Mining vs MSTR

Mining vs MSTR vs Buying BTC

To understand which approach is the best, you need to have a benchmark (a ruler to measure with).

We are trying to get more in BTC terms.

“What actions can I take now that will return me the most Bitcoin 10 years from now?”

Also, I will say none of these approaches is “best.”

Each has unique benefits.

Some combination might yield the highest ROI.

Let's break down how each stacks up across five main categories:

1. Bitcoin Ownership and Custody

With regular direct purchases of Bitcoin, you get varying levels of sovereignty.

For example, there are only ~ 2 million BTC on exchanges:

The amount on exchanges is going down over time.

What happens when this supply on exchanges runs out?

More people are seeking to protect their wealth in cold storage.

What happens when Bitcoin is the most demanded asset in the world?

Mining Bitcoin also has varying levels of sovereignty.

For example, you could get a mini home miner (bitaxe), or you could partner with a Bitcoin miner host.

Mining Bitcoin means you get a portion of newly minted BTC from each block (the BTC may also be KYC-free).

Even if you use hosting services like Simple Mining, your mined Bitcoin goes straight from a pool into your wallet, offering a seamless level of ownership.

NOTE: The sovereignty of your mining operation depends on which pool you are using.

Best case scenario:

If you receive 1 BTC mined through your own hardware or a hosting solution, that BTC could be a virgin coin sent straight from the coinbase.

MicroStrategy (now Strategy) is a stock. You never actually have custody of any BTC when you buy a share of MSTR.

You are buying ownership in a company that has custody of BTC.

Each MSTR share is backed by ~ 0.0017 BTC.

The company is currently valued at ~ 2x its Net Asset Value (NAV).

In other words, they are worth 2x the value of their Bitcoin holdings.

This introduces trust in a third-party entity and comes with potential regulatory and management risks.

“Not your keys, not your coins.”

I like to think of it as a trading play in BTC terms.

For example:

You are hoping you can buy 1 MSTR for 1 BTC at time 0 and sell 1 MSTR for 2 BTC at time n.

You rely entirely on the success of Strategy as a company (which, granted, is highly correlated to the success of Bitcoin).

In terms of actual BTC ownership, mining and spot buying have a clear advantage.

2. Profitability and Bitcoin Accumulation

Profitability, or rather, wealth accumulation in BTC terms, is the name of the game for most.

Buying BTC directly is simple—your stack grows directly with your purchases. Profitability depends entirely on your entry price and returns less BTC over time.

Buying MSTR is straightforward—your investment's value tracks Bitcoin's price at a multiple (because the company leverages debt and financial wizardry).

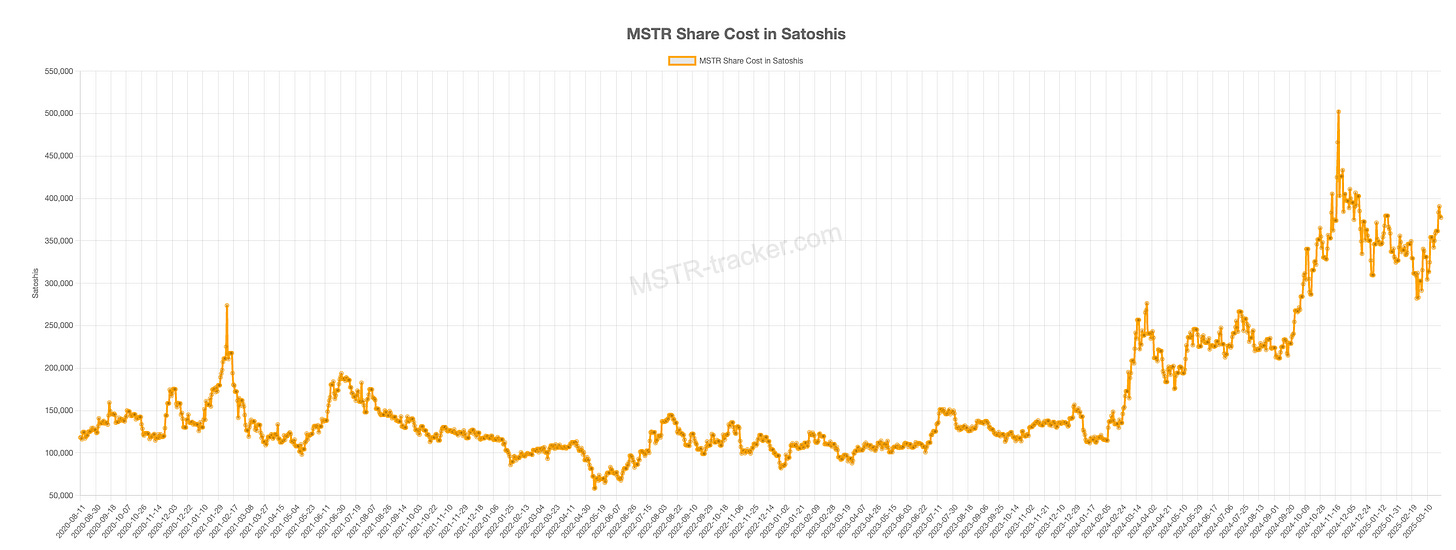

In August of 2020 (when the company started buying BTC), one share of MSTR was worth 0.001182 BTC. At the time of writing, one share of MSTR is worth 0.00377 BTC (219% increase in BTC terms)

Does this mean you should just buy MSTR stock?

