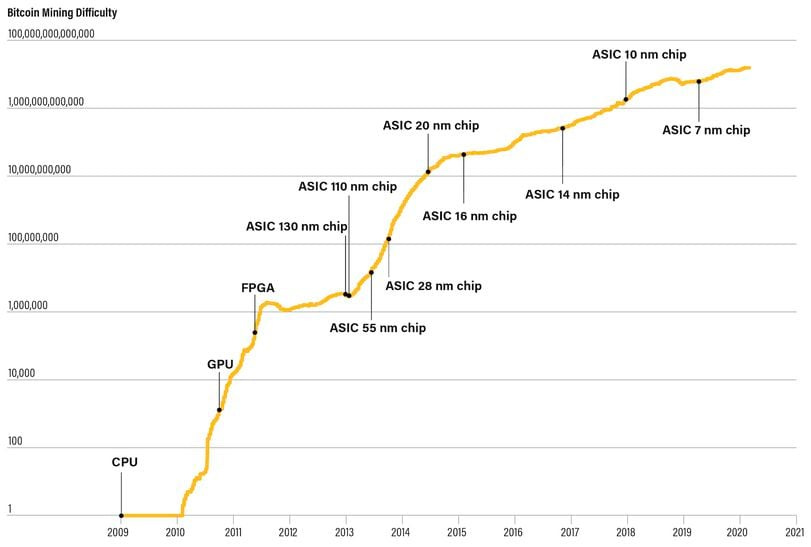

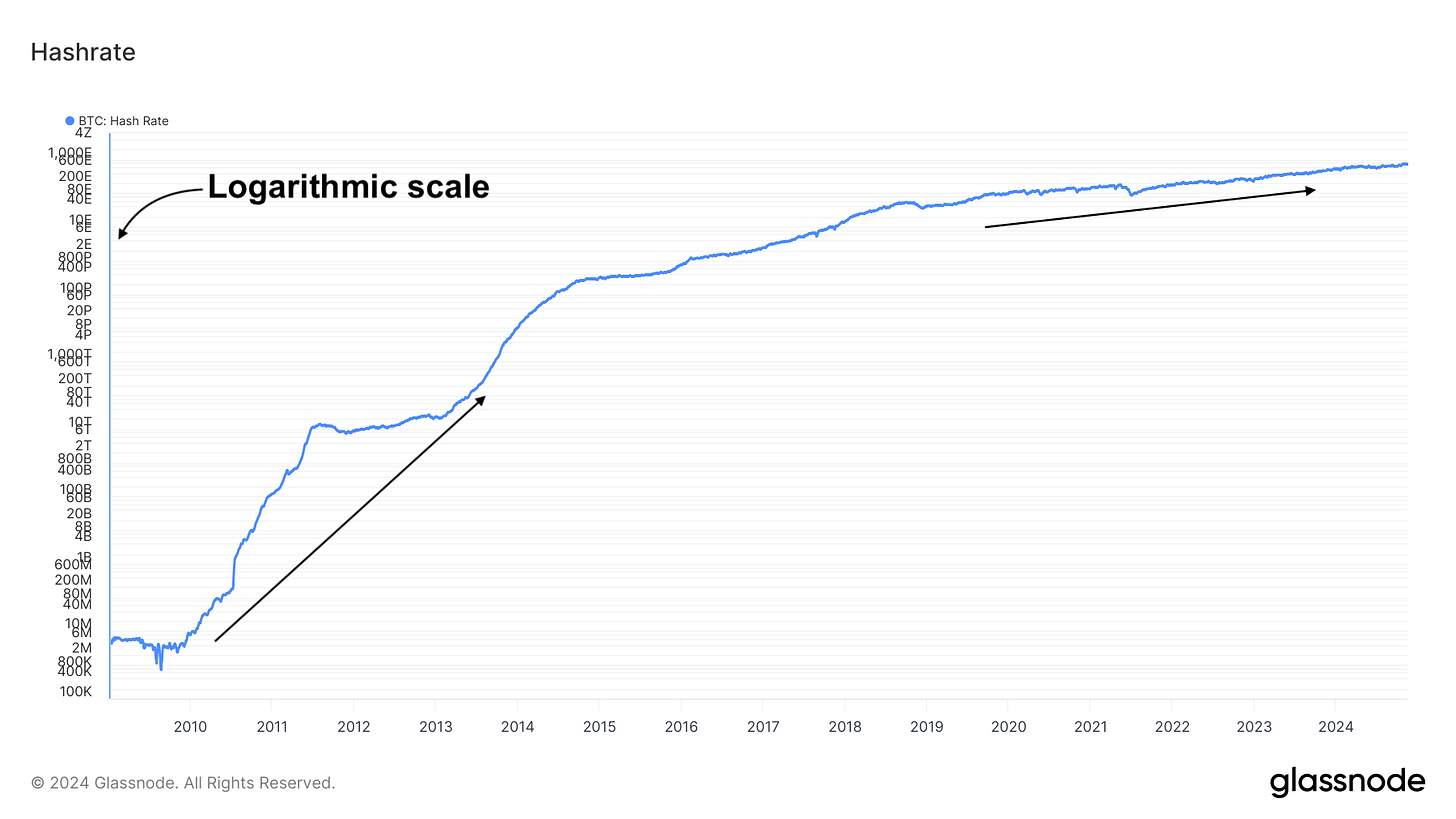

Hashrate has also been growing at a slower rate due to ASICs starting to reach maximum efficiency.

This image illustrates this well:

The 55nm chip to 28nm chip is a ~50% improvement.

The 10nm chip to the 7 nm chip is a ~30% improvement.

If ASICs are reaching a maximum efficiency threshold, then hashrate will start to plateau:

Hashprice is the number one indicator of mining profitability.

How does it respond when price outpaces hashrate?

Hashprice follows exponential price increases:

Miners plugged in and hashing during the ~ 12-20 month mania following the halving reap serious rewards. So much so, it makes it worth it to mine during periods when DCA outperforms.

When hashprice takes a stairway to heaven, it more than makes up for all the lost profits.

For example, if the BTC price doubles in the next 6 months to $180k, a $200/mo DCA loses HALF of its purchasing power:

$200 at $90k gets you ~ 0.0022 BTC

$200 at $180k gets you ~ 0.0011 BTC

But if you have a miner plugged in during the exponential price increase, you mine in terms of BTC, not in terms of dollars.

If you are mining 0.0022 BTC per day, you keep mining the same amount every day until more hashrate can come online and increase mining difficulty.

This is a miners arbitrage.

The best time to mine is during the price - hashrate breakaway.

There are also many other benefits to mining such as ASIC resale value, diversification, taxes & depreciation, and KYC free BTC.

If you are interested in hosting a miner with us, email sales@simplemining.io or visit our website www.simplemining.io

Spots are filling up fast. When price outpaces hashrate, rack space can dry up quickly.

The best part of the Bitcoin cycle is on the horizon.

Hope this helps✌️