MicroStrategy uses strategies such as options, equity conversions, convertible bonds, and other financial maneuvers to increase Bitcoin per share.

MicroStrategy is able to access cheap debt and use it as leverage to get more Bitcoin.

They have more than any other publicly traded company. People get their stock because they believe this will be an extremely valuable advantage in the future.

It has *more* counterparty risk and less sovereignty than mining and spot buying, so you decide.

NOTE: MicroStrategy could have THE SAME counterparty risk as spot buying if you’re holding your BTC on an exchange and NOT taking self-custody.

The Bitcoin mining strategy introduces many profitability variables to think through.

Such as:

- Price: How much does it cost to purchase this ASIC? What is the opportunity cost in terms of Bitcoin?

- Hashpower: How much BTC can I expect the machine to mine? Higher hashing power = higher revenue.

- Efficiency: Is the machine energy efficient? How many watts does it consume per hash? Lower W/Th = more efficient.

- Life Span: What's this machine's expected lifespan? How long will it remain competitive before newer machines make it obsolete?

- Electricity Cost: How much will this machine cost in electricity each month? Will I be able to pay the monthly hosting out of pocket without having to sell any of my mining rewards?

When mining, you purchase a machine (which we price in Bitcoin terms) and aim to produce more Bitcoin than you initially spent.

I wrote an entire report explaining how mining can appreciate in BTC terms.

In the report, mining returned 13% more BTC, and that’s not even factoring in depreciation.

Mining is also somewhat of a trade because, in the perfect mining scenario, you purchase equipment when hashprice is relatively low, mine a bunch of BTC, and then resell your equipment when hashprice is relatively high.

You get the same amount of BTC back on your machine; anything you mined is extra.

This could be a 10% or 300% increase in BTC terms. It could also be negative with poor timing.

Mining has several unique advantages:

- Depreciation of mining hardware

- Tax-deductible expenses

- A dollar cost average at an electricity rate

- Financing options

- Non-KYC value

Mining also allows you to benefit from transaction fees. When you are buying stock or BTC on an exchange, you are paying a fee to whoever is executing the transaction for you.

In Bitcoin’s case, those transactions pay a fee to the machines executing the order (miners).

The TLDR is it depends on your situation. If you are mining with Simple Mining, it is possible to stack more BTC than the MSTR and spot buy strategies.

3. Cost and Cash Flow Considerations

Investing in MSTR is relatively simple—buy shares and hold with no additional costs.

However, if MSTR trades at a premium to its Bitcoin holdings (NAV), you often pay more for the underlying Bitcoin.

Mining involves ongoing operational expenses.

For instance, an S21 miner might cost around $200 monthly to run with a host. These expenses can often be offset by tax benefits.

The initial purchase of MSTR or spot BTC does not currently have any tax advantage.

All three of these strategies are very price and market dependent. You will get a higher BTC return if you have a good entry point.

This is why people use a dollar cost average strategy to smooth out the cost.

Mining effectively does this at a discount to spot buying because you are paying in electricity terms.

4. Liquidity and Flexibility

Liquidity refers to how accessible your money is. MSTR is the least liquid in BTC terms. You can sell shares fairly quickly, but then you need to convert back into BTC and send to your wallet.

Mining is a combination of liquidity. You can easily sell ASIC hardware on our miner marketplace and receive your payout in BTC. The mined rewards distributed from the mining pool are also liquid.

5. Privacy and KYC Considerations

Investing in MSTR means you're fully transparent. Your ownership and identity are linked through brokerage accounts, reporting requirements, and regulations.

Mining offers more privacy (the advantage of accumulating KYC-free Bitcoin).

Depending on your pool, the BTC rewards go directly to your wallet without mandatory reporting to centralized entities (freshly minted virgin BTC).

Example: Non-KYC Bitcoin typically trades at a premium on peer-to-peer exchanges.

If privacy and reduced third-party exposure matter to you, mining holds significant advantages over buying BTC on an exchange and publicly traded stock.

In summary:

- Direct ownership: Mining and spot BTC purchases are winners.

- Potential Profitability: Mining and MSTR can outperform with a good entry.

- Cost Management: Mining is the only solution offering tax advantages.

- Liquidity: Mining and spot BTC provide the most flexible liquidity.

- Privacy: Mining and spot buying (peer-to-peer) have the best privacy.

Ultimately, your choice depends on your individual priorities—ownership control, profitability, liquidity, costs, or privacy.

I’m also hosting a space today at 5PM ET to break down this topic in further detail.

P.S. We have S21 Pros available starting at $5650. You can book a call if you have any questions.